- Research

- Open access

- Published:

Frontiers in microfinance research for small and medium enterprises (SMEs) and microfinance institutions (MFIs): a bibliometric analysis

Future Business Journal volume 9, Article number: 17 (2023)

Abstract

This article aims to present current research trends in microfinance for small and medium enterprises (SMEs) and microfinance institutions (MFIs), as microfinance plays an increasingly role in entrepreneurship development and poverty alleviation. The study uses a bibliometric analysis, in this work, we performed citation, bibliographic coupling, and keyword evolution analyses. The results show that research in microfinance for SMEs and microfinance institutions continue to grow. The authors found that recent research in microfinance for SMEs and microfinance institutions has evolved around eight thematic clusters, covering (1) access to and constraints on microcredit for SMEs (2) microfinance and economic empowerment, (3) sustainability of MFIs, (4) creditworthiness, microfinance technology infrastructure and financing patterns, (5) Islamic financial inclusion, (6) credit assessment models for microcredit, (7) microfinance and innovative business models, and (8) gender and equity crowdfunding. Research gaps in each of the thematic clusters are identified. Topics related to COVID-19, Islamic social finance, microfinance institutions, credit scoring models, crowdfunding, and entrepreneurial finance are likely to feature in the domain of microfinance and sustainability of MFIs in future.

Introduction

Finance is widely acknowledged as one of the crucial resources for entrepreneurial development and poverty alleviation in developing countries. Resource-based view theory identifies three categories of important resources, namely (1) physical resources, (2) human resources, and (3) organizational resources [1]. These resources cover finance, organizational processes, people, and information (knowledge). This represents a synergy of resources that is important to the survival, growth, and development of any organization. However, small and medium enterprises (SMEs) continue to face significant obstacles to fulfilling their potential to grow, innovate, and create jobs due lack of finance and inadequate access to reliable sources of finance [2–4]. As a result, they fail to execute their strategies efficiently, grow, and build sustainable competitive advantages [5]. This failure is linked to several reasons, including the underdeveloped formal financial sector in many developing countries which is characterized by risk aversion, limited size, and a bias against small businesses, thus making the financial requirements of small businesses not sufficiently addressed by large financial institutions and banks [5, 6].

Over the past three decades, there has been widespread recognition of microfinance institutions (MFIs) and an increasing provision of microcredit services in developing countries in all economic sectors. These institutions provide a wide range of services, including loans, savings, insurance, and remittances, to the rural and urban poor through cooperatives, credit unions, specialty banks, commercial banks, and other institutional arrangements [7]. The previous goals of microfinance institutions have been to meet the financial needs of poor and marginalized members of society, such as women, through an increased outreach of services, and the sustainability of microfinance institutions [7]. MFIs are believed to be instrumental in poverty reduction initiatives by both governments and non-governmental organizations (NGOs) in developing countries, particularly in tackling social and financial exclusion. As a result, governments and public institutions instituted policies and strategies aimed at addressing the financial problems of the less privileged. This includes formulating microfinance policies, guidelines, and creating a conducive business environment for the creation of microfinance institutions (MFIs). The measures aimed to liberalize financial systems and attract more investment to the sector by lowering entry barriers. However, some of the MFIs still have rigid regulations, bureaucratic tendencies, charge high interest rates, lack sufficient capacity, governance, and transparency and accountability to act as responsible financial intermediaries [8–11]. These challenges raise doubts about the sustainability of microfinance institutions and microfinance services for the development of the SME sector. Therefore, in this article we consider the dynamic change in microfinance research for SMEs and microfinance institutions over the last six (6) years. Bika et al. [12] reported on the underdevelopment of research on entrepreneurial practices related to microfinance in developing countries. The existing and growing literature tends to focus on the relationship between entrepreneurial growth, microfinance, and institutional formalization [12–14]. Similarly, there exist several reviews and bibliometric works on the topic of microfinance in the literature, e.g., Kaushal et al. [15], Nisa et al. [16], and Ribeiro et al. [17]. However, most of these publications are topic and industry specific. For example, Kaushal et al. [15] discussed microfinance institutions and the empowerment of women. Nisa et al. [16] examined the effects of competition on microfinance institutions and Ribeiro et al. [17] examined whether microfinance promotes the development of its clients. The current research consolidates all studies on microfinance research for SMEs and microfinance institutions and suggests the likely future research direction. The specific goals were:

-

To identify the most influential publications, authors, and institutions in microfinance research for SMEs and microfinance institutions

-

What are the collaboration networks in microfinance research for SMEs and microfinance institutions?

-

To understand the current research themes or topics in microfinance research for SMEs and microfinance institutions.

Methodology

This study adopts bibliometric analysis using tools such as citation, bibliographic coupling, co-authorship, and keyword analysis to answer research questions and objectives [18]. Bibliographic coupling is used to identify current research trends and future priorities as they are reflected at the frontiers of research. It groups two documents with common references. In contrast to co-citation analysis, bibliographic coupling captures recent contributions, including future research direction [19]. On the other hand, co-authorship assesses the social ties between researchers, it captures the state of the research collaboration network within a field [20, 21]. Similarly, keyword analysis captures the most used words using keyword co-occurrence analysis [22].

Data extraction process

We used Scopus for the collection of bibliographic data which is a large database covering over 20,000 peer-reviewed journals [23]. The search criteria and article selection are indicated in Table 1.

Results and discussions

Descriptive bibliometric analysis

Data collection shows that a final sample of 338 articles was written by 904 authors and were published in 205 journals. Most authors wrote multi-author documents (868 authors) and only 36 documents were single-authored (Table 2). This study covers a duration of 6 years.

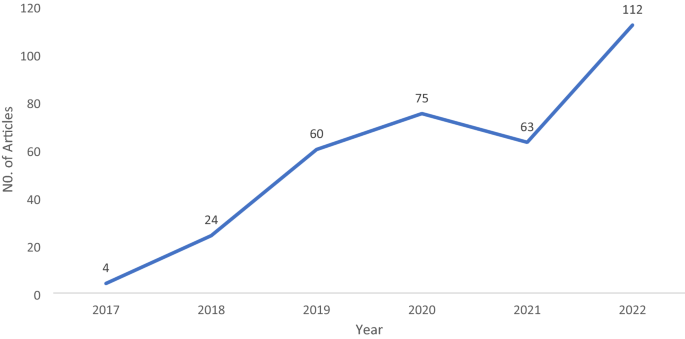

The level of item production in 2017 was slightly low with only four publications. However, the number of publications increased thereafter registering a total number of publications of 112 in August 2022 (Fig. 1). This suggests a growing research interests in microfinance research for SMEs and microfinance institutions.

The most important publications, authors, and institutions are listed in Table 3. Based on a set of citations, the most influential researchers in microfinance for SMEs and microfinance institutions are Chandio. A, Jiang Y. and Mohsin M. with 74, 72, and 51 citations, respectively. Based on several publications in microfinance for SMEs and microfinance institutions, Chandio. A is the most prolific researcher with three publications. In terms of institutions, the most influential institutions are Henan Agricultural University, Sichuan Agricultural University, and the Jiangsu University with 51, 51, and 51 citations, respectively. This shows that all top three institutions are based in China and recorded a similar number of citations and are majoring in the agriculture sector. This means that the agricultural sector is one of the most important sectors in need of microfinance support. In terms of intellectual contribution, the countries with the highest total number of publications and citations are the USA, China, and the UK with 54 (310), 29 (168), and 22 (161), respectively.

The main journals published in microfinance and microfinance institutions are listed in Table 4. Based on citations, the most influential journals are Review of International Political Economy, Journal of Business Ethics, and Journal of Asian Business and Economic Studies with 64, 58, and 51 citations, respectively. The first two journals are rated A by the Australian Business Dean Council’s Journal Quality List 2020 (ABDC). Most articles are published in leading journals hosted by publishers such as Elsevier, Taylor and Francis, Emerald Insight, Springer Open, and Wiley Online Library.

Thematic clusters of microfinance and microfinance institutions research through bibliographic coupling

Using bibliographic coupling, we analyze the intellectual structure and recent knowledge development of the literature (Table 5). Bibliographic coupling captures the similarity between two documents based on the number of references they share [24, 25]. The bibliographic coupling analysis revealed seven clusters as follows.

Cluster 1: access to and constraints on microcredit for SMEs

This is the largest among all the eight clusters, it consists of 31 articles related with access to and constraints on microcredit for SMEs. The three most cited articles on this cluster are Chandio et al. [26], Nguyen et al. [27], and Tran et al. [28] with 51, 11, and 10 citations, respectively. The studies in this cluster show that factors such as formal education, company size, investments, financial assets, debt, equity, registration, sex, and age of the business owner significantly influenced the likelihood of credit constraints or demand [26, 27, 29]. Factors such as farming experience, size of land holdings, road access and advisory services, credit source information, deposits, household size, and marital status were important in the agribusiness sector [26, 29]. Likewise, gender was an important factor, as women were more restricted in accessing credit than their male counterparts, resulting in fewer women than men having access to formal credit [28, 29]. Other factors include lack of collateral, higher interest rates, rigid loan repayment schedules that limit access to microcredit and contribute to higher default rates [32, 33, 34, 37]. Initiatives such as empowering women in business leadership, strengthening credit agencies, membership of farmers’ unions, and agricultural extension services can increase both access to and demand for credit [28, 30]. Similarly, increasing the informal sector’s credit base by providing credit to specific segments of the informal credit market, as practiced in India, creating novel rural financial institutions, and establishing separate channels for lending to the most disadvantaged are proposed [31, 36, 35].

Cluster 2: microfinance and economic empowerment

This is the second largest cluster with 30 articles dedicated to microfinance and economic empowerment. Articles in this cluster discuss the role of microfinance in economic empowerment. In this cluster, studies show that areas with dominant microfinance access have experienced high levels of economic improvement [41, 44]. Similarly, access to microfinance by MFIs has benefited culturally excluded members of society, particularly women, thereby narrowing the gender gap in access to formal credit [38, 42, 43, 45]. However, high interest rates still prevent many women from obtaining credit [47]. Studies in this cluster also show that despite the positive impact of MFIs, the saturation of uncoordinated microfinance institutions and the expansion of multiple indebtedness have created challenges for regulators and management of microfinance institutions, leading to deterioration in loan portfolios and the financial sustainability of institutions [39, 41]. To enhance the sustainability of MFIs, effective MFI policies and improved regulatory regimes need to be put in place to enable MFIs to play a key role in poverty reduction [46, 47, 101].

Cluster 3: sustainability of microfinance institutions

This cluster consists of 27 articles related with sustainability of microfinance institutions. The three most cited articles in this cluster are Gul et al. [49], Awaworyi [50], and Cervelló-Royo et al. [51] with 20, 18 and 10 citations, respectively. The topics in this cluster deal with the financial sustainability of microfinance institutions (MFIs) for the thriving and growth of the microfinance industry. To achieve MFI sustainability, the complementarity between financial sustainability and outreach, the government’s positive ideology on MFI performance, social and technological innovation and financial deepening, and the exploration of digital technologies to increase operational efficiency are crucial factors [49, 50, 51, 52, 57]. We also observe different purposes between for-profit and not-for-profit microfinance institutions, while for-profit MFIs target relatively wealthier individuals and are therefore able to achieve wider outreach and charge higher interest rates than not-for-profit MFIs, the not-for-profit MFIs might have a smaller outreach and serve the poor more with lower interest rates [54]. Similarly, subsidies and deposit mobilization have been found to be a substitute fund with similar impacts on outreach and sustainability, lowering microcredit interest rates and allowing MFIs to reach poorer borrowers, but they both improve outreach and sustainability [56]. To improve sustainability, and institutional quality, most MFIs are targeting areas where they have a niche market or where commercial banks cannot serve low-income borrowers, and are trying to attract more start-ups and small industries, an activity which will potentially increase economic growth and the risk of insolvency of MFIs [55, 59].

Cluster 4: creditworthiness, microfinance technology infrastructure, and financing patterns

This cluster consists of 21 articles dealing with creditworthiness, microfinance technology infrastructure, and microfinance patterns. The three most cited articles in this cluster are Bernards [64], Tanima et al. [65], and Langevin [66] with 34, 20, and 13 citations, respectively. Studies in this cluster show that technological change and innovations in microfinance have increased efficiency in microfinance systems, this includes the use of big data technologies is trying to transform the fringe finance sector [66]. However, due to heterogeneity of MSMEs, the financing patterns of micro-enterprises differ significantly from that of larger SMEs. This explains to some extent why some MSMEs owners are reluctant to embrace mainstream funding [72]. It has also been found that alliances between SMEs and large companies do not have a major impact on overall creditworthiness, but do affect SME collateral and terms [67, 68]. Likewise, trustworthiness in microfinance is linked to gender differences, for example, female micro-borrowers have a better repayment record than male borrowers [70]. Similarly, it was found that in post-conflict communities in sub-Saharan Africa, social cohesion was used as a tool of social protection and as a safety net when female MSME borrowers lacked collateral and property rights [69].

Cluster 5: Islamic financial inclusion

This cluster consists of 18 articles related with financial inclusion. The three most cited articles in this cluster are Pomeroy et al. [73], Ali et al. [74], and Zauro et al. [75] with 20, 12, and 8 citations, respectively. Financial inclusion enhances the ability of people to engage in economic activities that lead to economic development and poverty reduction [76]. The themes in this cluster discuss about the barriers and determinants of financial inclusion. The identified barriers in this cluster relate to factors such as limited financial capability and literacy, lack of assets for collateral, geographic distance from a financial institution, and lack of formal identification [73]. Zauro et al. [75] proposed the use of Islamic financial instruments as means to enhance socioeconomic justice and financial inclusion in the Muslims’ communities. However, determinants of Islamic financial inclusion include financial literacy, religious commitment, socio-economy, and social influence, human capital, product and services, infrastructure readiness, and policies and regulation [74, 75]. Financial inclusion improves people’s ability to engage in economic activities that lead to economic development and poverty reduction [76, 80]. The themes in this cluster discuss the barriers and determinants of financial inclusion. Identified barriers in this cluster relate to factors such as limited financial capacity and literacy, lack of collateral assets, geographic distance from a financial institution, and lack of formal identification [73]. Zauro et al. [75] and Khmous and Besim [78] proposed the use of Islamic financial instruments as a means of enhancing socioeconomic equity and financial inclusion in Muslim communities. The determinants of Islamic financial inclusion include financial literacy, religious commitment, socioeconomics and social influence, human capital, products and services, infrastructure readiness, and policies and regulations [74, 75]. In terms of the performance of Islamic finance in Islamic countries compared to conventional finance, it has been equally successful with conventional finance. However, the percentage of women empowerment through financial inclusion in Islamic financial countries has surpassed the conventional financial sector in non-Islamic countries, thereby narrowing the gender gap. However, conventional finance is more advanced than Islamic finance in terms of the use of technology to provide financial services [77]. A study by Shaikh [79] proposes an integrative model embedding fintech on both the demand side and the supply side to enhance the reach, scale, and impact of Islamic microfinance services. This cluster suggests that more research needs to be explored in areas such as digital financial services in Islamic finance and financial sustainability issues.

Cluster 6: credit assessment models for microcredit

This cluster consists of 14 articles related with credit assessment models for microcredit. The three most cited articles in this cluster are Shi et al. [81], Liang and He [82] and Ali et al. [74], and Enimu et al. [83] with 18, 13, and 8 citations, respectively. The themes in this cluster discuss about credit assessment models for microcredit. A study by Liang and He [82] examines whether semantic textual information on the loan description helps in predicting the credit risk of different types of borrowers using a Chinese P2P platform. The results show that the semantic features of textual soft information significantly improve the predictability of credit scoring models and the promotional effect is most evident in first-time borrowers. One of the credit risk assessment tools is the loss given default (LGD) which is performed by minimizing the LGD for higher rated loans as a standard for risk rating in the sense that decreasing LGD is associated with higher creditworthiness from the creditors’ perspective of the borrower. This helps guide the way to solving the phenomenon of mismatch between credit ratings and LGDs in the existing credit rating literature [81]. de Paula et al. [88] also found that using statistical methods such as combining credit scoring and profit scoring makes it possible to provide credit to the customers with the highest potential for paying off credit union debt. Similarly, a study by Enimu et al. [83] argued that lenders should consider the socioeconomic determinants of group members to ensure sustainable loan repayment benefits. Factors such as age of group members, household size, household income and level of education, amount of credit received, length of stay in their community, distance to credit source, supervision, and disbursement are important in determining viability and sustainability of repayment [83]. Another method is the spatial random effects credit scoring model. It helps improve the ability to predict defaults and non-defaults for both individual and group loans, and several credit characteristics and demographic information are important determinants of individual loan defaults but not group loans [84]. On the other hand, to predict the credit risk of SMEs in supply chain finance (SCF), DeepRisk is proposed. This method applies the multimodal learning strategy to merge the two different data sources. The concatenated vectors derived from the data fusion are then used as input to the feed-forward neural network to predict SME credit risk. The fusion of the two different data sources is superior to existing approaches to SME credit risk forecasting in SCF [85]. Furthermore, three methods such as logistic regression (LR), artificial neural network (NN), and support vector machine (SVM) were compared to achieve the banks’ strategic and business goals. The results showed that the LR model outperformed both ANN and SVM on various performance indicators, including the achievement of the bank’s strategic and business objectives [87]. A study by Wang et al. [91] discusses the role of social and psychological soft information in predicting defaults in the P2P lending market and assesses the importance of such information in fintech lending analysis by combining hard and soft information on defaults. The results show that soft information can make a valuable contribution to credit assessment. Soft information shows high predictive power in our test, and in combination with hard information, it increases the power of our model to predict failures [91].

Cluster 7: microfinance and innovative business models

This cluster consists of eight articles related with microfinance and innovative business models. The three most cited articles in this cluster are Zhang et al. [92], Kimmitt and Dimov [93], and Souza et al. [94] with 14, 9, and 4 citations, respectively. The themes in this cluster discuss about microfinance and innovative business models for entrepreneurship development. A study by Kimmitt and Dimov [93], which uses Amartya Sen’s concepts of freedom of process and freedom of opportunity to understand microfinance and entrepreneurial behavior, found that microfinance institutions need to understand the needs of their customers in terms of a generative recursive mechanism that drives the chain of action and how entrepreneurs deal with their attitudes and intended relationships in practice. Souza et al. [94] discussed the importance of understanding each microfinance program and its clients on a case-by-case basis in order to use microfinance consumer market segmentation to develop the most appropriate strategies to address clients’ needs. Similarly, Kumra et al. [95] found that the faster access and ease associated with P2P lending positively influence borrowers’ intention to participate, lenders are positively influenced by the high returns and diversified risk. In addition, a study by Zhang et al. [92] proposes the use of new business models to leverage more opportunities to deliver customer value. This includes the use of e-business microcredit platforms. However, a thorough understanding of the models and their implementation is crucial to avoid disruptive business model innovations of e-business microcredit.

Cluster 8: gender and equity crowdfunding

This cluster consists of four articles dealing with gender and equity crowdfunding. The three most cited articles in this cluster are Geiger and Oranburg [97], Figueroa-Armijos and Berns [98], and Zhao et al. [99] with 24, 7, and 3 citations, respectively. The topics in this cluster discuss about relationship between gender and funding raised through equity crowdfunding. Geiger and Oranburg [97] using population data collected from US equity crowdfunding campaigns, found that campaigns receive significantly less funding when the main signatory is female. Regarding the interactions between gender and a campaign’s funding goal, their results show that campaigns raise significantly less funding as the target amount increases when the main signatory is female. Similarly, Figueroa-Armijos and Berns [98] found that applying for funds through a field partner that targets vulnerable populations can negatively impact the entrepreneur’s application for full funding. However, identifying the entrepreneur as female or rural as key characteristics of individual vulnerability increases the likelihood that the project will be fully funded. This study provides evidence that prosocial crowdfunding can indeed support the vulnerable and poor through a unique framing mechanism. Along the same lines, Zhao et al. [99] found that female entrepreneurs are more likely to be funded through equity crowdfunding than their male counterparts. The study found that lead investors placed the funding advantage for women entrepreneurs in the equity crowdfunding market. These results contribute to the literature on equity crowdfunding and female entrepreneurship by showing that an entrepreneur’s gender influences equity crowdfunding performance. This finding is supported by Cicchiello et al. [100] who found that having at least one woman on the board of companies seeking equity financing increases campaign success rates. The articles in this cluster suggest the existence of a relationship between gender and funding raised through equity crowdfunding.

Based on bibliographic coupling of thematic clusters, we present the research gaps and the future research direction (Table 6).

Collaboration networks in microfinance research for SMEs and microfinance institutions

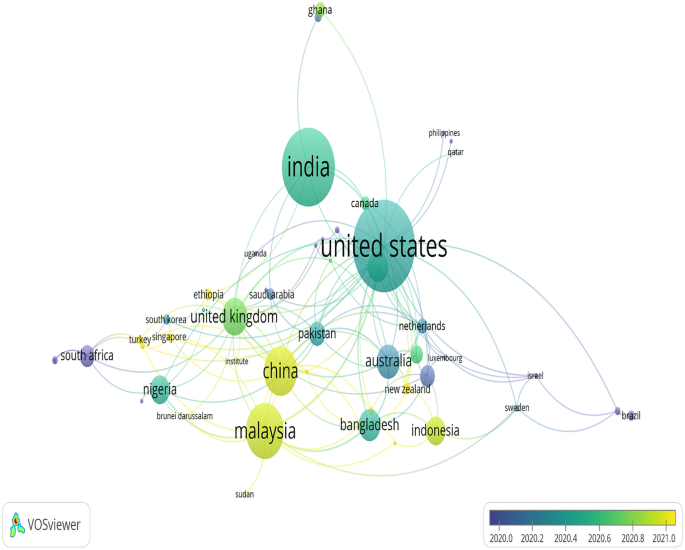

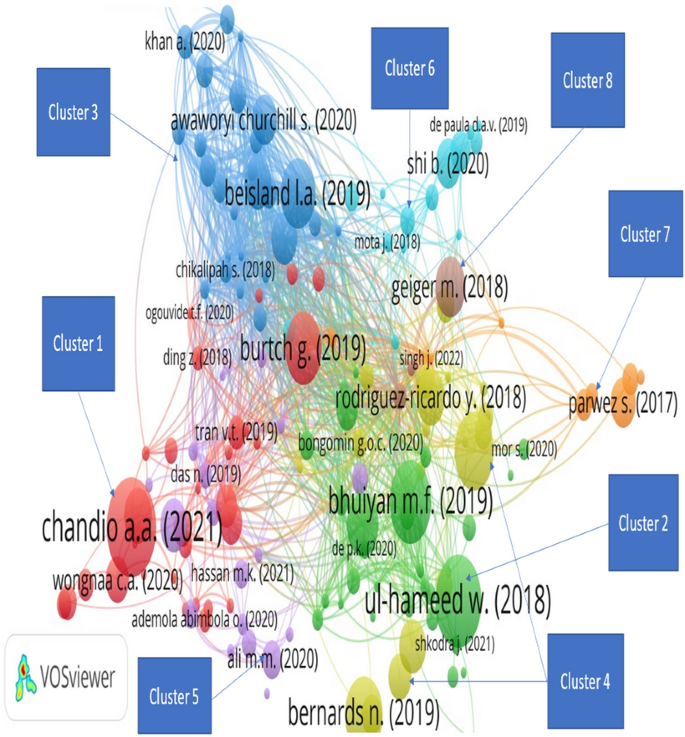

In terms of co-authorship and collaboration between authors and countries, the analysis shows that Chandio A., Jiang Y., and Kumar A. are the most influential authors in terms of overall link strength. Figure 2 shows the nodes representing author names, the links representing the co-authorship relationships between different authors, and the node sizes representing the publication counts of each author. Chandio. A is the most influential author with 74 citations. The data and network structure in Table 7 and Fig. 3 show that the research collaboration ties between developed economies and African countries is low. However, the analysis suggests that the collaborative network among developing countries is increasing. In terms of the country co-author network, Malaysia, Bangladesh, USA, and China are influential centers for research in microfinance for SMEs and microfinance institutions. Others are India, UK, and France. The cooperation relationship between the Malaysia and Bangladesh is the most common with six cooperations. USA and China follow with 6 cooperations.

Thematic development of the microfinance research for SMEs and microfinance institutions using a conceptual thematic map

A conceptual thematic map was used to assess the thematic development of the microfinance research for SMEs and microfinance institutions based on keywords analysis (Fig. 4). The strategic diagram is divided into four quadrants (the upper right quadrant defines motor clusters, the upper left quadrant defines highly developed and isolated clusters, the lower left quadrant defines emerging or declining clusters, and the lower right quadrant defines fundamental and transversal clusters). Centrality measures the degree of a network’s interaction with other networks and can be understood as the external cohesion of the network, and density measures the internal strength of the network and can be understood as the internal cohesion of the network [102, 103].

First quadrant (motor themes)

This part presents well-developed themes that are of central importance for the structure of the research field. There are three bubbles in this quadrant, two of which traverse the fourth quadrant. Regarding to the Ghana corresponding bubble, the keywords with the highest frequency scores (occurrence) are; Ghana (6), credit access (5), and formal credit (4). Referring the bubble corresponding to financial inclusion, the keywords with the highest occurrence are; financial inclusion (24), Vietnam (8), and Fintech (6). Similarly, the bubble corresponding to microcredit, keywords with the highest frequency are: microcredit (38), Bangladesh (10), and poverty alleviation (10). The results of the two bubbles crossing the fourth quadrant suggest that they are well-developed themes that can structure the research field and are still the leading themes in broader microfinance research.

Niche themes (second quadrant)

These are well-developed and very specialized topics that are marginal in the overall field. This quadrant consists of two bubbles represented by India and COVID-19. In terms of the bubble corresponding to India, the top occurrence scores are: India (10), access to finance (4), and emerging economies (4). On the other hand, with the bubble corresponding to COVID-19, the highest occurrence scores come from COVID-19 (4), Islamic social finance (4), and waqf (3). The results suggest that issues in this quadrant (niche) such as access to finance, COVID-19, and Islamic social finance are potential topics that need to be more loosely linked to broader microfinance research. Researchers can explore these areas to advance knowledge in the broader field of microfinance.

Peripheral themes (third quadrant)

This quadrant consists of three bubbles represented by credit union, microfinance institution, and credit scoring. Credit union is the smallest bubble in this quadrant with only two occurrences. Regarding the bubble corresponding to credit scoring, the keywords with the highest frequency scores (occurrence) are: credit scoring (7), crowdfunding (6), and entrepreneurial finance (5). Similarly, with a bubble corresponding to a microfinance institution traversing the fourth quadrant, the highest frequency scores are: microfinance institution (13), financial development (5), and credit rationing (4). This bubble means that some of its components are fundamental and necessary for the development of the microfinance field. The results in this quadrant suggest that future research direction will continue to focus on topics such as microfinance institution, credit scoring, crowdfunding, credit union, entrepreneurial finance, and credit rationing.

Transversal and general basic themes (Four quadrant)

These are high-centrality, low-density themes that are important to the microfinance field but are not well developed. This includes four major bubbles represented by gender, sustainability, credit, and microfinance. Regarding the bubble corresponding to gender, the top occurrence scores are found for gender (15), Pakistan (7), and credit constraints (6). On the other hand, the bubble corresponding to sustainability, sustainability (11), financial performance (7), and microfinance institution (7) are the highest occurrence values. Similarly, the bubble corresponding to credit, credit (9), productivity (6), and agriculture (5) are the highest occurrence values. Lastly, the bubble corresponding to supply chain, supply chain (46), local food (11), and agriculture (8) are the highest occurrence values. On the other hand, the bubble corresponding to microfinance, microfinance (95), poverty (14), and empowerment (10) are the highest occurrence values.

Conclusion, future research direction, and study limitations

This research is among the few studies covering microfinance research for small SMEs and microfinance institutions using bibliometric analysis. By applying bibliographic coupling, we found that recent research in this area has evolved around eight thematic clusters, covering (1) access to and constraints on microcredit for SMEs, (2) microfinance and economic empowerment, (3) sustainability of microfinance institutions, (4) creditworthiness, microfinance technology infrastructure and financing patterns, (5) Islamic financial inclusion, (6) credit assessment models for microcredit, (7) microfinance and innovative business models, and (8) gender and equity crowdfunding. The emerging research topics in the microfinance research for small SMEs and microfinance institutions relate to COVID-19, Islamic social finance, microfinance institution, credit scoring, crowdfunding, credit union, entrepreneurial finance, and credit rationing. Areas where research gaps remain include the sustainability of informal sources of credit and their impact on SME performance, financing models and patterns used by MFIs, the sustainability of Islamic finance, crowdfunding in developing countries, and regulatory and policy frameworks for MFIs. We have also observed that most microfinance research is focused on the agricultural sector and Western countries and Asian countries like China, Bangladesh, Australia, USA, and UK are dominating microfinance research lately and there is less research collaboration between Africa and Western countries. The limitations of the research are that is based on the bibliometric analysis and only one database, namely Scopus was involved. Secondly, the research conducted a retrospective review from 2017 to August 2022 to identify the current research trends, a wider inclusion of other databases and deeper content analysis could expand the findings of this research.

Theoretical and managerial implications

The results of this study may be of practical interest to managers, industry researchers, and policy makers. For example, managers can apply various models and techniques to enhance sustainability of microfinance institutions such as increasing outreach, social and technological innovation, financial deepening, and the use of digital technologies to increase operational efficiency. Managers can also employ various efficient credit assessment models such as the loss given default (LGD). Similarly, managers can combine credit scoring and profit scoring makes it possible to provide credit to the customers with the highest potential for paying off credit union debt. Another method is the spatial random effects credit scoring model which helps to improve the ability to predict defaults and non-defaults for both individual and group loans. Industry researchers can use our research to understand the broad spectrum of research in the field, emerging research areas, research gaps, and future research direction. Similarly, policy makers can apply the outcomes to design policies and interventions in regions of the regulatory and policy frameworks for financial access to the poor and the sustainability of MFIs.

Availability of data and materials

Available.

Abbreviations

- MFIs:

-

Microfinance institutions

- LGD:

-

Loss given default

- SMEs:

-

Small and medium enterprises

- SCF:

-

Supply chain finance

- NN:

-

Artificial neural network

- ABDC:

-

Australian Business Dean Council’s Journal Quality List

- SVM:

-

Support vector machine

- LR:

-

Logistic regression

References

Barney JB (2001) Resource-based theories of competitive advantage: a ten-year retrospective on the resource-based view. J Manag 27:643–650

Lwesya F (2021) SMEs’ competitiveness and international trade in the era of Global Value Chains (GVCs) in Tanzania: an assessment and future challenges. Small Bus Int Rev 5(1):e325. https://doi.org/10.26784/sbir.v5i1.325

Mkenda BK, Rand J (2020) Examining the ability of Tanzanian small and medium enterprises (SMEs) to increase their penetration into export markets. Bus Manag Rev 23(1):9–102

Pasape L (2018) Internationalization of small and medium enterprises from Arusha Tanzania: market information, financial resources and product quality setbacks. Bus Manag Stud 4(2):77. https://doi.org/10.11114/bms.v4i2.3268

Kuada J (2022) Financial inclusion and small enterprise growth in Africa: emerging perspectives and research agenda. Afr J Econ Manag Stud 13(3):402–417. https://doi.org/10.1108/AJEMS-05-2021-0230

Atiase VY, Mahmood S, Wang Y, Botchie D (2017) Developing entrepreneurship in Africa: investigating critical resource challenges. J Small Bus Enterp Dev 25(4):644–666

Meyer RL, Nagarajan G (2006) Microfinance in developing countries: accomplishments, debates, and future directions. Agric Finance Rev 66(2):167–193

Abor J, Quartey P (2010) Issues in SME development in Ghana and South Africa. Int Res J Finance Econ 39:218–228

Banerjee SB, Jackson L (2017) Microfinance and the business of poverty reduction: critical perspectives from rural Bangladesh. Hum Relat 70(1):63–91

Bruton GD, Ahlstrom D, Si S (2015) Entrepreneurship, poverty, and Asia: moving beyond subsistence entrepreneurship. Asia Pac J Manag 32(1):1–22

Webb JW, Bruton GD, Tihanyi L, Ireland RD (2013) Research on entrepreneurship in the informal economy: framing a research agenda. J Bus Ventur 28(5):598–614. https://doi.org/10.1016/j.jbusvent.2012.05.003

Bika O, Subalova M, Locke C (2022) Microfinance and small business development in a transitional economy: insights from borrowers’ relations with microfinance organisations in Kazakhstan. J Dev Stud 58(1):183–203

Si S, Ahlstrom D, Wei J, Cullen J (2020) Business, entrepreneurship and innovation toward poverty reduction. Entrep Reg Dev 32(1–2):1–20

Sutter C, Bruton GD, Chen J (2019) Entrepreneurship as a solution to extreme poverty: a review and future research directions. J Bus Ventur 34(1):197–214

Kaushal N, Sanjoli S, Raj JM, Suman J (2021) Microfinance institutions and women empowerment trends and future research directions: a bibliometric analysis. Libr Philos Pract (e-journal) 5534:1–23

Nisa CC, Viverita V, Chalid DA (2022) Impact of competition on microfinance institutions: bibliometric analysis and systematic literature review. Heliyon 8(10):e10749

Ribeiro JP, Duarte F, Gama APM (2022) Does micro-finance foster the development of its clients? A bibliometric analysis and systematic literature review. Financ Innov 8:34

Cisneros L, Ibanescu M, Keen C, Lobato-Calleros O, Niebla-Zatarain J (2018) Bibliometric study of family business succession between 1939 and 2017: mapping and analyzing authors’ networks. Scientometrics 117(2):919–951. https://doi.org/10.1007/s11192-018-2889

Vogel R, Güttel W (2013) The dynamic capability view in strategic management: a bibliometric review. Int J Manag Rev 15:426–446

Glänzel W, Schubert A (2004) Analyzing scientific networks through co-authorship. In: Glänzel W, Schmoch U (eds) Handbook of quantitative science and technology research. Springer, Dordrecht, pp 257–276. https://doi.org/10.1007/1-4020-2755-9_12

Newman MEJ (2004) Co-authorship networks and patterns of scientific collaboration. Proc Natl Acad Sci 101:5200–5205. https://doi.org/10.1073/pnas.0307545100

Zou X, Long W, Le H (2018) Visualization and analysis of mapping knowledge domain of road safety studies. Accid Anal Prev 118(September):131–145. https://doi.org/10.1016/j.aap.2018.06.010

Sarkis J, Davarzani H, Fahimnia B (2015) Green supply chain management: a review and bibliometric analysis. Int J Prod Econ 162:101–114. https://doi.org/10.1016/j.ijpe.2015.01.003

Elango B (2019) A bibliometric analysis of franchising research (1988–2017). J Entrepreneurship 28(2):223–249. https://doi.org/10.1177/0971355719851897

Zupic I, Čater T (2015) Bibliometric methods in management and organization. Organ Res Methods 18(3):429–472. https://doi.org/10.1177/1094428114562629

Chandio AA, Jiang Y, Rehman A, Twumasi MA, Pathan AG, Mohsin M (2021) Determinants of demand for credit by smallholder farmers’: a farm level analysis based on survey in Sindh, Pakistan. J Asian Bus Econ Stud 28(3):225–240. https://doi.org/10.1108/JABES-01-2020-0004

Nguyen T, Su J, Sharma P (2019) SME credit constraints in Asia’s rising economic star: fresh empirical evidence from Vietnam. Appl Econ 51(29):3170–3183. https://doi.org/10.1080/00036846.2019.1569196

Tran VT, Trung-Thanh N, Nguyet TM (2019) Gender difference in access to local finance and firm performance: evidence from a panel survey in Vietnam. Econ Anal Policy 63(C):150–164

Silong AKF, Gadanakis Y (2020) Credit sources, access and factors influencing credit demand among rural livestock farmers in Nigeria. Agric Finance Rev 80(1):68–90. https://doi.org/10.1108/AFR-10-2018-0090

Afari-Sefa V, Bidogeza JC, Djoumessi Y, Kamdem C (2018) Determinants of smallholder vegetable farmers credit access and demand in southwest region, Cameroon. Econ Bull AccessEcon 38(2):1231–1240

Archer L, Sharma P, Su J-J (2020) SME credit constraints and access to informal credit markets in Vietnam. Int J Soc Econ 47(6):787–807. https://doi.org/10.1108/IJSE-11-2017-0543

Abimbola OA, Egbide B-C, Adekunle EA, Damilola FE, Adebanjo JF, Abiodun SA (2020) Rotating and Savings Credit Association (ROSCAs): a veritable tool for enhancing the performance of micro and small enterprises in Nigeria. Asian Econ Financ Rev 10(2):189–199. https://doi.org/10.18488/journal.aefr.2020.102.189.199

Diaz-Serrano L, Sackey F (2018) Microfinance and credit rationing: does the microfinance type matter? J Sustain Finance Invest 8(2):114–131. https://doi.org/10.1080/20430795.2017.1403181

Ding Z, Abdulai A (2018) Smallholder preferences and willingness-to-pay measures for microcredit: evidence from Sichuan province in China. China Agric Econ Rev 10(3):462–481. https://doi.org/10.1108/CAER-02-2017-0022

Bairagya I, Bhattacharya T, Bhattacharjee M (2020) Impact of credit accessibility on the earnings of self-employed businesses in India. J Asian Econ 69:101202

Weng C, Wang H, Heerink N, van den Berg M (2022) Credit constraints and rural households’ entrepreneurial performance in China. Emerg Mark Finance Trade 58(2):570–583. https://doi.org/10.1080/1540496X.2020.1788538

Shuaibu M, Nchake M (2021) Impact of credit market conditions on agriculture productivity in Sub-Saharan Africa. Agric Finance Rev 81(4):520–534. https://doi.org/10.1108/AFR-05-2020-0063

Drori I, Ronny M, Estefania S, Amir S (2020) How does the global microfinance industry determine its targeting strategy across cultures with differing gender values? J World Bus 55(5):100985

Mia MA, Lee H, Chandran V, Rasiah R, Rahman M (2019) History of microfinance in Bangladesh: a life cycle theory approach. Bus Hist 61(4):703–733. https://doi.org/10.1080/00076791.2017.1413096

Bel hadj Miled K, Rejeb JB (2018) Can microfinance help to reduce poverty? A review of evidence for developing countries. J Knowl Econ 9(2):613–635

Samineni S, Ramesh K (2020) Measuring the impact of microfinance on economic enhancement of women: analysis with special reference to India. Glob Bus Rev. https://doi.org/10.1177/0972150920923108

Shoma C (2019) Financing female entrepreneurs in cottage, micro, small, and medium enterprises: evidence from the financial sector in Bangladesh 2010–2018. Asia Pac Policy Stud 6(3):397–416

Patel R, Patel N (2021) Does microfinance empower women from economic, social, and political perspectives?: Empirical evidence from rural Gujarat. Prabandhan Indian J Manag. 14(3):32–48

Aslam M, Kumar S, Ismail T, Sorooshian S (2020) Impact of microfinance on poverty: qualitative analysis for Grameen Bank borrowers. Int J Financ Res 11(1):49–59

Khan ST, Bhat MA, Sangmi M-U-D (2020) Impact of microfinance on economic, social, political and psychological empowerment: evidence from women’s self-help groups in Kashmir Valley, India. FIIB Bus Rev. https://doi.org/10.1177/2319714520972905

Nilakantan R, Iyengar D, Datta SK et al (2021) On ethical violations in microfinance backed small businesses: family and household welfare. J Bus Ethics 172:785–802. https://doi.org/10.1007/s10551-020-04499-0

Okunlola FA, Babajide AA, Isibor AA (2020) Empowering women through micro finance empirical evidence from Ibadan, Oyo State, Nigeria. Acad Entrep J 26:1–12

Patel R, Patel N (2020) Impact of microfinance on women empowerment: a study from the decision—making perspective. Indian J Finance 14(9):52–68

Gul FA, Podder J, Shahriar AM (2017) Performance of microfinance institutions: does government ideology matter? World Dev 100(C):1–15

Awaworyi CS (2020) Microfinance financial sustainability and outreach: is there a trade-off? Empir Econ 59:1329–1350. https://doi.org/10.1007/s00181-019-01709-1

Cervelló-Royo R, Guijarro F, Martinez-Gomez V (2019) Social Performance considered within the global performance of microfinance institutions: a new approach. Oper Res Int J 19:737–755. https://doi.org/10.1007/s12351-017-0360-3

Li LY, Hermes N, Meesters A (2019) Convergence of the performance of microfinance institutions: a decomposition analysis. Econ Model 81(C):308–324

Sinha RP, Pandey P (2019) Efficiency of microfinance institutions in India: a two-stage DEA approach. Int J Rural Manag 15(1):49–77. https://doi.org/10.1177/0973005219832494

Leite RO, Mendes LS (2019) To profit or not to profit? Assessing financial sustainability outcomes of microfinance institutions. J Finance Econ 24(3):1287–1299

Abrar A, Hasan I, Kabir R (2021) Finance-growth nexus and banking efficiency: the impact of microfinance institutions. J Econ Bus 114(C):105975

Al-Azzam M (2019) Financing microfinance institutions: subsidies or deposit mobilisation. Appl Econ 51(15):1621–1633. https://doi.org/10.1080/00036846.2018.1527467

Chikalipah S (2018) Do microsavings stimulate financial performance of microfinance institutions in Sub-Saharan Africa? J Econ Stud 45(5):1072–1087. https://doi.org/10.1108/JES-05-2017-0131

Banto JM, Monsia AF (2021) Microfinance institutions, banking, growth and transmission channel: a GMM panel data analysis from developing countries. Q Rev Econ Finance 79(C):126–150

Adusei M, Sarpong-Danquah B (2021) Institutional quality and the capital structure of microfinance institutions: the moderating role of board gender diversity. J Inst Econ 17(4):641–661. https://doi.org/10.1017/S1744137421000023

Tchuigoua HT, Soumaré I, Hessou HT (2020) Lending and business cycle: evidence from microfinance institutions. J Bus Res 119(C):1–12

Bharti N, Malik S (2022) Financial inclusion and the performance of microfinance institutions: does social performance affect the efficiency of microfinance institutions? Soc Responsib J 18(4):858–874. https://doi.org/10.1108/SRJ-03-2020-0100

Memon A, Akram W, Abbas G, Chandio AA, Adeel S, Yasmin I (2022) Financial sustainability of microfinance institutions and macroeconomic factors: a case of South Asia. South Asian J Macroecon Public Finance 11(1):116–142. https://doi.org/10.1177/22779787211007970

Mia MA, Banna H, Noman A, Alam MR, Rana S (2021) Factors affecting borrowers’ turnover in microfinance institutions: a panel evidence. Ann Public Coop Econ. https://doi.org/10.1111/apce.12325

Bernards N (2019) The poverty of Fintech? Psychometrics, credit infrastructures, and the limits of financialization. Rev Int Polit Econ 26(5):815–838. https://doi.org/10.1080/09692290.2019.1597753

Tanima FA, Brown J, Dillard J (2020) Surfacing the political: women’s empowerment, microfinance, critical dialogic accounting and accountability. Acc Organ Soc 85(C):101141

Langevin M (2019) Big data for (not so) small loans: technological infrastructures and the massification of fringe finance. Rev Int Polit Econ 26(5):790–814. https://doi.org/10.1080/09692290.2019.1616597

Masiak C, Block JH, Moritz A, Lang F, Kraemer-Eis H (2019) How do micro firms differ in their financing patterns from larger SMEs? Venture Cap 21(4):301–325. https://doi.org/10.1080/13691066.2019.1569333

Wasiuzzaman S, Nurdin N, Abdullah AH, Vinayan G (2020) Creditworthiness and access to finance of SMEs in Malaysia: do linkages with large firms matter? J Small Bus Enterp Dev 27(2):197–217. https://doi.org/10.1108/JSBED-03-2019-0075

Bongomin GOC, Woldie A, Wakibi A (2020) Microfinance accessibility, social cohesion and survival of women MSMEs in post-war communities in sub-Saharan Africa: Lessons from Northern Uganda. J Small Bus Enterp Dev 27(5):749–774. https://doi.org/10.1108/JSBED-12-2018-0383

Shahriar AZ, Unda L, Alam Q (2019) Gender differences in the repayment of microcredit: the mediating role of trustworthiness. J Bank Finance 110:105685. https://doi.org/10.1016/j.jbankfin.2019.105685

Koh L, Solarin S, Yuen Y, Ramasamy S, Goh G (2021) The impact of microfinance services on socio-economic welfare of urban vulnerable households in Malaysia. Int J Bus Soc 22:696–712. https://doi.org/10.33736/ijbs.3752.2021

Mittal V, Raman TV (2022) Financing woes: estimating the impact of MSME financing gap on financial structure practices of firm owners. South Asian J Bus Stud 11(3):316–340. https://doi.org/10.1108/SAJBS-07-2020-0228

Pomeroy R, Arango C, Lomboy C, Box S (2020) Financial inclusion to build economic resilience in small-scale fisheries. Mar Policy 118(2):103982. https://doi.org/10.1016/j.marpol.2020.103982

Ali MM, Devi A, Furqani H, Hamzah H (2020) Islamic financial inclusion determinants in Indonesia: an ANP approach. Int J Islam Middle East Finance Manag 13(4):727–747. https://doi.org/10.1108/IMEFM-01-2019-0007

Zauro NA, Zauro NA, Saad RAJ, Sawandi N (2020) Enhancing socio-economic justice and financial inclusion in Nigeria: the role of zakat, Sadaqah and Qardhul Hassan. J Islam Acc Bus Res 11(3):555–572. https://doi.org/10.1108/JIABR-11-2016-0134

Raza MS, Tang J, Rubab S, Wen X (2019) Determining the nexus between financial inclusion and economic development in Pakistan. J Money Laund Control 22(2):195–209. https://doi.org/10.1108/JMLC-12-2017-0068

Baber H (2020) Financial inclusion and FinTech: a comparative study of countries following Islamic finance and conventional finance. Qual Res Financ Mark 12(1):24–42. https://doi.org/10.1108/QRFM-12-2018-0131

Khmous DF, Besim M (2020) Impact of Islamic banking share on financial inclusion: evidence from MENA. Int J Islam Middle East Finance Manag 13(4):655–673. https://doi.org/10.1108/IMEFM-07-2019-0279

Shaikh SA (2021) Using Fintech in scaling up Islamic microfinance. J Islam Acc Bus Res 12(2):186–203. https://doi.org/10.1108/JIABR-10-2019-0198

Bolarinwa ST, Olaoye OO, Ullah W, Agbi B (2022) Does financial development really matter for poverty reduction in Africa? Forum Soc Econ 51(4):415–432. https://doi.org/10.1080/07360932.2021.1896564

Shi B, Chi G, Li W (2019) Exploring the mismatch between credit ratings and loss-given-default: a credit risk approach. Econ Model. https://doi.org/10.1016/j.econmod.2019.11.032

Liang K, He J (2020) Analyzing credit risk among Chinese P2P-lending businesses by integrating text-related soft information. Electron Commer Res Appl. https://doi.org/10.1016/j.elerap.2020.100947

Enimu S, Eyo EO, Ajah EA (2017) Determinants of loan repayment among agricultural microcredit finance group members in Delta state, Nigeria. Financ Innov 3:21. https://doi.org/10.1186/s40854-017-0072-y

Medina-Olivares V, Calabrese R, Dong Y, Shi B (2022) Spatial dependence in microfinance credit default. Int J Forecast 38(3):1071–1085

Zhang Z, Yan S, Li J, Tian X, Yoshida T (2022) Credit risk prediction of SMEs in supply chain finance by fusing demographic and behavioral data. Transp Res Part E Logist Transp Rev 158:102611

Mota J, Moreira AC, Brandão C (2018) Determinants of microcredit repayment in Portugal: analysis of borrowers, loans and business projects. Port Econ J 17:141–171. https://doi.org/10.1007/s10258-018-0148-2

Ala’raj M, Abbod M, Radi M (2018) The applicability of credit scoring models in emerging economies: an evidence from Jordan. Int J Islam Middle East Finance Manag 11(4):608–630. https://doi.org/10.1108/IMEFM-02-2017-0048

de Paula PD, Artes R, Ayres F, Minardi A (2019) Estimating credit and profit scoring of a Brazilian credit union with logistic regression and machine-learning techniques. RAUSP Manag J. 54(3):321–336. https://doi.org/10.1108/RAUSP-03-2018-0003

Fuming Y, Huang W, Xiaojing L (2019) Micro- and small-sized enterprises’ willingness to borrow via internet financial services during coronavirus disease 2019. Int Entrep Manag J 18:191–216. https://doi.org/10.1007/s11365-021-00763-5

Mou J, Christopher Westland J, Phan TQ et al (2020) Microlending on mobile social credit platforms: an exploratory study using Philippine loan contracts. Electron Commer Res 20:173–196. https://doi.org/10.1007/s10660-019-09391-2

Wang Y, Drabek Z, Wang Z (2021) The role of social and psychological related soft information in credit analysis: evidence from a Fintech Company. J Behav Exp Econ 96:101806. https://doi.org/10.1016/j.socec.2021.101806

Zhang W, Daim T, Zhang Q (2019) Exploring the multi-phase driven process for disruptive business model innovation of E-business microcredit: a multiple case study from China. J Knowl Econ 10:590–617. https://doi.org/10.1007/s13132-017-0483-z

Kimmitt J, Dimov D (2021) The recursive interplay of capabilities and constraints amongst microfinance entrepreneurs. Int J Entrep Behav Res 27(3):600–628. https://doi.org/10.1108/IJEBR-10-2018-0642

Souza LLF, Bassi F, Ferreira de Freitas AA (2019) Multilevel latent class modeling to segment the microfinance market. Int J Bank Mark 37(5):1103–1118. https://doi.org/10.1108/IJBM-05-2018-0132

Kumra R, Khalek SA, Samanta T (2021) Factors affecting BoP producer intention to use P2P lending platforms in India. J Glob Mark 34(4):328–352. https://doi.org/10.1080/08911762.2021.1915440

Singh J, Dutt P (2019) Microfinance and entrepreneurship at the base of the pyramid. Acad Manag Proc 16(1):3–31. https://doi.org/10.5465/AMBPP.2019.64

Geiger M, Oranburg SC (2018) Female entrepreneurs and equity crowdfunding in the US: receiving less when asking for more. J Bus Ventur Insights 10:e00099

Figueroa-Armijos M, Berns JP (2022) Vulnerable populations and individual social responsibility in prosocial crowdfunding: does the framing matter for female and rural entrepreneurs? J Bus Ethics 177:377–394. https://doi.org/10.1007/s10551-020-04712-0

Zhao Y, Xie X, Yang L (2021) Female entrepreneurs and equity crowdfunding: the consequential roles of lead investors and venture stages. Int Entrep Manag J 17:1183–1211. https://doi.org/10.1007/s11365-020-00659-w

Cicchiello AF, Kazemikhasragh A, Monferra S (2021) In women, we trust! Exploring the sea change in investors’ perceptions in equity crowdfunding. Gend Manag 36(8):930–951. https://doi.org/10.1108/GM-10-2020-0309

Tisdell C, Ahmad S, Agha N, Steen J, Verreynne M (2020) Microfinance for wives: fresh insights obtained from a study of poor rural women in Pakistan. J Res Gender Stud 10(1):9–37. https://doi.org/10.22381/JRGS10120201

Callon M, Courtial JP, Laville F (1991) Co-word analysis as a tool for describing the network of interactions between basic and technological research: the case of polymer chemistry. Scientometrics 1991(22):155–205

Cobo MJJ, López-Herrera AGG, Herrera-Viedma E, Herrera F (2012) SciMAT: a new science mapping analysis software tool. J Am Soc Inf Sci Technol 2012(63):1609–1630

Acknowledgements

Not applicable.

Funding

Not applicable.

Author information

Authors and Affiliations

Contributions

FL involved in writing, data analysis, editing, and finalizing the manuscript. ABSM involved in reviewing, editing, and analysis of the manuscript. Both authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The authors declare that they have no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Lwesya, F., Mwakalobo, A.B.S. Frontiers in microfinance research for small and medium enterprises (SMEs) and microfinance institutions (MFIs): a bibliometric analysis. Futur Bus J 9, 17 (2023). https://doi.org/10.1186/s43093-023-00195-3

Received:

Accepted:

Published:

DOI: https://doi.org/10.1186/s43093-023-00195-3