- Review

- Open access

- Published:

Emerging new themes in green finance: a systematic literature review

Future Business Journal volume 9, Article number: 108 (2023)

Abstract

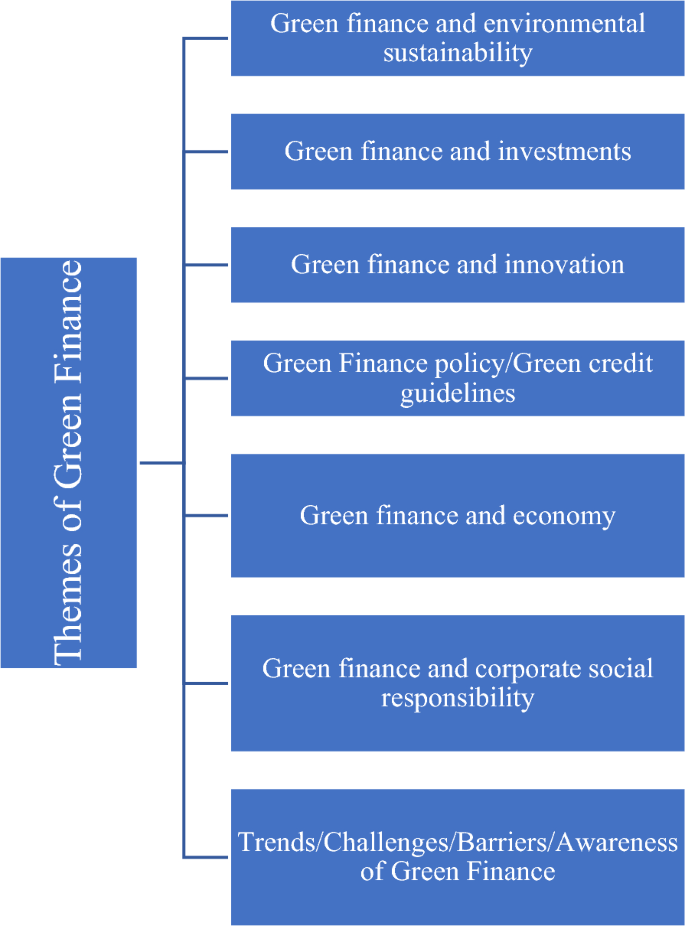

There is a need for an extensive understanding of the emerging themes and trends within the domain of green finance, which is still evolving. By conducting a systematic literature review on green finance, the purpose of this study is to identify the emerging themes that have garnered significant attention over the past 12 years. In order to identify the emerging themes in green finance, bibliometric analysis was performed on 978 publications that were published between 2011 and 2023 and were taken from the databases of Scopus and Web of Science. The author examined annual scientific production, journal distribution, countries scientific production, most relevant authors, most frequent words, areas where empirical research is lacking, words' frequency over time, trend topics, and themes of green finance. The outcome of the review identified the following seven themes: (i) green finance and environmental sustainability; (ii) green finance and investments; (iii) green finance and innovation; (iv) green finance policy/green credit guidelines; (v) green finance and economy; (vi) green finance and corporate social responsibility; (vii)trends/challenges/barriers/awareness of green finance. The analysis of these emerging themes will contribute to the existing corpus of knowledge and provide valuable insights into the landscape of green finance as it evolves.

Introduction

Cities will face their greatest challenges ever during the next 30 years, and three-quarters of the world's population will reside in urban areas by 2050 due to the unparalleled rate of urbanization as a result of population growth, resource scarcity, such as peak oil, water shortages, and food security [100].

One of the main challenges in building and maintaining sustainable cities is discovering the sources required to fund vital infrastructure, development, and maintenance activities that have a sustainable future. To achieve the creation of sustainable cities, there is a need for green projects via green financial bonds, green banks, carbon market tools, other new financial instruments, new policies, fiscal policy, a green central bank, fintech, community-based green funds, and expanding the financing of investments that provide environmental benefits [26, 78].

It is evident that green financing plays a crucial role in promoting sustainable initiatives. Thus, a transition from a rising economy to a green economy necessitates that a country's leadership offers green financing [112]. To assure green economic growth, nations around the world have invested in green projects to promote, invent, and employ environmentally friendly technologies to safeguard the environment and maximize environmental performance [55]. Because of new stakeholders' and institutions' understanding of environmental issues, regulatory authorities are likely to seek out extra ecologically acceptable financial resources. In an effort to establish environmental legitimacy, this type of environmental proactivity will be required when new methods of providing financial resources and green financing arise.

In numerous ways, the impact of adopting green financing is proven. First, green finance provides financial support for firms engaged in green innovation, including the purchase of green equipment, the introduction of new environmentally efficient technologies, and the training of their personnel. Second, green funding from various projects can assist stakeholders (organizations, governments, and regulators) in spending R&D funds on environmental challenges and minimize the associated risk with green legislation. Lastly, green policies have higher costs than conventional practices, and green finance can assist an organization in covering these expenses without encountering significant financial obstacles. As a result, green finance-driven economic growth can significantly support green policies, lessen environmental pollution, and build sustainable cities [128].

There have previously been systematic literature reviews conducted in the green finance area. However, a study's reliance on one database can exclude some recent developments in green finance from its analysis [93]. Findings from several databases could be compared and contrasted to create a more all-encompassing view of the area. Therefore, this study focuses on using Scopus and WoS databases.

Though additional methods, such as systematic literature reviews (SLR) and more complex network analyses such as co-occurrence of index terms, citations, co-citations, and bibliometric coupling, are available, previously conducted studies used a fundamental bibliometric technique [23]. A more detailed picture of the green finance study setting may emerge from an examination of the identification of various themes.

As part of a systematic review of the literature concerning emerging trends in green finance, it is critical to ascertain the dominant themes that are present in the field. By adopting this methodology, an intentional emphasis is placed on maintaining the review's relevance and excluding any studies that are obsolete. In addition, by identifying and classifying these themes, one can gain significant knowledge regarding the ever-changing characteristics of green finance, thereby illuminating the latest advancements and patterns. A study conducted by Pasupuleti and Ayyagari [99] identified different themes in green finance, but the researchers were only focused on polluting companies. By amalgamating insights from the literature review, one can attain a holistic comprehension of the current state of research in the field of green finance. Additionally, this process identifies areas where additional inquiry is necessary. Engaging in such an undertaking provides advantages not only to the scholarly community but also carries practical implications for policymakers, practitioners, and investors, assisting them in formulating effective policies and investment strategies and making well-informed decisions.

Green finance research is growing rapidly. However, the rising themes and trends in green finance literature must be comprehended. A comprehensive literature review can summarize current knowledge, identify research gaps, and identify the field's most relevant topics. This study seeks to uncover green finance's emerging themes through a rigorous literature review. This research aims to advance green finance knowledge by synthesizing and analyzing a wide range of scholarly articles.

Methods and methodology

Study selection process and methods

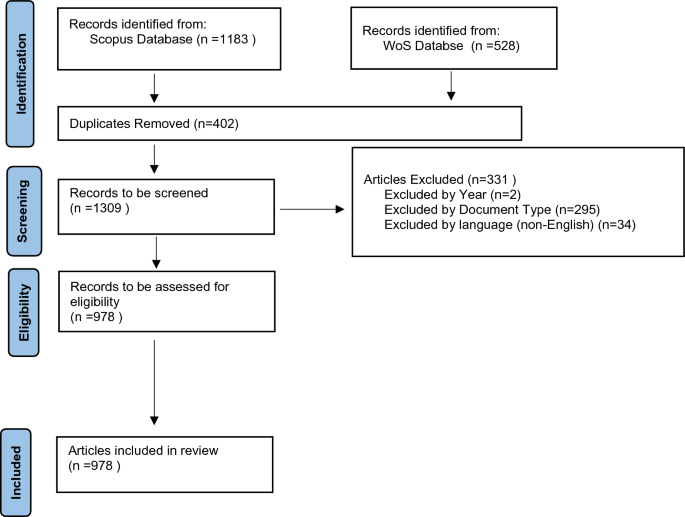

In this study, a systematic literature review (SLR) was applied. It used inclusion criteria, analysis techniques, and a more objective method of article selection. As recommended for SLRs [65] with regard to the article selection process, the PRISMA article selection steps were adhered to. The steps are "identification," "screening," and "included". The steps that were taken in this study are shown in Fig. 1.

In the identification phase, the search terms, search criteria, databases, and data extraction technique are chosen. The keyword to use in the search was "green finance" as the study is aimed at identifying emerging themes in green finance.

The identified articles need to be screened in accordance with the PRISMA guidelines. The tasks carried out at the screening were the screening, retrieval, and evaluation of each article's eligibility. According to Priyashantha et al. in [103], articles in each task that did not meet the inclusion criteria were removed. The "empirical studies" published in "Journals" from "2011–2023" in "English" were the inclusion criteria for screening the articles. In 2023, up to May, the journal articles were chosen.

This screening was carried out both manually and automatically. Utilizing Scopus' and Web of Science's (WoS) automatic article screening features by study type, language, report type, and publication date, articles achieving the inclusion criteria "empirical studies" published in "English" "journals" from "2011–2023″ were included. The other publication types such as conference papers, book chapters, reviews, research notes, editor's comments, short surveys, and unpublished data, as well as non-English articles and articles published within the considered year range, were excluded. The full versions of the screened articles were then retrieved for the eligibility assessment, the next stage of screening. The author manually evaluated each article's eligibility.

Study risk of bias assessment

Researcher bias in article selection and analysis lowers the quality of reviews [8, 102]. Avoiding bias in article selection and analysis requires using a review protocol, adhering to a systematic, objective article selection procedure, using objective analysis methods [8, 102], and performing a parallel independent quality assessment of articles by two or more researchers [8]. By adhering to all of these requirements, the risk of bias in the articles was removed.

Methods of analysis

Biblioshiny and VOSviewer were used for bibliometric analysis. Green finance literature was captured by Scopus and WoS. These databases were used exclusively to get a representative sample of journal articles to study green finance articles. The data were collected and analyzed using Biblioshiny. Select databases can be systematically extracted and analyzed with the software. It collects year-by-year article distribution, journal distribution, country-specific scientific production, most relevant authors, most frequent words, word frequency over time, trend topics, density visualization, etc.

Trends and patterns were found by analyzing green finance paper distribution by year. This analysis shows green finance research's growth. By analyzing article distribution by year, we may also establish green financing and rising theme trends. To identify green finance research publications, article distribution was studied. Academic journal distribution can indicate green finance's prominence in various academic journals. Analyzing scientific production by region reveals regional green finance research tendencies. Scientific production across nations identifies knowledge-producing regions.

Analyzing influential green finance authors helps identify their contributions. This strategy acknowledges influential scholars. The research's most frequently used words reveal the fundamental questions and ideas of environmentally responsible economics. This analysis reveals the discipline's primary topics and studies. By counting words, it may focus on green finance's most important and widely used components. Word frequency can show how green finance's focus has shifted. By tracking word usage, it can identify trending topics. This analysis reveals changing green finance research priorities. Biblioshiny explores green financial trends. This study reveals new topics, research gaps, and subject interests. The trend themes allow us to evaluate green finance studies.

Results and findings

Study selection

The PRISMA flow diagram illustrates that during the identification step, 528 articles from the WoS database and 1183 articles from the Scopus database that include the term "green finance" were identified. There were 402 duplicates, which were removed. The overall number of articles remained at 1302 at that point. Further attempts were made to include papers on empirical investigations in the final versions that were published in English. 34 non-English articles were thus disregarded. In addition, 295 papers from conferences, book chapters, reviews, news articles, notes, letters, abstracts, and brief surveys were not included. Two articles were disqualified because they were published before 2011. The next step was to retrieve the remaining 978 articles and transfer their pertinent data to an MS Excel file, including the article's title, abstract, keywords, authors' names and affiliations, journal name, citation counts, and year of publication. After that, each article was examined by a third party to determine whether it met the requirements for its eligibility.

Study characteristics

Main information

This study examined 978 studies by 1830 authors from 59 countries. They've been published in 281 publications. The average number of citations each article received was 12.37. There were a total of 2206 keywords and 44,712 references. This information is detailed in Table 1.

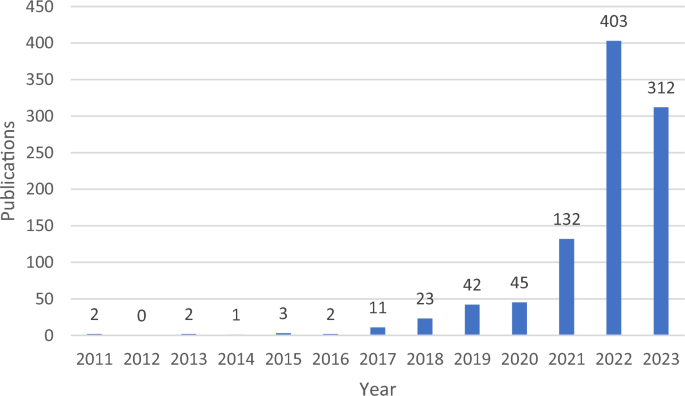

Annual scientific production

The fluctuations in green financing for scientific production are depicted in Fig. 2. In 2011, two articles were published that demonstrated interest in this research. No publications were released in 2012, indicating a paucity of research or interest. The trend persisted in 2013 with two articles. One publication appeared in 2014, indicating a halt in research. Since 2015, scientific output has gradually increased. In 2015, three articles contributed to the development of green finance research. Two articles survived in 2016. With eleven articles published in 2017, green finance has become a significant area of study. In 2018, 23 articles were published; in 2019, there will be 42. With 45 publications in 2020, green finance research remains robust. Green finance research increased to 132 publications in 2021. This significant increase in articles on the subject indicates a growing interest in the matter. The publication of 403 research articles in 2022 represents a notable increase. This increase reflects the expanding literature on green finance and its academic significance.

Journal distribution

Table 2 consists of a list of journals that were included in the sample and had more than six relevant papers published inside the journals. The majority of the journals that publish articles relating to green finance are, unsurprisingly, those that focus on environmental science, renewable energy, and sustainability. This is despite the fact that finance is considered an essential component of green financing. Not a single journal in the field of finance was able to attract more than 10 papers.

Based on the number of papers, Environmental Science and Pollution Research emerges as the top journal, demonstrating a strong focus on comprehending the intersection between environmental science, pollution, and financial aspects. The prevalence of journals focused on renewable energy and sustainability, each of which publishes 50 papers, demonstrates the growing interest in examining the financial aspects of sustainable development and renewable energy sources. The fact that Resources Policy was included in the list of 49 papers indicates that a significant emphasis was placed on understanding the financial implications of resource management and extraction.

Green finance is interdisciplinary in nature, exploring the connections between finance and various environmental issues, as evidenced by the existence of interdisciplinary journals like Frontiers in Environmental Science. The existence of journals like Finance Research Letters and Economic Research-Ekonomska Istrazivanja highlights the importance of economic and financial analysis in the context of green finance.

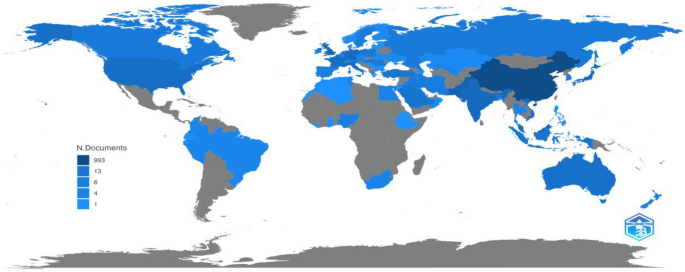

Countries scientific production

The analysis of region frequencies in the provided data in Fig. 3 reveals intriguing patterns and highlights the varying levels of research focus in various countries. The analysis is focused on the top ten countries for scientific production on green finance.

China is the part of the world most frequently mentioned, with a striking frequency of 993. This suggests a significant research interest in comprehending and analyzing diverse aspects of China's economy, policies, and development. Given China's status as the world's most populous nation and its growing global influence, it is unsurprising that researchers have devoted considerable effort to examining China's position in various fields, including finance, sustainability, and innovation.

Pakistan follows with a frequency of 79, indicating a notable but relatively lower research emphasis. Researchers may have investigated particular Pakistan-related topics, such as its economy, governance, or social issues. Pakistan may be of particular interest to a subset of researchers, or there may be a paucity of relevant literature in the analyzed dataset.

With a frequency of 60, the UK is the third-most-mentioned region. This demonstrates a sustained interest in researching various aspects of the UK, such as its economy, financial sector, and policies. It is possible that the historical significance of the UK, particularly in terms of finance and international relations, contributed to its prominence in literature.

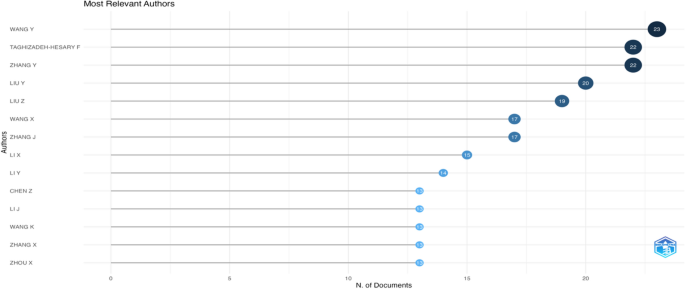

Most relevant authors

The prominent and active contributors to the discipline are shown in Fig. 4. Wang Y has significantly added to the body of literature. The top authors have a constant record of publishing, which shows a dedication to knowledge advancement and suggests a high level of expertise in their field of study.

Discussion

In this section, the findings that conform to the aims of the research are reported. The conclusions were generated through the use of trend themes, keyword co-occurrence analysis, "most frequent words," and "word frequency over time." During the course of the investigation, both the "keyword co-occurrence; network visualization" and the "density visualization" methods were applied.

Most frequent words

The analysis of the most frequent words sheds light on the emerging themes in the field of green finance, as illustrated in Table 3 and Fig. 5. A significant emphasis on China, which appears 253 times in the literature, is one of the important observations. This indicates that China's initiatives and role in the context of sustainable finance and green investment are gaining increasing recognition. China's approach to green finance and its potential implications for global sustainability initiatives are likely the primary focus of researchers and policymakers.

The term "finance" appears 122 times, emphasizing the importance of financial mechanisms and instruments to the advancement of green initiatives. This emphasizes the significance of financial institutions, policies, and frameworks that support environmental protection and sustainable development. The frequency of the term "investment" (103) emphasizes the significance of allocating financial resources to environmentally friendly businesses and initiatives.

The 105 occurrences of "sustainable development" indicate the close relationship between green finance and broader sustainability goals. This indicates that researchers and practitioners recognize the need to align financial decisions with environmental, social, and governance (ESG) factors in order to achieve long-term sustainable development objectives.

The terms "green economy" (75) and "environmental economics" (57) refer to the integration of environmental considerations into economic systems and decision-making procedures. This emphasizes the importance of transitioning to environmentally sustainable economic models and policies.

The frequency of terms such as "carbon," "carbon emissions," and "carbon dioxide" (55, 55, and 51 times, respectively) indicates a focus on mitigating greenhouse gas emissions and addressing climate change via financial mechanisms. This is consistent with the worldwide drive for decarbonization and the transition to low-carbon economies.

In addition, the terms "innovation" (71), "impact" (67), and "efficiency" (49) emphasize the significance of technological advancements, measurable outcomes, and resource optimization in green finance. These ideas illustrate the ongoing pursuit of innovative strategies and solutions to promote positive environmental impact while maximizing resource utilization.

The terms "sustainability" (44), "policy" (49), and "financial system" (41) highlight the need for policy frameworks and a robust financial system to facilitate the incorporation of sustainability considerations into mainstream finance. These themes emphasize the critical role that regulations, incentives, and institutional arrangements play in promoting green finance practices and nurturing a sustainable economy.

In addition, the terms "climate change" (50) and "alternative energy" (42) suggest an emphasis on addressing climate-related issues and investigating renewable and sustainable energy sources. This demonstrates an acknowledgment of the role of green finance in the transition to a low-carbon, resilient future.

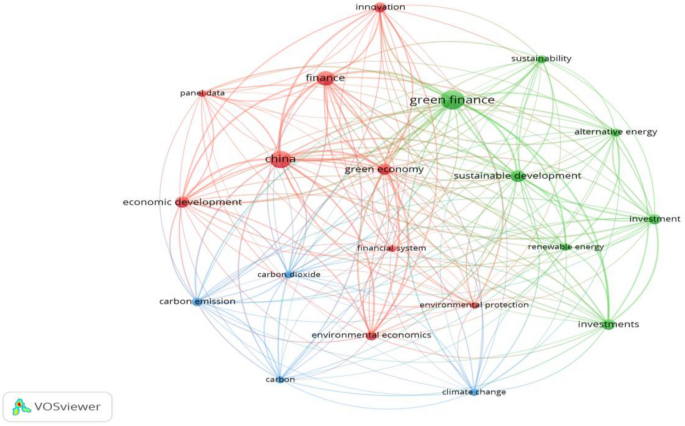

The relationships between the keywords depicted as nodes are displayed in Fig. 6's keyword co-occurrence network visualization. The link shows how each keyword relates to the others. In particular, the thickness of the line indicates how strong the relationship is. As a result, Fig. 8 illustrates how China and green finance are connected by a thicker line, showing that the majority of green finance research is carried out in China. Additionally, the connection between finance, sustainable development, and investments in green finance shows their connection to green finance. In Fig. 6, the nodes are grouped into the red, green, and blue clusters. These clusters contain the keywords listed in Table 3 for each one. The various clusters in Fig. 6 demonstrate how different areas of research had distinct effects on green financing. When keywords are grouped together, it indicates that the topics they refer to are quite likely to be the same. As a result, the red, green, and blue clusters in Fig. 6 highlight common themes, while Table 4 provides explanations for the clusters.

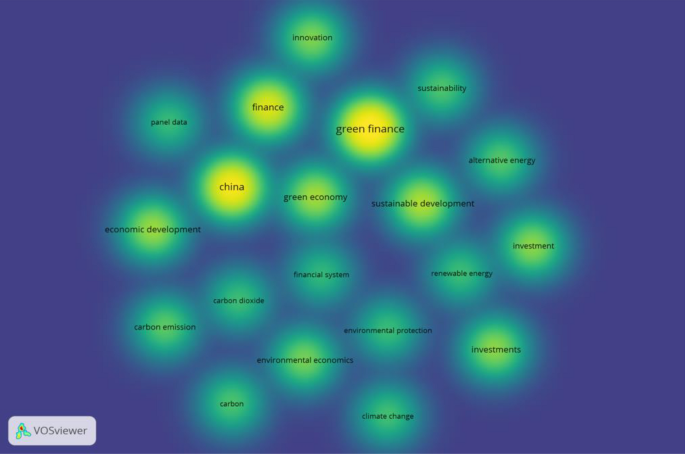

Areas where empirical research is lacking

Figure 7 displays the density visualization map that the VOSviewer generated. The VoSviewer manual states that a node with a red background denotes sufficient research for established knowledge and that it is evident that more study on green finance is still needed. On the other hand, keyword nodes with a green background show that there hasn't been much research on those particular keywords. Other than finance and China, the other keywords in the figure are therefore in the green background, which denotes insufficient research.

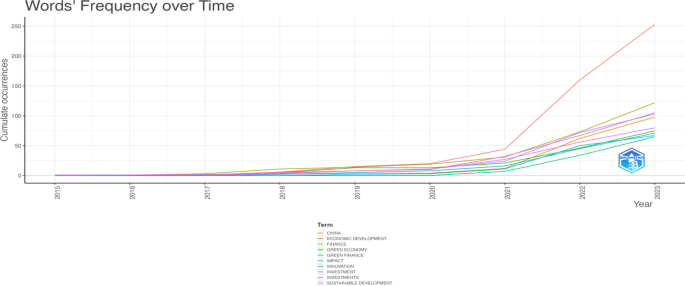

Word’s frequency over time

The analysis of words' frequency over time in Fig. 8 reveals a number of significant trends. Beginning in 2018, the frequency of the term "China" increases considerably, with a significant rise in 2022 and a peak of 253 occurrences in 2023. This indicates a growing emphasis on China's role in green finance and its expanding prominence in the academic literature.

The persistent occurrence of the term "finance" over the years indicates the sustained significance of financial mechanisms and instruments in the context of green finance research. Its increasing frequency over time demonstrates the continued emphasis placed on financial aspects of the field.

The consistent growth of the term "sustainable development" from 2016 to 2019 indicates a growing recognition of the connection between green finance and broader sustainability objectives. However, after 2019, its occurrence remains comparatively stable, indicating that sustainable development has become a well-established and consistent theme in the literature.

Similarly, the term "investment" has maintained a consistent presence throughout the years, indicating a continued emphasis on allocating financial resources to green and sustainable initiatives. Its frequency fluctuates but remains relatively high throughout the period under consideration.

The frequency of the term "economic development” increased gradually until 2021, after which it remained relatively stable. This indicates that researchers have acknowledged the need to incorporate economic development and sustainable practices, resulting in a continued emphasis on this topic.

Similar to the term "investments," it has maintained a consistent presence throughout the years. This demonstrates a persistent desire to investigate investment opportunities and strategies within the context of green finance.

The frequency of the term "green economy” increased until 2020, after which it stabilized. This demonstrates an ongoing commitment to transitioning to a greener and more sustainable economy.

The terms "innovation" and "impact" have exhibited a general upward trend over the years. This suggests that innovative approaches to measuring the impact of green finance initiatives and projects are gaining importance.

The term "green finance" has been used significantly more frequently, particularly after 2021. This demonstrates the increasing interest and focus on the specific discipline of green finance, reflecting its emergence as a distinct research area within the context of sustainable finance as a whole.

Trend topics

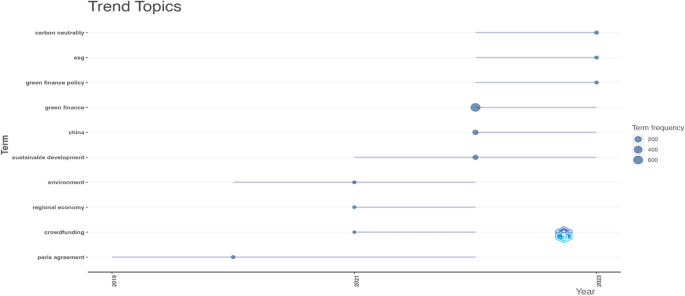

Insights into novel areas and their developments over time can be gained from an analysis of trend themes using author keywords in the bibliometric data, as shown in Fig. 9.

There are nine times where the "Paris Agreement" is mentioned as a subject. It was consistently present from 2019 to 2022, demonstrating a strong interest in comprehending the ramifications and execution of this global climate agreement. The Paris Agreement's effects on environmental regulations and attempts to slow down climate change were probably among the topics on which researchers concentrated.

Seven uses of the word "environment" show that it is a recurring subject. This implies maintaining a focus on environmental concerns and the interactions between human actions and the environment as a whole. It's likely that academics and researchers have examined numerous environmental concerns and their effects on various industries and regulations.

Six occurrences of "regional economy" are found in the literature. This shows a rise in interest in learning about the dynamics and growth of regional economies and how they relate to sustainable practices. The emphasis on regional economies indicates that scholars are looking at the regional and context-specific elements affecting sustainable development and economic progress.

Another subject with five mentions per topic is "crowdfunding". This shows that crowdsourcing is becoming more and more popular as a method of finance, especially for sustainable projects. Crowdfunding's ability to assist green projects, as well as the opportunities and challenges that come with it, has probably been studied by researchers.

With 631 occurrences, the topic "green finance" stands out due to its very high frequency and demonstrates its rising importance in the literature. This demonstrates a rise in interest in the nexus between finance and environmental sustainability. The methods, laws, and procedures that encourage financial investments in green projects and companies have probably been studied by academics and policymakers.

With 92 mentions, "China" stands out as being quite popular. In the context of green finance and sustainable development, this suggests a strong focus on China's participation. Researchers are probably looking at China's policies and initiatives and how they may affect international sustainability efforts.

The phrase "sustainable development" also comes up 70 times, demonstrating a steadfast interest in learning and implementing sustainable practices in a variety of fields. There is a good chance that academics have looked into the frameworks, policies, and tactics that help achieve long-term sustainable development goals.

Seventeen times are mentioned when the term "carbon neutrality" is brought up, which shows that efforts to achieve it are becoming more and more of a priority. To minimize greenhouse gas emissions and combat climate change, researchers have probably looked into a variety of strategies and regulations.

ESG (environmental, social, and governance) is a term with a frequency of ten references, which reflects the growing understanding of the significance of ESG aspects in investment choices and company practices. The incorporation of ESG factors into financial analysis and decision-making processes has probably been researched by researchers and practitioners.

Last but not least, the phrase "green finance policy" is used nine times, showing that policies that support and oversee green finance efforts are a particular emphasis of the study. It's likely that academics and policymakers have looked at how well these policies work and how they affect the growth of sustainable practices and investments.

In conclusion, study subjects that have attracted interest over time are shown by an analysis of trend topics in the bibliometric data. These themes show the continued attempts to understand and manage environmental concerns through research, policy, and finance, from global agreements like the Paris Agreement to specific topics like green finance and sustainable development.

Themes of green finance

This study uncovered a variety of topics relating to green finance as well as potential areas for further research. The descriptions of the themes are presented in Fig. 10. Different themes related to green finance, along with significant studies that contributed significantly, are discussed below.

Green finance and environmental sustainability

In recent years, there has been a growing emphasis on the significance of green finance and environmental sustainability, leading to increased attention and focus in both academic research and practical applications. The world is currently experiencing an unparalleled environmental crisis, with issues like resource depletion, biodiversity loss, and climate change becoming more pressing. Green finance, which falls under the umbrella of sustainable finance, centers its attention on investments and financial methods that not only yield economic profits but also contribute to favorable environmental consequences.

Existing research mostly focuses on green finance and environmental sustainability in Asian countries, with specific focus on China. Green finance's function in low-carbon development has been thoroughly studied in relation to carbon emissions [13, 147]. Green financing and renewable energy growth have also received attention, aiding China's clean energy revolution [4, 12, 20, 21, 40, 49, 51, 56, 61, 67, 72, 75, 76, 80, 85, 89, 97, 104, 105, 107, 109, 110, 119, 121, 129, 135, 144, 145, 149, 169, 172]. Environmental rules and green finance have also been studied to determine how well they promote sustainable financing [19, 22, 62, 114, 123, 145, 159].

When it comes to the study of regions outside of Asia, such as Africa, South America, and parts of Europe, there is a significant knowledge gap. It may be helpful to gain useful insights into regional variances and strategies if one is able to comprehend the various ways in which these various regions approach green financing and environmental sustainability initiatives.

Green finance and investments

Following a global shift toward sustainable and ecologically responsible economic practices, green finance and investments have developed dramatically.

Green bond quality and effectiveness, notably in China, is a major study topic. Green bonds finance ecologically friendly projects, therefore verifying their quality is crucial to green financial markets. To help green bonds meet sustainability goals, researchers have studied their quality procedures and standards [3, 6, 9, 10, 33,34,35, 38, 79, 92, 95, 108, 115, 164]. The relationship between green and non-green investments is another frequent research topic. Researchers have studied the hedging or diversification impacts of these two assets. This study examines how green and non-green investments affect portfolio strategies, risk management, and the financial environment [1, 116]. Another interesting relationship is natural resource richness, FDI, and regional eco-efficiency. Given global agreements like COP26, scholars are studying how natural resources and FDI effect regional ecological efficiency as states attempt to combine economic growth with environmental sustainability [15, 36, 42, 143, 157].

A key feature of green finance study is how financial institutions, integrate green investment and financing teams. The green finance agenda requires understanding how bank’s structure and behave to encourage sustainable investment. Green financial instrument creation and effect are another study topic. Researchers have examined green finance products including green bonds and minibonds to determine their performance and impact on environmental and sustainability goals. This field helps design policies and strategies to optimize industrial structures and promote sustainable development.

Green finance research examines how it affects industrial structures. Studies have examined how green finance initiatives including loans and investments optimize and shift industrial sectors toward sustainability. These findings are crucial for governments and business stakeholders seeking financial incentives for eco-friendly operations [12, 31, 46, 57, 85, 96, 124, 130, 139].

Green finance market interactions with financial variables must also be assessed for sustainable financial development. Researchers examine the relationship between green financial indices and other financial indicators to better understand how green finance affects the financial landscape [27, 32, 48, 68, 137].

Green finance and investments have many unexplored areas, presenting research opportunities. The behavioral dimensions of green investment focus on the psychological drivers and biases that influence investment choices; subnational and local initiatives, which are frequently ignored despite their crucial role in ecological action; cross-country comparisons to provide a more holistic view of effective green finance practices; the role and impact of green finance in emerging economies; and innovative green financial instruments like blockchain. Examining these lesser-known aspects could improve our understanding of sustainability in the financial sector and offer insightful information to investors, financial institutions, and legislators that want to make a positive impact on a more sustainable and environmentally friendly future.

Green finance and innovation

The convergence of green finance and innovation is a crucial topic that addresses the pressing global concerns of environmental sustainability and financial stability. Much study has been done on green finance and innovation, yet various themes and gaps emerge, demonstrating its complexity.

Green financing policies and instruments promote innovation, especially in environmental technologies and renewable energy. Many studies have studied how green funding affects green innovation and if it promotes sustainable technology. They've studied green bonds, green banking, and green finance reform laws, offering empirical evidence that financial incentives combined with green practices can stimulate environmental innovation [16, 41, 44, 47, 52, 64, 70, 81, 87, 107, 133, 152, 162].

The role of environmental legislation in green financing and innovation is another common theme. Researchers have studied how these restrictions affect green finance's impact on technology. Studying how financial policies and regulatory frameworks interact has helped explain the complex dynamics affecting innovation in environmentally sensitive industries [11, 29, 54, 84, 120, 126, 132, 151, 152, 174].

Nevertheless, there are obvious gaps in the existing knowledge within the field. The effects of green finance on innovation have been extensively studied, but a better knowledge of the factors driving innovation in other areas is needed. Further study may reveal how green funding might boost innovation in non-environmental industries. How can financial mechanisms support sustainable transportation, agricultural, and urban planning innovation.

Further research is needed on education and the human element in green innovation. How green finance, educational investments, and innovation interact can help individuals, businesses, and societies develop a sustainable future. Green finance and innovation's impact on environmental adaptation and resilience also understudied. More research is needed to determine how financial mechanisms and new solutions may help communities and organizations adapt to climate change.

Green finance policy/green credit guidelines

Climate change and environmental degradation are major worldwide issues. Green finance, which promotes environmentally and socially responsible investments, is a key instrument in this battle. Research and discussion have focused on how green finance policies affect the economy and environment.

The switch to renewable energy is crucial to fighting climate change globally. This transition relies on green financing initiatives. Researchers are investigating how well such regulations promote renewable energy. They examined how green finance regulations affect renewable energy output, investment, and job development in this growing sector. Understanding these implications helps improve green finance initiatives for sustainability [18, 98, 118].

China and other nations have implemented green finance pilot programs to test the waters and stimulate innovation. This research evaluates pilot policy implementation and impacts. Scholars use synthetic control and other tools to study how these initiatives affect green innovation. The results help determine the real-world implications of such experiments and their potential for wider use [48, 113, 121, 131, 146, 162].

Green financing policies vary worldwide. Comparative research of green financing rules can highlight policy differences among jurisdictions. Researchers compared the EU and Russia's green financing laws. These studies emphasize differences, similarities, and the potential influence of these policies on green finance development, promoting cross-border cooperation and knowledge exchange [60, 125].

Monitoring and measuring green finance progress is essential for future development. Researchers are developing green finance indices to assess green finance in a country or region. These indices help policymakers, investors, and the public understand green finance's growth and potential [141].

Despite significant and informative research on green finance policies and their effects on the economy and environment, several research gaps and opportunities for additional investigation remain. First, a thorough evaluation of the durability and long-term sustainability of green finance policies is lacking in the literature. Many studies focus on short-term outcomes, but long-term planning and implementation need understanding these policies' long-term implications. Second, green finance policies' cross-border effects need greater study. As the global economy grows more interconnected, it's important to understand how regional policies affect others and the possibility for international collaboration. Green finance and social effects as creating employment and community development are understudied. Such studies could illuminate these policies' overall impact. Finally, additional multidisciplinary research combining economics, environmental science, and social science are needed to comprehend green finance policies' complex implications. Scholars can fill these gaps to improve our understanding of this crucial topic and inform sustainable policymaking.

Green finance and economy

The relationship between carbon intensity and economic development is a growing topic in green finance research. How nations may shift to low-carbon economies while maintaining economic growth has been studied. Several studies have quantified how green finance policies reduce carbon emissions and boost economic growth [63, 71, 122, 155, 175].

The study of the impact of green financing on agriculture, particularly in China, is gaining attention. Green financing impacts agricultural trade, sustainability, and food security, according to researchers [37, 140]. Given its connection with economics, food production, and sustainability, this type of researches is crucial.

Efficient utilization of natural resources in Asian countries has gained attention for promoting green economic growth. Researchers have studied how nations might maximize economic gains from natural resources while reducing environmental harm. Addressing sustainable economic development concerns requires this area [86, 101, 146, 166].

The significance of judicial quality in reducing emissions without hindering economic growth is a common issue in green finance research. Researchers examine how strong legal systems can enforce environmental laws and promote green practices while boosting the economy [154].

Even while the previously stated research topics have unquestionably enhanced our understanding of the intricacies of green finance, there are still a number of uncharted territories and research gaps that need to be investigated further. Currently, research on green finance mostly focuses on economic and environmental concerns. Integrated research combining economic, environmental, and social science is needed. It can provide a holistic view of green finance policy' many implications. The globalization of green finance policy has significant implications and cross-border effects. These policies' worldwide spillover effects and country collaboration are rarely studied. Research is lacking on how regional policies affect others and international cooperation.

Green finance and corporate social responsibility

Fostering CSR requires understanding how environmental regulations affect companies' sustainable strategies. Researchers should examine how CSR goals can be better aligned with regulations to improve environmental and social outcomes. Researchers have studied green finance-CSR approaches to promote sustainability. This research seeks to understand how green finance initiatives like green bonds and sustainable investment practices affect CSR performance [173]. Businesses and investors looking to maximize their environmental and social impact must understand these mechanisms.

One intriguing research topic is empirical evidence from heavily polluting enterprises, especially in China. This study shows how green finance can reduce environmental harm and promote CSR in industries with a high environmental impact [45, 66]. Researchers can find ways to help heavily polluting companies become more sustainable by studying their experiences.

Bangladesh banks' CSR and green finance practices have also been studied [168]. This study studies how green financing affects financial institution CSR and environmental performance. Financial organizations can use these results to incorporate environmental responsibility while being profitable. Another relevant research topic is post-pandemic CSR practices as a business strategy to combat volatility and drive energy and environmental transition [53]. Understanding how CSR and green finance can help companies whether economic downturns and pandemics are crucial. This research can help businesses adapt to changing business conditions.

Further studies can explore socially responsible mutual funds and low-carbon economies. The impact of the investment industry on sustainability and environmental responsibility can be better understood by scholars by examining how these funds affect company behavior and investment decisions. Investors and businesses pursuing sustainable development may find these insights to be beneficial.

Green bond issuance is growing, thus study on its effects on company performance and CSR is needed. Investors seeking to support environmentally responsible businesses and companies contemplating green finance must have a comprehensive understanding of the repercussions on associated with green financing.

Trends/challenges/barriers/awareness of green finance

Regional patterns in China's green finance trends are well-studied, but little is known about applying these findings elsewhere, especially in countries with similar environmental issues [24, 30, 83, 88]. Analysis of green finance growth by sector is common; however, there may be a knowledge vacuum about how sectors might learn from each other to create more successful sectoral plans [28, 50, 142].

Analyzing the structural barriers to green financing is vital, but also understanding how consumers, financial institutions, and governments can work together to close this gap is crucial. Political and institutional restrictions in green financing have been extensively examined, but cross-national comparisons might reveal similar concerns and inventive solutions. Cultural variety is crucial in ethical and green finance, but the challenges of adapting cultural methods to different places may not be adequately examined [7].

Conclusion

There were 213 papers pertaining to green finance research that were published between the years 2011 and 2021. However, between 2022 and May 2023, there was an enormous increase in the number of publications, which was 715. These publications can be found in Scopus and WoS. This spike can be associated with a number of causes that have encouraged both academia and industry to focus on sustainable and environmentally friendly practices. These drivers can be found in both the public and private sectors.

To begin, there has been a growing awareness of the urgent need to address climate change and its adverse impacts on the world. An increasing number of demands for action have accompanied this recognition. Green finance provides a means by which funds can be directed toward projects and investments that promote environmental sustainability, such as the development of sustainable infrastructure, clean technologies, and renewable sources of energy. In addition, global initiatives such as the Paris Agreement have put pressure on governments and financial institutions to align their strategies with climate goals, which has led to an increased demand for research on green finance practices and regulations [58]. Additionally, investors and consumers are becoming more aware of the environmental impact of their financial actions, which is contributing to an increase in demand for environmentally responsible investing products and services [39]. As a direct consequence of these developing tendencies, researchers and academics have developed responses to them, adding to the expanding body of literature on green finance.

993, more than any other nation, are references to China. This shows a keen interest in learning about China's economy, politics, and development. Researchers have concentrated on China's position in finance, sustainability, and innovation given its status as the world's largest population country and its growing global relevance due to its critical role in fostering sustainable and low-carbon development. Reduced energy use and waste are the goals of energy efficiency measures, which also have a positive effect on the environment by reducing greenhouse gas emissions. Researchers want to comprehend the procedures, regulations, and financial tools that can successfully encourage and support energy efficiency projects, which will ultimately contribute to a greener and more sustainable future. This is why they are focused on energy efficiency within the context of green finance [2, 14, 60, 67, 69, 74, 106, 117, 134, 136, 156, 160, 170].

The construction of pilot zones for green finance reform and innovations (GFRI) is a significant step the Chinese government has taken to build a green economy. Many authors have conducted surveys on China's GFRI policy and its impact on innovations. The GFRI policy program supports green innovation in large, polluting companies and urban green development by enhancing total factor productivity in pilot cities, emphasizing the importance of debt finance in corporate green innovation [40, 82, 148, 150, 153, 158]. A different study by Wang et al. in 2022 [127] discovered that while the GFRP generally plays a positive role in fostering green technology innovation capabilities, the extent to which it has an impact varies depending on the region's resources, environment, and level of economic development, with middle- and high-income areas seeing a more noticeable impact. Wang et al. in 2022 [127] propose a green finance index, employing statistical indicators from 2011 to 2019, to analyze China's green finance development and predict its growth from 2020 to 2024. New energy, green mobility, and new energy vehicles have boosted China's green finance index during the previous nine years, according to research.

The Green Financial Reform and Innovation Pilot Zones (GFPZ) policy's effect on the ESG ratings of Chinese A-share listed firms between 2014 and 2020 is examined in another study. The findings showed that the GFPZ policy raises ESG scores, which are mainly based on social responsibility, and helps businesses in the pilot zones do better financially and environmentally [17]. In 2023, Shao and Huang [111] reviewed China's green finance policy mix, showing a shift toward market-based approaches and greater private sector engagement, influenced by dynamic vertical interactions between different levels of government.

Chen et al. [14] examined the response of China's equity funds to institutional pressure on green finance in 2021. The results showed that funds with negative screening strategies, which exclude environmentally harmful investments, have higher green investment levels and higher financial returns, while funds with positive screening strategies face negative investor reactions despite their green investments.

A study done by Lv et al. [88] found that while green finance development in China is improving, regional disparities and a polarization trend exist, requiring measures to narrow the gap and promote coordinated development across economic regions. Because it is crucial for striking a balance between economic development, environmental conservation, and social well-being, researchers in green finance concentrate on sustainability. The authors focused on studies on sustainable investment options, analyzed how environmental, social, and governance aspects are incorporated into financial decision-making, and evaluated how sustainability affects financial performance. Researchers are expected to advance ethical and sustainable financial practices and help the world accomplish its sustainability goals by studying sustainability within the context of green finance [5, 25, 43, 46, 59, 73, 77, 90, 91, 94, 104, 109, 138, 161, 163, 165, 167, 171].

In conclusion, research on green finance has primarily focused on Asian countries, particularly China, where it plays a crucial role in low-carbon development and renewable energy growth. However, there is a significant knowledge gap in regions outside Asia, such as Africa, South America, and parts of Europe. Further research is needed to understand regional variances and strategies in these areas.

Studies have examined various aspects of green finance, including green bond quality, the relationship between green and non-green investments, and the impact of green finance on environmental and sustainability goals. Behavioral dimensions of green investment, subnational and local initiatives, cross-country comparisons, and the role of green finance in emerging economies have also been explored. Additionally, the role of green finance in stimulating innovation in environmental technologies and renewable energy has been studied, but there are gaps in understanding its impact on non-environmental industries and the human element in green innovation.

Further research is needed to understand the role of environmental legislation in green finance, its impact on technology, and its cross-border effects. The durability and long-term sustainability of green finance policies should also be examined, along with their social effects such as employment creation and community development. The relationship between carbon intensity and economic development, as well as the alignment of corporate social responsibility goals with environmental regulations, are important areas for investigation.

There is a need for more research on applying the findings from China's green finance trends to other countries facing similar environmental issues. Structural barriers to green financing should be analyzed, and the collaboration between consumers, financial institutions, and governments in closing this gap should be explored. Cultural diversity in ethical and green finance should also be considered, along with the challenges of adapting cultural methods to different places. Overall, further research in these areas can contribute to a more sustainable and environmentally friendly future.

When compared to other fields of study, it is clear that research on green finance has not been investigated to the same extent. In contrast to the less-researched areas of carbon, carbon emissions, climate change, financial systems, policymaking, agriculture, CSR, supply chain, risk management, corporate strategy, regional planning, and governance, green financing has been well-liked with investments, sustainable developments, green innovations, and green economies. On the other hand, taking into account the growing attention paid to sustainability on a worldwide scale and the pressing need to find solutions to the problems posed by the environment, it is quite likely that research into green finance will become more important in the years to come.

The increasing significance of sustainable development and the change to an economy with lower carbon emissions will require the development of innovative financial solutions to support green initiatives and assist the shift toward a financial system that is more friendly to the environment and more sustainable. It is anticipated that researchers will devote a greater amount of attention to green finance as the level of awareness regarding the environmental and social impacts of financial activities continues to rise. These researchers will investigate topics such as sustainable investment strategies, green bond markets, sustainable banking practices, and the incorporation of environmental considerations into financial decision-making. In addition to this, the incorporation of environmentally friendly financial practices into policy frameworks and regulatory measures further emphasizes the requirement for research in this particular area. In general, it is projected that research on green finance will pick up steam in the years to come because it plays such an important role in the process of sculpting a financially sustainable and resilient.

Availability of data and materials

SCOPUS and WoS databases.

Abbreviations

- CSR:

-

Corporate social responsibility

- Fintech:

-

Financial Technology

- GFRI:

-

Green finance reform and innovations

- GFPZ:

-

Green Financial Reform and Innovation Pilot Zones

- SLR:

-

Systematic literature review

References

Akhtaruzzaman M, Banerjee AK, Ghardallou W, Umar Z (2022) Is greenness an optimal hedge for sectoral stock indices? Econ Model. https://doi.org/10.1016/j.econmod.2022.106030

An Q, Lin C, Li Q, Zheng L (2023) Research on the impact of green finance development on energy intensity in China. Front Earth Sci 11:1118939. https://doi.org/10.3389/feart.2023.1118939

Azhgaliyeva D, Kapsalyamova Z, Mishra R (2022) Oil price shocks and green bonds: An empirical evidence. Energy Econ. https://doi.org/10.1016/j.eneco.2022.106108

Bai J, Chen Z, Yan X, Zhang Y (2022) Research on the impact of green finance on carbon emissions: evidence from china. Econ Res-Ekon Istraz 35(1):6965–84. https://doi.org/10.1080/1331677X.2022.2054455

Bai X, Wang K-T, Tran TK, Sadiq M, Trung LM, Khudoykulov K (2022) Measuring china’s green economic recovery and energy environment sustainability: econometric analysis of sustainable development goals. Econ Anal Policy. https://doi.org/10.1016/j.eap.2022.07.005

Barua S, Chiesa M (2019) ‘Sustainable financing practices through green bonds: What affects the funding size? Bus Strategy Environ. https://doi.org/10.1002/bse.2307

Borbely, Emese. ‘The Relevance of Cultural Diversity in Ethical and Green Finance’. In Sustainable Economic Development: Green Economy and Green Growth, edited by W. L. Filho, D. M. Pociovalisteanu, and A. Q. AlAmin, 67–82. Cham: Springer International Publishing Ag, 2017. https://doi.org/10.1007/978-3-319-45081-0_4.

Brereton P, Kitchenham B, Budgen D, Turner M, Khalil M (2007) Lessons from applying the systematic literature review process within the software engineering domain. J Syst Softw 80(4):571–583. https://doi.org/10.1016/J.JSS.2006.07.009

Cerqueti R, Deffains-Crapsky C, Storani S (2023) Green Finance Instruments: Exploring Minibonds Issuance in Italy. Corpor Soc Responsib Environ Manag. https://doi.org/10.1002/csr.2467

Chang K, Liu L, Luo D, Xing K (2023) The impact of green technology innovation on carbon dioxide emissions: the role of local environmental regulations. J Environ Manag. https://doi.org/10.1016/j.jenvman.2023.117990

Chang L, Moldir M, Zhang Y, Nazar R (2023) Asymmetric impact of green bonds on energy efficiency: fresh evidence from quantile estimation. Util Policy. https://doi.org/10.1016/j.jup.2022.101474

Chen D, Haiqing H, Chang C-P (2023) Green finance, environment regulation, and industrial green transformation for corporate social responsibility. Corpor Soc Responsib Environ Manag. https://doi.org/10.1002/csr.2476

Chen J, Li L, Yang D, Wang Z (2023) The dynamic impact of green finance and renewable energy on sustainable development in China. Front Environ Sci 10:1097181. https://doi.org/10.3389/fenvs.2022.1097181

Chen J, Siddik AB, Zheng G-W, Masukujjaman M, Bekhzod S (2022) The effect of green banking practices on banks environmental performance and green financing: an empirical study. Energies. https://doi.org/10.3390/en15041292

Chen Q, Ning Bo, Pan Y, Xiao J (2022) Green finance and outward foreign direct investment: evidence from a Quasi-natural experiment of green insurance in China. Asia Pacific J Manag 39(3):899–924. https://doi.org/10.1007/s10490-020-09750-w

Chen S, Xie G (2023) Assessing the linkage among green finance, technology, and education expenditure: evidence from G7 economies. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-023-25625-1

Chen Z, Ling H, He X, Liu Z, Chen D, Wang W (2022) Green financial reform and corporate ESG performance in China: empirical evidence from the green financial reform and innovation pilot zone. Int J Environ Res Public Health. https://doi.org/10.3390/ijerph192214981

Cheng Z, Kai Z, Zhu S (2023) Does green finance regulation improve renewable energy utilization? Evidence from energy consumption efficiency. Renew Energy. https://doi.org/10.1016/j.renene.2023.03.083

Cho H, Lehner OM, Nilavongse R (2020) Combining financial and ecological sustainability in bank capital regulations. J Appl Account Res. https://doi.org/10.1108/JAAR-10-2020-0221

Chu H, Hongjuan Y, Chong Y, Li L (2023) Does the development of digital finance curb carbon emissions? Evidence from county data in China. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-023-25659-5

Cui Y, Wang G, Irfan M, Desheng W, Cao J (2022) The effect of green finance and unemployment rate on carbon emissions in China. Front Environ Sci 10:887341. https://doi.org/10.3389/fenvs.2022.887341

Deng W, Zhang Z (2023) Environmental regulation intensity, green finance, and environmental sustainability: empirical evidence from China based on spatial metrology. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-023-26946-x

Desalegn G, Fekete-Farkas M, Tangl A (2022) The effect of monetary policy and private investment on green finance: evidence from Hungary. J Risk Financ Manag 15(3):117. https://doi.org/10.3390/jrfm15030117

Ding R, Du Y, Du L, Fu J, Chen S, Wang K, Xiao W, Peng L, Liang J (2023) Green finance network evolution and prediction: fresh evidence from China. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-023-27183-y

Dong C, Hao Wu, Zhou J, Lin H, Chang L (2023) Role of renewable energy investment and geopolitical risk in green finance development: empirical evidence from BRICS countries. Renew Energy. https://doi.org/10.1016/j.renene.2023.02.115

Duchêne S (2020) Review of Handbook of Green Finance. Available at from: https://www.sciencedirect.com/science/article/abs/pii/S0921800920311873.

Fabozzi FJ, Tunaru DE, Tunaru RS (2022) The interconnectedness between green finance indexes and other important financial variables. J Portfolio Manag. https://doi.org/10.3905/jpm.2022.1.392

Falcone PM, Sica E (2019) Assessing the opportunities and challenges of green finance in Italy: an analysis of the biomass production sector. Sustainability 11(2):517. https://doi.org/10.3390/su11020517

Fang Y, Shao Z (2023) How does green finance affect cleaner industrial production and end-of-pipe treatment performance? Evidence from China. Environ Sci Pollut Res 30(12):33485–33503. https://doi.org/10.1007/s11356-022-24513-4

Feng W, Bilivogui P, Wu J, Mu X (2023) Green finance: current status, development, and future course of actions in China. Environ Res Commun 5(3):035005. https://doi.org/10.1088/2515-7620/acc1c7

Gao J, Wu D, Xiao Q, Randhawa A, Liu Q, Zhang T (2023) green finance, environmental pollution and high-quality economic development—a study based on China’s provincial panel Data. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-022-24428-0

Gao L, Tian Q, Meng F (2023) The impact of green finance on industrial reasonability in China: empirical research based on the spatial panel durbin model. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-022-18732-y

García-Lamarca M, Ullström S (2022) Everyone wants this market to grow: the affective post-politics of municipal green bonds. Environ Plann E: Nat Space. https://doi.org/10.1177/2514848620973708

Gilchrist D, Yu J, Zhong R (2021) The limits of green finance: a survey of literature in the context of green bonds and green loans. Sustainability. https://doi.org/10.3390/su13020478

Glomsrød S, Wei T (2018) Business as unusual: the implications of fossil divestment and green bonds for financial flows, economic growth and energy market. Energy Sustain Dev. https://doi.org/10.1016/j.esd.2018.02.005

Gong W (2023) A study on the effects of natural resource abundance and foreign direct investment on regional eco-efficiency in China under the target of COP26. Resour Policy. https://doi.org/10.1016/j.resourpol.2023.103529

Guo J, Zhang K, Liu K (2022) Exploring the mechanism of the impact of green finance and digital economy on China’s green total factor productivity. Int J Environ Res Public Health 19(23):16303. https://doi.org/10.3390/ijerph192316303

Hadaś-Dyduch M, Puszer B, Czech M, Cichy J (2022) Green bonds as an instrument for financing ecological investments in the V4 countries. Sustainability. https://doi.org/10.3390/su141912188

Hales R, Dai J, Fu T (2023) Green finance: opportunities and challenges for the financial sector. J Financ Serv Res 1–23

Han S, Zhang Z, Yang S (2022) Green finance and corporate green innovation: based on china’s green finance reform and innovation pilot policy. J Environ Public Health 2022:1833377. https://doi.org/10.1155/2022/1833377

Han Y, Tan S, Zhu C, Liu Y (2023) Research on the emission reduction effects of carbon trading mechanism on power industry: plant-level evidence from China. Int J Climate Change Strateg Manag. https://doi.org/10.1108/IJCCSM-06-2022-0074

Hawash MK, Taha MA, Hasan AA, Braiber HT, Mahdi RAA, Thajil KM, Albakr AMA (2022) Financial inclusion, foreign direct investment, green finance and green credit effect on iraq manufacturing companies sustainable economic development: a case on static panel data. CUAD Econ 45(128):53–60. https://doi.org/10.32826/cude.v1i128.706

He C, Yan G (2020) Path selections for sustainable development of green finance in developed coastal areas of China. J Coast Res. https://doi.org/10.2112/JCR-SI104-014.1

He J, Iqbal W, Fangli Su (2023) Nexus between renewable energy investment, green finance, and sustainable development: role of industrial structure and technical innovations. Renew Energy. https://doi.org/10.1016/j.renene.2023.04.010

He L, Zhong T, Gan S (2022) Green finance and corporate environmental responsibility: evidence from heavily polluting listed enterprises in China. Environ Sci Pollut Res 29(49):74081–74096. https://doi.org/10.1007/s11356-022-21065-5

Hu J, Zhang H (2023) Has green finance optimized the industrial structure in China? Environ Sci Pollut Res 30(12):32926–32941. https://doi.org/10.1007/s11356-022-24514-3

Huang Di (2022) Green finance, environmental regulation, and regional economic growth: from the perspective of low-carbon technological progress. Environ Sci Pollut Res 29(22):33698–33712. https://doi.org/10.1007/s11356-022-18582-8

Huang H, Zhang J (2021) Research on the environmental effect of green finance policy based on the analysis of pilot zones for green finance reform and innovations. Sustainability 13(7):3754. https://doi.org/10.3390/su13073754

Huang J, An L, Peng W, Guo L (2023) Identifying the role of green financial development played in carbon intensity: evidence from China. J Clean Prod. https://doi.org/10.1016/j.jclepro.2023.136943

Jain K, Gangopadhyay M, Mukhopadhyay K (2022) Prospects and challenges of green bonds in renewable energy sector: case of selected Asian economies. J Sustain Finance Invest. https://doi.org/10.1080/20430795.2022.2034596

Jia Q (2023) The impact of green finance on the level of decarbonization of the economies: an analysis of the United States’, China’s, and Russia’s current agenda. Bus Strateg Environ 32(1):110–119. https://doi.org/10.1002/bse.3120

Jiang K, Chen Z, Chen F (2022) Green creates value: evidence from China. J Asian Econ. https://doi.org/10.1016/j.asieco.2021.101425

Karagiannopoulou S, Sariannidis N, Ragazou K, Passas I, Garefalakis A (2023) Corporate social responsibility: a business strategy that promotes energy environmental transition and combats volatility in the post-pandemic world. Energies. https://doi.org/10.3390/en16031102

Khalatur S, Dubovych O (2022) Financial engineering of green finance as an element of environmental innovation management. Market Manag Innov 1:232–46. https://doi.org/10.21272/mmi.2022.1-17

Khan KI, Nasir A, Rashid T (2022) Green practices: a solution for environmental deregulation and the future of energy efficiency in the post-COVID-19 era. Front Energy Res. https://doi.org/10.3389/fenrg.2022.878670

Kong F (2022) A better understanding of the role of new energy and green finance to help achieve carbon neutrality goals, with special reference to China. Sci Prog 105(1):00368504221086361. https://doi.org/10.1177/00368504221086361

Kong H, Xu Y, Zhang R, Tang D, Boamah V, Wu G, Zhou B (2023) Research on the upgrading of China’s regional industrial structure based on the perspective of green finance. Front Environ Sci 11:972559. https://doi.org/10.3389/fenvs.2023.972559

Kroeze C, Ntziachristos L, Blok K, Hausler R (2022) Energy and climate governance for sustainable development. Annu Rev Environ Resour 47:1–27

Lan J, Wei Y, Guo J, Li Q, Liu Z (2023) The effect of green finance on industrial pollution emissions: evidence from China. Resour Policy 80:103156. https://doi.org/10.1016/j.resourpol.2022.103156

Larsen M (2023) Adding “origination” to diffusion theory: contrasting the roles of china and the EU in green finance. Rev Int Polit Econ. https://doi.org/10.1080/09692290.2023.2204532

Lee C-C, Zhang J, Hou S (2023) The impact of regional renewable energy development on environmental sustainability in China. Resour Policy. https://doi.org/10.1016/j.resourpol.2022.103245

Lee C-C, Ho S-J (2022) Impacts of export diversification on energy intensity, renewable energy, and waste energy in 121 countries: Do environmental regulations matter? Renew Energy. https://doi.org/10.1016/j.renene.2022.09.079

Lee C-C, Wang F, Lou R, Wang K (2023) How does green finance drive the decarbonization of the economy? Empirical evidence from China. Renew Energy 204:671–684. https://doi.org/10.1016/j.renene.2023.01.058

Lee JW (2020) Green finance and sustainable development goals: the case of China. J Asian Finance Econ Bus 7(7):577–86. https://doi.org/10.13106/jafeb.2020.vol7.no7.577

Liberati A, Altman DG, Tetzlaff J, Mulrow C, Gøtzsche PC, Ioannidis JPA, Clarke M, Devereaux PJ, Kleijnen J, Moher D (2009) The PRISMA statement for reporting systematic reviews and meta-analyses of studies that evaluate health care interventions: explanation and elaboration. PLoS Med 6(7):e1000100. https://doi.org/10.1371/journal.pmed.1000100

Li C, Sampene AK, Agyeman FO, Brenya R, Wiredu J (2022) The role of green finance and energy innovation in neutralizing environmental pollution: empirical evidence from the MINT economies. J Environ Manag 317:115500. https://doi.org/10.1016/j.jenvman.2022.115500

Li C, Umair M (2023) Does green finance development goals affects renewable energy in China. Renew Energy. https://doi.org/10.1016/j.renene.2022.12.066

Li C, Gan Y (2021) The spatial spillover effects of green finance on ecological environment-empirical research based on spatial econometric model. Environ Sci Pollut Res 28(5):5651–5665. https://doi.org/10.1007/s11356-020-10961-3

Li C, Feng X, Li X, Zhou Y (2023) Effect of green credit policy on energy firms’ growth: evidence from China. Econ Res-Ekon Istraz. https://doi.org/10.1080/1331677X.2023.2177701

Li G, Jia X, Khan AA, Khan SU, Ali MAS, Luo J (2023) Does green finance promote agricultural green total factor productivity? Considering green credit, green investment, green securities, and carbon Finance in China. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-022-24857-x

Li J, Dong K, Taghizadeh-Hesary F, Wang K (2022) 3G in China: How green economic growth and green finance promote green energy? Renew Energy 200:1327–1337. https://doi.org/10.1016/j.renene.2022.10.052

Li W, Fan Y (2023) Influence of green finance on carbon emission intensity: empirical evidence from China based on spatial metrology. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-022-23523-6

Li X, Wang Z, Yu Y, Chen Y (2023) Does green finance promote the social responsibility fulfilment of highly polluting enterprises?–Empirical evidence from China. Econ Res-Ekon Istraz. https://doi.org/10.1080/1331677X.2022.2153719

Li Z, Kuo T-H, Siao-Yun W, The Vinh L (2022) Role of green finance, volatility and risk in promoting the investments in renewable energy resources in the post-Covid-19. Resour Policy 76:102563. https://doi.org/10.1016/j.resourpol.2022.102563

Li Z, Lu X, Wang S, Li X, Li H (2023) The threshold effect of environmental regulation in the nexus between green finance and total factor carbon productivity: evidence from a dynamic panel threshold model. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-023-25214-2

Liang J, Song X (2022) Can green finance improve carbon emission efficiency? Evidence from China. Fron Environ Sci 10:955403. https://doi.org/10.3389/fenvs.2022.955403

Lin C, Zhang X, Gao Z, Sun Y (2023) The development of green finance and the rising status of China’s manufacturing value chain. Sustainability 15(8):6395. https://doi.org/10.3390/su15086395

Lin J-D (2023) Explaining the quality of green bonds in China. J Clean Product. https://doi.org/10.1016/j.jclepro.2023.136893

Lin L, Hong Y (2022) Developing a green bonds market: lessons from China. Eur Bus Organ Law Rev. https://doi.org/10.1007/s40804-021-00231-1

Lin R, Wang Z, Gao C (2023) Re-examining resources taxes and sustainable financial expansion: an empirical evidence of novel panel methods for China’s provincial data. Resour Policy. https://doi.org/10.1016/j.resourpol.2022.103284

Liu C, Xiong M (2022) green finance reform and corporate innovation: evidence from China. Financ Res Lett 48:102993. https://doi.org/10.1016/j.frl.2022.102993

Liu H, Yao P, Latif S, Aslam S, Iqbal N (2022) Impact of green financing, FinTech, and financial inclusion on energy efficiency. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-021-16949-x

Liu H, Zhu Q, Khoso WM, Khoso AK (2023) Spatial pattern and the development of green finance trends in China. Renewable Energy. https://doi.org/10.1016/j.renene.2023.05.014

Liu X, Nie W (2022) Study on the coupling coordination mechanism of green technology innovation, environmental regulation, and green finance. Environ Sci Pollut Res 29(47):71796–71809. https://doi.org/10.1007/s11356-022-20905-8

Liu X, Zhang Y (2023) Green finance, environmental technology progress bias and cleaner industrial structure. Environ Dev Sustain. https://doi.org/10.1007/s10668-023-03062-x

Liu Y, Xia L (2023) Evaluating low-carbon economic peer effects of green finance and ICT for sustainable development: a chinese perspective. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-022-24234-8

Liu Z, Zheng S, Zhang X, Mo L (2023) The impact of green finance on export technology complexity: evidence from China. Sustainability 15(3):2625. https://doi.org/10.3390/su15032625

Lv C, Bian B, Lee C-C, He Z (2021) Regional gap and the trend of green finance development in China. Energy Econ 102:105476. https://doi.org/10.1016/j.eneco.2021.105476

Lyu Y, You Wu, Zhang J (2023) How industrial structure distortion affects energy poverty? Evidence from China. Energy. https://doi.org/10.1016/j.energy.2023.127754

Ma H, Miao X, Wang Z, Wang X (2023) How does green finance affect the sustainable development of the regional economy? Evidence from China. Sustainability 15(4):3776. https://doi.org/10.3390/su15043776

Mao Q, Ma X, Shi L, Jing Xu (2021) Effect of green finance on regional economic development: evidence from China. Transform Bus Econ 20(3C):505–525

Mejía-Escobar JC, González-Ruiz JD, Franco-Sepúlveda G (2021) Current state and development of green bonds market in the Latin America and the Caribbean. Sustainability. https://doi.org/10.3390/su131910872

Mohanty S, Nanda SS, Soubhari T, Vishnu NS, Biswal S, Patnaik S (2023) Emerging research trends in green finance: a bibliometric overview. J Risk Financ Manag. https://doi.org/10.3390/jrfm16020108

Muganyi T, Yan L, Sun H-P (2021) Green finance, fintech and environmental protection: evidence from China. Environ Sci Ecotechnol 7:100107. https://doi.org/10.1016/j.ese.2021.100107

Naeem MA, Conlon T, Cotter J (2022) Green Bonds and other assets: evidence from extreme risk transmission. J Environ Manag. https://doi.org/10.1016/j.jenvman.2021.114358

Nie L, Chen P, Liu X, Shi Q, Zhang J (2022) Coupling and coordinative development of green finance and industrial-structure optimization in china: spatial-temporal difference and driving factors. Int J Environ Res Public Health 19(17):10984. https://doi.org/10.3390/ijerph191710984

Pan J, Chen X, Luo X, Zeng X, Liu Z, Lai W, Yue Xu, Chuangxin Lu (2022) Analysis of the impact of China’s energy industry on social development from the perspective of low-carbon policy. Energy Reports Elsevier Ltd. https://doi.org/10.1016/j.egyr.2022.05.052

Pan Y, Dong F (2023) Green Finance policy coupling effect of fossil energy use rights trading and renewable energy certificates trading on low carbon economy: taking China as an example. Econ Anal Policy 77:658–679. https://doi.org/10.1016/j.eap.2022.12.014

Pasupuleti A, Ayyagari LR (2023) A thematic study of green finance with special reference to polluting companies: a review and future direction. Environ Process 10:24. https://doi.org/10.1007/s40710-023-00642-x

Pearson L, Newton P, Roberts P (2014) Resilient sustainable cities: a future, vol 10. Routledge, Abingdon, p 9780203593066

Phung Thanh Q (2022) Economic effects of green bond market development in Asian economies. J Risk Finance. https://doi.org/10.1108/JRF-08-2022-0216

Priyashantha KG, De Alwis AC, Welmilla I (2022) Disruptive human resource management technologies: a systematic literature review. Eur J Manag Bus Econ

Priyashantha KG, De Alwis AC, Welmilla I (2021) Gender stereotypes change outcomes: a systematic literature review. J Human Appl Soc Sci. https://doi.org/10.1108/JHASS-07-2021-0131

Qin, Jiahong, and Jianhua Cao. ‘Carbon Emission Reduction Effects of Green Credit Policies: Empirical Evidence From China’. Frontiers in Environmental Science. Frontiers Media S.A., 2022. https://doi.org/10.3389/fenvs.2022.798072.

Qin M, Zhang X, Li Y, Badarcea RM (2023) Blockchain market and green finance: the enablers of carbon neutrality in China. Energy Econ 118:106501. https://doi.org/10.1016/j.eneco.2022.106501

Ran C, Zhang Y (2023) Does green finance stimulate green innovation of heavy-polluting enterprises? Evidence from green finance pilot zones in China. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-023-26758-z

Ran Q, Liu Lu, Razzaq A, Meng Y, Yang X (2023) Does green finance improve carbon emission efficiency? Experimental Evidence from China. Environ Sci Pollut Res 30(16):48288–48299. https://doi.org/10.1007/s11356-023-25571-y

Rao H, Chen D, Shen F, Shen Y (2022) ‘Can green bonds stimulate green innovation in enterprises? Evidence from China. Sustainability. https://doi.org/10.3390/su142315631

Ren X, Shao Q, Zhong R (2020) Nexus between green finance, non-fossil energy use, and carbon intensity: empirical evidence from China based on a vector error correction model. J Clean Prod 277:122844. https://doi.org/10.1016/j.jclepro.2020.122844

Ren Y, Jian Yu, Shuhua Xu, Tang J, Zhang C (2023) Green finance and industrial low-carbon transition: evidence from a quasi-natural experiment in China. Sustainability 15(6):4827. https://doi.org/10.3390/su15064827

Shao J, Huang P (2023) The policy mix of green finance in China: an evolutionary and multilevel perspective. Climate Policy. https://doi.org/10.1080/14693062.2023.2202181

Shen Y, Su Z-W, Malik MY, Umar M, Khan Z, Khan M (2020) Does green investment, financial development and natural resources rent limit carbon emissions? A provincial panel analysis of China. Sci. Total Environ. 755(2020):142538