- Review

- Open access

- Published:

Unlocking the full potential of digital transformation in banking: a bibliometric review and emerging trend

Future Business Journal volume 9, Article number: 30 (2023)

Abstract

Purpose

Every aspect of life has been affected by digitization, and the use of digital technologies to deliver banking services has increased significantly. The purpose of this study was to give a thorough review and pinpoint the intellectual framework of the field of research of the digital banking transformation (DBT).

Methodology

This study employed bibliometric and network analysis to map a network in a single study, and a total of 268 publications published between 1989 and 2022 were used.

Findings

Our findings demonstrate that the UK, USA, Germany, and China are the countries that have conducted most of the studies on the digital banking transformation. Only China and India are considered emerging economies; everyone else is looking at it from a developed economy perspective. Additional research reveals that papers rated with A* and A grades frequently publish studies on digital banking transformation. Once more, the analysis identifies key theoretical underpinnings, new trends and research directions. The current research trend points toward FinTech, block chain, mobile financial services apps, artificial intelligence, mobile banking service platforms and sustainable business models. The importance of emphasizing the need for additional research in these fields of study cannot be stressed, given the expanding popularity of blockchain technology and digital currency in the literature.

Originality

It appears that this is the first study that examines the theoretical studies of digital banking transformation using bibliometric analysis. The second element of originality is about the multiple dimensions of the impact of technology in the banking sector, which includes customer, company, bank, regulation authority and society.

Introduction

The advent of information communication technology (ICT) is believed to have caused a paradigm shift in all aspects of human life. Technology has therefore become a necessary, unavoidable demand for society and the business environment, from work automation to service digitalization, from cloud computing to data analytics, from virtual collaboration to smart homes. Almost every industry is undergoing constant transformation because to technology. In the past 20 years, digitalization has had an impact on a variety of sectors, presenting fresh business prospects and encouraging new systems of innovation [1].

The finance sector is actively experimenting and inventing with the power of technology's digitization. It is also one of the industries that have successfully embraced digitization. One of the most laudable digital developments of the finance sector is the widespread adoption of digital banking over traditional banking methods. Recently, potentially disruptive technological breakthroughs and Internet-based solutions appear to have been introduced to the banking industry, one of the most established and conservative sectors of the economy. Digital transformation in banking is essential to enhance how banks and other financial organizations learn about, communicate with and satisfy the needs of customers. An effective digital transformation starts with understanding digital client behavior, preferences, choices, likes, dislikes, and stated and unstated expectations, to be more precise. Many academics are interested in how information and communications technology is advancing and how it can affect the banking industry [2]. However, the bibliometric analysis conducted by academics utilizing VOS viewer is assumed to be the first to look at the digital banking transformation (DBT) studies from a performance analysis and science mapping perspective.

Large data sets from databases like Web of Science, Scopus index or Dimension are permitted for bibliometric study. The bibliometric analysis moves the banks' digital transformation survey from single to multi-dimensional outcomes. A quick search of DBT studies shows that the first journal was published in 1989, despite the earliest forms of digital banking being traced back to the advent of ATMs and cards in the 1960s. The quantum of increase after 2014, amounting to 203 articles, representing 76% of all published articles on the topic, compels this study to focus on this field of DBT studies. We contend that establishing the area's intellectual framework is more crucial than ever. As a result, we make a contribution by offering a relevant, distinctive and significant intellectual map of the literature on digital banking studies through quantitative and bibliometric analysis. In mapping the intellectual structure of DBT, our study sets out to address the following critical research questions:

-

1.

Who are the predominant contributors (publication by year, journals, publishers, authors, publication, journal quality, country, and universities) to the DBT theory?

-

2.

What are the country's collaboration and citation analysis of the impact of digitalization on banks?

-

3.

What is digital banking theory's intellectual foundation (co-citation)?

-

4.

What are emerging research themes/trends and future direction (bibliography coupling

-

5.

and keywords analysis) to digital banking theory?

In response to the above four questions, this study has at least four significant additions to the literature on digital banking. First, we extend and build upon prior assessments of digital banking by offering a factual, quantitative perspective on the theory's historical development across time. Of course, this study considers notable contributors, the intellectual framework and theoretical groundwork of the discipline, the degree to which individuals are connected, and thematic subdomains. We show how digital banking has advanced by evaluating the significant offshoots from the original work by [3]. Second, we objectively assess how faithfully emerging subtopic literature streams acknowledge and build upon Burk and Pfitzmann’s seminal works. As a result, our paper is uniquely suited to detect significant gaps that might exist in subtopic areas, and we offer suggestions for improving literature unification. Thirdly, we show how scholars of digital banking have historically changed their study goals over time in response to gaps between theory and practice in order to determine how faithfully they have addressed these gaps. Finally, we contribute to the digital banking literature by identifying emerging digital banking research and study trends. Overall, we think that our research exposes chances to grow more effectively and collaboratively in the future by highlighting well-traveled roads that previous researchers have taken, identifying potential cracks that may leave the literature in a state of disarray, and so forth [4].

This study used bibliometric and network analysis to map a network that comprises authors, co-authors, keyword occurrences, journal citations and author names in a single study. The approach can give a thorough overview and pinpoint the field's intellectual hierarchy [5]. Furthermore, according to [6], bibliometric approaches are suitable for mapping the academic structure of a certain area because doing so enables researchers to recognize "'what,' 'where' and 'by whom' founded the field. We carry out a thorough bibliometric evaluation to meet the research objectives by carefully extracting the sample literature using the proper inclusion and exclusion criteria and selecting the search string. The first stage involved a descriptive analysis, while the second stage involved a comprehensive bibliometric analysis. Utilizing VOSviewer and Rstudio assistance, citation and co-citation analyses were carried out to determine the intellectual structure of the study on digital banking studies. Weighted citation measures were used to identify the lead publications from the clusters.

The format of our paper is as follows: A brief theoretical overview of the DBT literature, including its core principles, significant developments and limits, is given in section "Theoretical background." Section "Methods" describes the research approach in depth, and section "Results" shows the results of our investigation. The limitations of our study and their consequences for theory and practice are discussed in section "Discussions and future research agenda." Finally, we provide our final observations in section "Conclusion."

Theoretical background

Society, economics, banks and banking are changing as a result of technological advancement. Banks are an unneeded remnant whose purpose is best provided by alternate arrangements, even though we still need banking. The value chain of traditional banking has been disintermediated by technology, and its business model has been severely altered. As a result, Fin-Tech adoption and digital technology collaboration are widespread, constant and profoundly changing company structures [7]. Nearly 90% of banks fear losing business to Fin-Tech, which has replaced traditional value chains with shorter multi-modal and multi-directional nodes, according to KPMG's 2017 annual reports. Digitalization permeates the contemporary world, and the banking industry is no different. Our lives seemed to have grown so ingrained with digital technology that we would feel empty without it. Banks of all sizes are investing a lot in digital initiatives to maintain their uniqueness and meet as many of their customers' needs as possible. Digitalization leads to more customization and closer to customers. It is called digital banking when a bank renders its services online, and customers can make transactions and other activities online. Since over 73% of consumers use products from numerous platforms, Lee and Shin [8] highlight that bank model disruption and ascribe this to ongoing innovation followed by disruptive challenges, with the possibility of losing market share to Fin-Techs omnipresent.Mobile technologies and social media digitize bank value chains simultaneously addressing and influencing client demands and expectations.

However, according to our knowledge, not much research has been done on the banking sector. Nevertheless, it is well known that the banking sector, which is frequently IT-intensive, requires special consideration due to its significance for the whole economy. Berger [2] emphasizes that the benefits of technology adoption may not convert into improved production, which is consistent with the literature mentioned above. According to Berger, rather than the organization itself, the advantages of technology might be passed on to consumers and other production-related elements. Sharing data allow banks to process information more efficiently while also achieving huge economies of scale in the processing of payments. For instance, banks have reportedly employed information processing to handle deposit and loan client information as well as to more accurately assess risks, according to Berger and Mester. Additionally, they have employed telecommunications technologies to expeditiously process payments and disseminate this data while consuming fewer resources (2003, p. 58). This would imply that cost productivity increased in the 1990s.

Digital transformation has an impact on business processes and alters how banks conduct operations. A contributing aspect to the traditional relationship between customers and banks is digital transformation. Customers in particular have the right to use a variety of communication channels to engage in active and convenient engagement with banks and other customers via online customer support services. Most importantly, digital transformation enables banks to service a variety of consumers simultaneously, enhancing the bank's operational efficiency. In addition, the employee's job procedures are digitalized, reducing time and resources for both human resources and transaction execution. Thus, the bank will benefit from digital transformation by increasing output (raising the number of clients) and decreasing input expenses (reducing the number of employees and the time to make transactions).

The banking and FinTech industries will expand further in joint ventures, mergers and acquisitions toward convergence among banks, FinTech and technology organizations, and social media network providers as the new decade gets underway [9]. Digital technologies including blockchain, artificial intelligence (AI), data platforms, cybersecurity regulation technology and strategic collaborations will be well positioned to be retained in the banking business in a completely digitally changed financial environment [10]. Up until the advent of digital banking and the branch-based banking model in the early 1990s, traditional banking remained unaltered and unopposed. In the USA, Stanford Federal Credit Union opened the first online bank in 1994. The number of local bank branches has substantially decreased globally with the advent of online banking. Globally, the number of digital banks has been steadily rising at the same time. The first digital disruptor was ING Direct, which launched as an entirely online bank in 1996 and over the course of a little more than a decade attracted more than 20 million customers in nine countries without having to make any investments in physical infrastructure. In 2013, the FinTech bank "N26" received initial approval for a banking license. Amazon introduced an e-commerce-based checking account feature in 2021, while Facebook developed a social network-based banking service in 2020. By 2020, banking clients have been accustomed to using mobile banking apps, direct deposit to P2P payments and cloud-based banking platforms with AI.

Methods

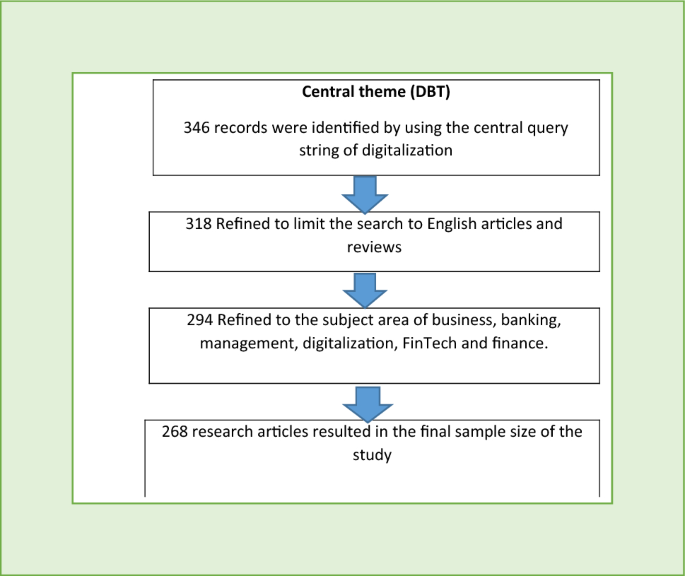

To address our research issues in the present study, we employed two bibliometric analytic techniques. Since bibliometric analysis is quantitative, systematic, transparent and repeatable, it is strongly recommended for mapping the intellectual architecture of a literature stream [11]. The specifics of our research methodology and key conclusions are shown in Fig. 1.

To achieve its goals, this study suggests using publications and citations to analyze the performance of authors, institutions, countries and journals. Another unique approach used in this study is known as scientific mapping. Co-authorship analysis, clustering, citation analysis and keywords analysis are the approach factors [5]. Bibliometric approaches have been applied in recent investigations [12, 13]. Then, we employ it to start the process of developing a bibliometric investigation [5]. The following actions are a part of the four-step process: data gathering and analysis, selecting the limiting criteria, data analysis, discussions and conclusions.

Defining the search terms

We started by conducting a methodical keyword search of the current literature on digital banking [14]. We extracted data from the Scopus index database. According to [15], Scopus has a larger journal than any other service that conducts data mining. As a result, this study made use of this database to mine data for its bibliometric analysis. To identify digital banking impact articles, we used the keyword methodology outlined by scholars who have recently conducted reviews of DBT. By concentrating primarily on work that has undergone thorough peer review, we aimed to maintain the academic integrity of our sample. Conference transcripts and book chapters were taken out of the analysis. Additionally, we excluded any non-English-language publications; 298 articles make up our final sample, which is deemed adequate for bibliometric study. These articles were published between 1989 and 2022. The keys words are: digital, bank, banking, business model, company, finance, economics and social sciences.

Keyword protocol applied in Scopus for extracting articles.

(TITLE-ABS-KEY ( digita*) AND TITLE-ABS- |

KEY ( bank AND business AND model)) AND ( LIMIT-TO ( SUBJAREA, "COMP") OR LIMIT- |

TO ( SUBJAREA, "BUSI") OR LIMIT- |

TO ( SUBJAREA, "ECON") OR LIMIT- |

TO ( SUBJAREA, "SOCI")) AND |

( LIMIT-TO ( LANGUAGE, "English")) |

Data search and collection

As a result of several authors using the Scopus database for bibliometric analysis, it was chosen as the database from which the study's data were extracted [12, 13]. In comparison with Web of Science and Dimension, the Scopus database has many indexed journals. The first stage of data extraction involved 295 publications with the titles "effect of digitalization on banks" and "digital transformation of banks" in June 2022. The following stage of the data processing was restricted to 268 English-language journals. The research is restricted to publications in the fields of banking, business management, accounting, economics, econometrics and finance. The last research search turned up 268 papers that were written between 1985 and 2022. Our literature review and bibliometric analysis are built on the foundation of the sample size of 268 articles. The method of data extraction is displayed in Table 1.

Results

This study raises different research questions covering contributors to DBT or impacts of digitalization on banks and banking, average journals and journal quality citation, digital banking intellectual foundations (co-citation), emerging research themes/trends and future direction (bibliography coupling and keywords analysis) in institutional theory.

Who are the predominant contributors to digital banking theory

This study responds to the first research question by addressing the dominant contributors to the DBT theory by using the following criteria: publication by year, journals, publishers, authors, publication, journal quality, country, and universities.

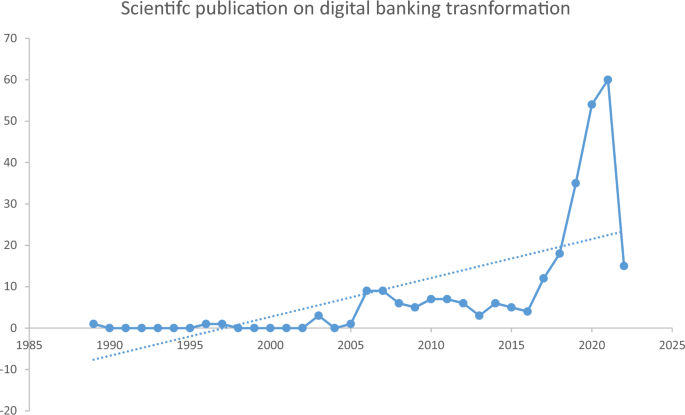

Publication by year

Figure 2 illustrates the number of DBT publications between 1989 and early 2022, recording 268 scientific publications. DBT received little attention from the scientific community in the early years from 1989 to 2005, recording as little as seven publications. The available data further show that publication increased slightly to sixty-seven (67) over a twenty (20) year period from 2006 to 2016. However, there was a dramatic change in this trend afterwards. Approximately 72 percent of these scientific publications, representing one hundred ninety-four (194) articles, occurred in the last six years. The figure further revealed that the years 2020 and 2021 alone accounted for 43 percent of all scientific publications in the field of DBT. Perhaps the havoc of Covid–19 and the strategic role of banks in successfully influencing the payment system architecture in particular resonated well with researchers to pay much attention to the field around this later period. While the quantity of publications has increased, publications within elite journals continue to grow. As recently as 2017, more over 40% of DBT research was published in prestigious publications. In fact, since 2017, the average annual proportion of publications in the top tier to all publications is 62 percent. As a result, our findings imply that the standard of published research has generally kept up with the volume of publications.

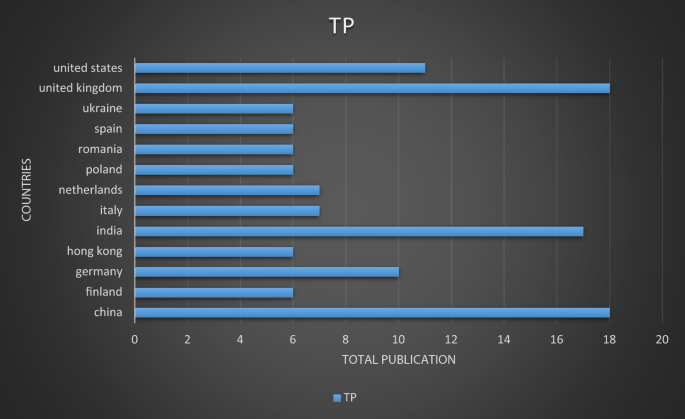

Publication activity by country

Our findings also show that DBT research has a truly global reach, as shown by the participation of authors from 65 different countries. Figure 3 gives a graphic representation of the top countries publishing DBT research. For better clarity, the study limited Fig. 3 to cover countries with more than five publications. Although the publication of digital banking is international, it is interesting to notice that a significant portion of the work originates from a limited group of wealthy nations. More specifically, more than 46% of all published DBT studies come from the USA, UK, India, China, Germany, Netherlands, Hon Kong, Romania, Finland, Poland, Ukraine, Italy and Spain. Only China and India are from emerging economies. Figure 3 illustrates publication activities by country.

Publishing activity by journal

Two hundred thirteen different journals published the 268 articles in our sample. Table 1 lists the top publishing Journals. Based on publication count, we found that the leading journals for DBT include Financial Innovation, Journal of Cleaner Production, Journal of Economics and Business, International Journal of Information Management, Journal of Information Technology and Sustainability Journal. Our observation revealed that even though the Journal of Financial Innovation had only two publications, it claimed the top spot with two hundred and twelve citations total citation, given an average citation of one hundred and six. This study also used Australian Business School Council (ABDC) rating & ranking. Journal quality is rated and ranked by ABDC, with A* being the highest-quality journal, followed by A and B as the second- and third-best journals, respectively. According to the ABDC ranking, journal C is the lowest ranked. The data available to us have shown that the high-quality journals in class A and A* are publishing works on digital transformation. Three of the top five journals in our data are in the A class.

Publishing activity by author and organization

According to [16], bibliometric methodologies can be used to evaluate the intellectual influence of universities and their research personnel. To determine the sources of digital transformation in banking, we assessed the research output of individual academics and institutions. We found 598 distinct writers from 224 organizations publishing on the subject of banking digital transformation inside our dataset. The top publishing scholars and institutions are listed in Tables 2 and 3. The descriptive statistics also show that [17,18,19,20] are the authors with the highest citation. In addition, the Financial University under the government of the Russian Federation, Comsats University—Islamabad, National Chiao Tung University—China and the State University of Management—Russia are the top four.

Country collaboration and citation analysis

Country collaborations of co-authors analysis

The UK is the most productive nation in terms of publishing changes in digital banking. Australia, Canada, Indonesia and the Russian Federation have the lowest populations. Figure 4 demonstrates that, with seven linkages and 18 times as many co-authorships, the UK has the highest level of collaboration. Countries like China, Hong Kong and the Netherlands, each with six links, tie for second place. The inflow of overseas students completing second and third degrees in the UK and the US may be one reason there are more significant connections between the two countries [21]. Additionally, the UK and China are two other significant technology superpowers laying the groundwork for digitization. This might have inspired and drawn academics to carry out studies in the area.

Citation analysis

The most read articles in the field of research on DBT were found through citation analysis. Citation analysis examines the connections between publications and finds the most significant publications in a given study area [5]. Similar studies that used citation analysis based on the Scopus database have also been looked at research [21]. The authors' and the study's primary focus are analyzed based on their citations in Table 4. The Financial Innovation Journal and Journal of Cleaner Production publish the most-cited article. Liu et al. [22] and Yip et al. are the authors of these articles [23]. Even though publications on the evolution of digital banking began in 1989, the most highly cited papers are in 2016 and 2018, respectively.

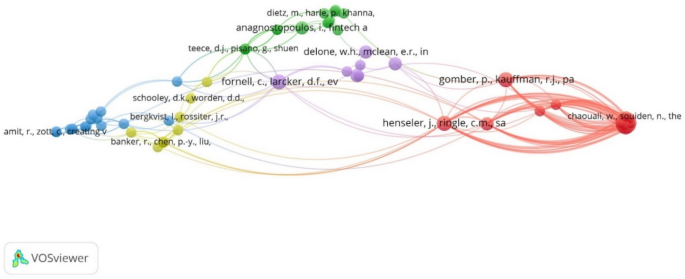

Cluster analysis (results of reference co-citation analysis with reference map)

By conducting the co-citation analysis of references as previously described and grouping the references cited by papers on DBT into clusters, we next looked at the intellectual foundation and structure of the DBT to answer the third research question. The 268 papers in our sample used 8720 different references in total. Our examination of co-citations revealed five interconnected clusters with a total of 67 articles. At least 20 of the 268 papers in our sample, which contained all 67 of these reference articles, collectively cited them. In other words, these 67 publications are the quantitatively most significant references in the literature on the shift of banking into the digital age. Similarly, we used the weighted citation count provided by VOS viewer to ensure high-quality articles in cluster analysis. We looked at the top 5 articles in each cluster as presented in Table 5, to find a common topic, and we labeled each theme accordingly, following [24]. We summarize the findings of the five most influential studies in each cluster. In the following sections, we give a quick overview of these reference clusters and how they integrate into the larger framework for digital banking (Fig. 5).

Cluster 1: Digital banking innovation

A cluster that established its boundaries improved its theoretical relevance and defined it as the first and most noticeable cluster to arise. Therefore, it makes sense that [25] are the most important tenet of this fundamental research stream. In 2022, digital transformation will continue to be a crucial trend in banking. The financial services sector is slowly changing as a result of technology, just like how it has affected other economic sectors. Physical bank branches have historically served as the primary point of contact for facilitating customer and retail banking transactions, according to [25]. Customers are continuing to transition from in-person to digital transactions as technology advances because of a complementary influence brought about by more access to digital banking services and an improved experience of new digital access, goods, services and functionality. They have developed a novel mapping technique for FinTech developments that assesses the extent of changes and transformations in four subfields of financial services: operations management, technological advancements, multiple innovations, and blockchain and other FinTech innovations. According to [26], the current wave of mergers and acquisitions in the financial services sector, combined with the broad availability of sophisticated technology, has increased competitiveness in the sector. Also, Henseler et al. [27] used discriminant validity assessment analysis to establish relationships between latent variables in business transformation. The digital banking revolution cannot go without challenges. All innovations encounter client resistance, claims [28] tested hypotheses using binary logit models comparing mobile banking adopters versus non-adopters, mobile banking postponers versus rejecters and Internet banking postponers versus rejecters using data from two comprehensive national surveys conducted in Finland (n = 1736 consumers). The value barrier is the main obstacle to the adoption of online and mobile banking, according to the study's findings. He also discovered that age and gender strongly influence decisions to adopt or reject. When [29] looked at the effect of cognitive age in explaining older people's resistance to mobile banking, they discovered that traditional and image barriers had an impact on usage, value and risk. All impediments, in turn, have an impact on resistance behavior. Furthermore, cognitive age was found to moderate these relationships. In order words, younger elders have limited or no resistance to DBT as opposed to elderly ones. All writers in this cluster agree that technology and evolving customer demands dramatically affect how banks operate in the twenty-first century. Indeed, the coronavirus outbreak has made it clear that banking institutions need to speed up their digital transitions. But the banking sector needs to modify its business models for front-facing and back-office operations to keep up with the changes and avoid potential upheavals. True digital banking and a complete transformation are built on implementing the most recent technology, such as blockchain cloud computing and Internet of Things (IoT).

Cluster 2: FinTech and RegTech in Banking

Scholars in this cluster preoccupied themselves with the concept of FinTech (Financial Technology) and RegTech (Regulatory Technology) thus the application of emerging technology to improve the way businesses manage regulatory compliance). They provided a range of viewpoints to make the disruptive potential of FinTech and its consequences for a more thorough financial ecosystem application in the banking and financial ecosystem easier to understand. Despite the widespread agreement that FinTech will have a big impact on the financial services industry, little academic literature has examined this topic, according to [30], citing [8]. Kindly assist with the changes.. Additionally, no accepted definition of FinTech has yet been established. On the other hand, according to Google, the query what is FinTech is presently ranked seventh among the most popular FinTech-related questions (Google, 2016b). He gave the most up-to-date definition of FinTech, which is a new financial business that uses technology to enhance financial activity. Contrarily, RegTech, or regulatory technology, uses cutting-edge tools and methods to assist financial institutions in enhancing their regulatory governance, reporting, compliance and risk management. According to [31] research, many desirable results might certainly be attained if regulators were willing to implement cultural change and integrate technical improvements with regulation. Such outcomes can include stabilizing the financial system, fostering systemic stability. The disruptive invention by [31] has the potential to improve consumer welfare, regulatory and supervisory outcomes, and the financial services industry's reputation. According to [10], the traditional business models of retail banks are seriously threatened by the emergence of digital innovators in the financial services industry. Lee and Shin [8] who contend that FinTech ushers in a new paradigm in which information technology drives innovation in the financial industry endorse this point of view. FinTech is hailed as a paradigm-shifting, disruptive innovation that has the power to upend established financial markets. The corporate world is quickly digitizing, shattering borders between industries, providing new opportunities and eliminating long-successful business models, according to [22], who added to the literature. They added that, on the plus side, growing digitalization presents opportunities, including the chance to take advantage of a solid customer connection and boost cross-selling. The dangers are typically precise and immediate, which is a drawback.

Cluster 3: The new digital business model of banks and other financial service providers

The papers in this cluster delved into the business model concept and, to a more significant extent, the new banking business model, which is technology-led. According to [32], business strategists and academics are paying more attention to business models as they try to understand how businesses create value and function well in order to gain a competitive advantage. Additionally, they argued that the digital economy had given businesses the chance to test out novel systems for networked value creation, where value is collaboratively produced by a firm and a big number of partners for a large number of users. The researchers came to the conclusion that four key themes are emerging, largely centered on the idea of the business model: as a new analytical unit, providing a systemic perspective on how to "do business," encompassing boundary-spanning activities (performed by a focal firm or others), and focusing on both value creation and value capture. These ideas are related and reinforce one another. Chesbrough [33] says that businesses must use their business models to commercialize novel concepts and technology. While businesses may make significant investments and have elaborate systems for investigating novel concepts and technologies, they frequently lack the ability to develop the business models that would be used to implement these inputs. He proposed that organizations should build the capacity to innovate their business models in order to make sound business decisions. Durkin et al. [34] did an excellent job investigating social media's role in a bank’s new digitally oriented business model. They suggested that social media had the power to profoundly alter customer-bank relationships and improve how the two sides communicate in the future. Their research shows that a wide range of clients regularly use transactional e-banking services. Loebbecke and Picot [35] presented a position paper that considers the factors driving how digitization and big data analytics drive the change of business and society. There is also discussion of the potential effects of digitalization and big data analytics on banking or employment, particularly in terms of cognitive work. Although several authors have recently proposed definitions of "business model," Shafer et al. [36] claim that none of them seem to be broadly recognized. This lack of agreement could be ascribed to the concept's interest from a variety of fields, all of which have connected it to something. To develop business models in the age of digital transformation, there must be an exponential shift in corporate culture and leadership concentration. The authors concur that banking is evolving as a result of a new wave of digital-only firms who are fragmenting the industry, componentizing products, and upending established business models. They claimed that switching from the previous business model to the new one is not the only way to succeed in this adaptable, fluid world. Instead, it will shift away from relying on a single, vertically integrated business model and toward a variety of non-linear models and value chain roles. In actuality, the Covid-19 epidemic has accelerated the development of business ecosystems for digital banking. Opportunities to develop, deliver and realize the value in new ways are made possible by digital technologies. The pipeline concept, the foundation of the classic universal bank, allows it to independently manufacture, sell and distribute products using its internal resources. This vertically integrated pipeline business model is disintegrating, making room for value chains that are becoming more fragmented and chances for new business models. A network of diverse business players from backgrounds including banking, insurance, pension, communications, real estate, education, healthcare service providers and IT are part of the new business model that the researchers have found. They work together to benefit each other through coexisting. The result of these developments and transformation is that financial services will continue to function in innovative and distinctive ways from those previously observed.

Cluster 4: Role of IT in banking

The fourth cluster concentrated on the crucial part information technology (IT) plays in the supply of financial services. According to [37], several banks have used information technology (IT) to provide consumers with a variety of more effective services. They think that in order to gain clients and boost profits in a cutthroat business environment, bank management must simultaneously use a variety of service channels. The majority of earlier research on IT investment in the banking sector has been on implementing cutting-edge IT-based service channels, including Internet banking, from the perspectives of clients [37]. From the standpoint of the bank, Barkhordari et al. [37] demonstrate that IT has a beneficial effect on performance by taking into account both the conventional physical and alternative IT-based service channels at once. They came to the conclusion that the purpose of using IT-related tools in banking is to forward a strategic, transformative objective. Due to the advancement of modern IT, the relationship between banks and their customers has changed substantially over the past few decades. They claimed that some of the examples include well-known innovations such as automated teller machines (ATMs), online banking (e-banking), and straight-through processing (STP), as well as others that have not (yet) gained widespread adoption, such as electronic cash (e-cash), or electronic bill presentment and payment (EBPP). At least the first has changed how people and businesses manage their finances and had an impact on the entire sector. They outlined how the aforementioned advances needed structures that took trends into account and might broaden the scope of current bank architectures to include horizontal and vertical integration dimensions. According to [38], enterprise architecture is typically represented by the following layers and design objects:

Product/services, market segments, corporate strategy goals, strategic plans/projects and interactions with customers and suppliers are all included in the strategic layer.

-

Organizational layer: Information flows, organizational units, roles/responsibilities, sales channels and business processes.

Applications, application domains, business services, IS functionalities, information objects, and interfaces make up the integration layer.

-

Software layer: programs, data structures, etc.

-

Hardware components, network components, and software platforms make up the IT infrastructure layer.

When it comes to transformations, architectures are really useful, because they integrate many layers. Creating new businesses or reorganizing old ones is transformation.

According to [32], organizations that are successful over the long term have basic principles and purposes that never change while continuously adapting their business strategies and operations to the external environment. IT's penetration of the banking industry falls under this category of business change. Liu et al. [22] contributed to the conversation by asserting that technological advancements like high-frequency trading systems (HFT) and algorithmic trading systems had altered the financial markets. The point is that information technology (IT) makes it possible to design complex products, improve market infrastructure, apply adequate risk management strategies and aid financial intermediaries in reaching geographically remote and diverse markets. The Internet has considerably impacted the delivery methods used by banks. The Internet has become an essential medium for distributing banking services and goods.

Cluster 5: Response to DBT

This fifth and final cluster considered the attitude of staff and clients toward DBT. If computer systems are not utilized, they cannot increase organizational performance. Unfortunately, managers' and professionals' opposition to end-user technology is a common issue. We need to comprehend why people accept or reject computers in order to better forecast, explain and promote user acceptance. The findings point to the potential for straightforward yet effective models of user acceptance factors, with practical utility for assessing systems and directing managerial actions aimed at addressing the issue of underutilized computer technology. Agarwal and Prasad [39] assert that a recent lack of user adoption of information technology breakthroughs is to blame for the frequently paradoxical link between investments in information technology and increases in productivity. They continued by saying that the academic and professional sectors had grown concerned about this paradoxical connection between spending on information technology and increases in productivity. The axiom that systems that are not used generate little value is an often proposed explanation for this relationship. Therefore, in order to achieve the expected productivity advantage, it is not enough to simply have the technology available; it must also be accepted and used effectively by its target user group [39]. The work of DeLone and McLean threw more light on technology acceptance. When [32] created a thorough taxonomy, they provided a more comprehensive picture of the concept of information system success. Six main characteristics or categories of the success of information systems are proposed by this taxonomy: system quality, information quality, utilization, user satisfaction, individual impact and organizational impact. Meanwhile, further discussions in this cluster have given more insights into customer acceptance or otherwise of IT in banking. Perceived utility, perceived ease of use, trust and perceived enjoyment are discovered to be immediate direct drivers of customers' views toward utilizing Internet banking, according to [40, 41] research. This finding is consistent with some of the findings of other studies. The clients' behavioral intentions to utilize Internet banking are determined by attitude, perceived risk, fun, and confidence. Although the perceived website design has a direct impact only on perceived usability, its indirect effects on perceived usefulness, attitude and behavioral intentions are considerable. Perceived enjoyment only has a short-term impact on perceived ease of use, but both a direct and indirect influence on perceived usefulness. Customer experience is at the heart of the digital banking transition. Therefore, banks must continuously innovate products, integrate cutting-edge technology and add value for their clients.

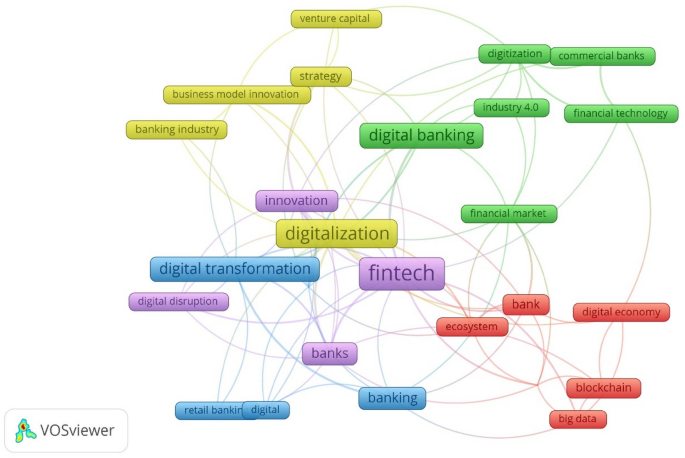

Keywords analysis

The trends in the keywords displayed in multiple studies can be used to determine the main study direction for upcoming investigations [42]. The VOSviewer r software, which has previously been utilized by other writers, is employed in this study to extract the author's keywords [12, 21, 43]. A co-occurrences network is produced by the VOS viewer program as a dimensional map [12]. We used bibliographical author keyword analysis to examine our sample and determine whether there was any increasing or declining themes of interest per research question four. We discovered that writers of the 268 publications in our sample employed 829 keywords to indicate their scientific work, meeting the studies' threshold. Only 26 words, or around 3% of the total, were used at least four times. Our findings imply that the literature on DBT is incredibly heterogeneous. Indeed, according to the results of most recent articles, 80 percent of the authors' specified keywords were utilized precisely once. However, there are several keywords that authors frequently utilize to describe their works (Fig. 6). FinTech is the most often used keyword, with 25 occurrences and 29 links to other keywords, followed by digitalization, with 18 and 20 links. Reporting on Digital Transformation contains 13 instances and 18 links. The bibliometric map of author keywords is shown in Fig. 6.

The theme areas contemporary academics focus on can be seen by closely examining the map. The use of bibliographic coupling is based on the subject the authors are investigating. The digital transformation of financial service delivery was investigated by [43] from the perspective of Nigeria about chatbot adoption. A moderated mediated model was used by [44] to examine how blockchain technology was adopted in the financial sector during the fourth industrial revolution. Additionally, Karjaluoto et al. [19] looked at how users' perceptions of value influence their use of mobile financial services apps. Similarly, Podsakoff et al. [16] focused on enhancing the value co-creation process: artificial intelligence and mobile banking service platforms. Taking the discussion to a different dimension, Teng and Khong [45] worked on Examining actual consumer usage of E-wallets: A case study of big data analytics. David-West et al. [46] examined sustainable business models to create mobile financial services in Nigeria. Yip and Bocken [23] deepened the discussion and, in turn, looked at Sustainable business model archetypes for the banking industry. Finally, Niemand et al. [20] highlighted digitalization in the financial sector: a backup plan with a strategic focus on digitalization and an entrepreneurial attitude. Future research on financial services provided via e-wallets and mobile banking is the main emphasis of the second cluster. Authors are still studying entrepreneurship and digitalization in the supply of financial services. Future research is required in these areas of study because blockchain technology and digital currency are also gaining traction in the literature. The most popular search terms and the number of times they were used are displayed in Table 6.

Discussions and future research agenda

The first paper on DBT was published by [3], and since then, both its audience and popularity have grown. Yet, the rapid rise in total publications across a wide range of specialist areas, notably during the last five years, has made it increasingly difficult for academics to ascertain the intellectual structure of the field. Existing qualitative assessments, which usually only address a small fraction of Digital Transformation in Banking while failing to accurately capture the entire body of work, have in some ways made the problem of theoretical specificity worse. It is rather tricky for a qualitative evaluation to describe more than 260 works over three decades. Thus, our research fills a critical vacuum in the literature by thoroughly (and quantitatively) mapping the digital banking domain, documenting its conceptual structure and suggesting its most likely future orientations. The theoretical underpinnings from which they have been developed, the subtopics and subthemes they have written about, and the notable historical contributors to DBT study (such as scholars, schools, and journals) are all identified in our work over time. Overall, our findings imply a considerable worldwide impact of digitization on banking, making it a truly global study paradigm. Additionally, the high number of citations for recent works shows that there is a great need for more research utilizing the DBT theoretical framework, suggesting that the field of study will continue to advance for a very long period. The study's structure is based on a wide range of goals and inquiries.

The initial research question aimed to characterize the increase in publication (document by year and county) and productivity of journals in terms of citations, top authors and institutions of studies on DBT. According to the data that are currently available, 174 papers, or 72% of all scientific publications, were published in the last six years, from 2016 to 2022. Also, prestigious journals carried out more than 40% of the publications. Therefore, our data imply that the quantity and quality of published research have typically stayed up. Our data also show that the research on the DBT is genuinely global in scope, as seen by the contributions of authors from 65 different countries. China and the UK are split equally, with India coming in second. It is essential to add that the BRIC (Brazil, Russia, India and China) countries perform well with publications. African countries like Ghana and Nigeria are equally showing promising signs of publications in this light. Regarding journal productivity, the study has revealed that articles on the banking industry's digital transformation are published in high-caliber journals in the A and A* classes. In our statistics, three top-five journals fall into the A category. These are the International Journal of Information Management (A*), Journal of Information Technology (A*), and Journal of Cleaner Production (A). We found 598 distinct writers from 224 organizations publishing on the subject of DBT inside our dataset. The descriptive statistics also reveal that Ranti et al. (2020) have the most citations, while the Financial University of the Government of the Russian Federation is the most productive institution in terms of the DBT, with seven publications.

The second research topic analyzes the co-authorship analysis and citation analysis by nation of authorship. Figure 3 shows that the UK has the maximum amount of collaboration, with 16 links and 18 co-authorships. China, Hong Kong and the Netherlands tie for second place with six linkages each. The increase in foreign students seeking second and third degrees in the UK and China may be one factor fostering closer ties between the two countries [21]. The UK and China are two other critical technological superpowers establishing the foundation for digitization. This might have attracted scholars and prompted them to conduct studies in the area. Future research might study the effects of digitization on banking on enforcing public and private sector regulations in emerging nations like Africa.

The third research question assesses the intellectual structure of the knowledge of DBT. This result was attained through citation analysis. Finding the most important publications in a specific field of study through citation analysis involves looking at the relationships between publications [5]. The primary point of contact for enabling retail banking and consumer transactions in the past has been actual bank branches. Customers are still transitioning from in-person to digital transactions as technology develops thanks to a complimentary effect brought on by increased access to digital banking services as well as an improved user experience of new digital access products, services and an improved user interface. Further research revealed that the banking sector's transition to digitization had increased competitiveness among service providers. The citation analysis highlighted the impact of FinTech on financial services innovations. According to [8], FinTech ushers in a new paradigm where information technology drives innovation in the financial sector. FinTech is hailed as a paradigm-shifting, disruptive innovation that has the power to upend established financial markets. We discovered that the corporate world is rapidly digitizing, removing industry barriers, opening up new opportunities, and dismantling long-established business structures. The concept of a business model and, to a greater extent, the new banking business model was also included in the analysis. The authors proposed that businesses build the capacity to innovate their business models since it makes good business sense. For instance, it has been seen that social media is significantly influencing the business models of some digitally focused banks. Social media, according to some, has the power to radically alter customer–bank interactions and improve how the two sides communicate in the future. If banks are to have an impact, they must transition from relying on a single, vertically integrated business model to multiple non-linear models and roles in the value chain. As a result of these developments and transformations, financial services will continue to operate in novel and unique ways from those previously observed. The study has proven beneficial for the use of IT in banking. IT-related tools are used in banking to advance a strategic transformational goal. The connection between banks and their customers has altered significantly over the past few decades with the development of contemporary IT. The most prevalent enterprise architecture layers and design items, according to [38], are the strategic, organizational, integration, software and IT infrastructure. It has been established that information technology (IT) enables the development of complicated products, enhances market infrastructure, implements efficient risk management techniques and enables financial intermediaries to access diverse and geographically dispersed markets. Despite the enormous advantages of digital banking, opinions on the systems are widely divided. Agarwal and Prasad [39] claim that a recent lack of user acceptance of information technology breakthroughs is to blame for the frequently paradoxical link between investments in information technology and productivity increases. They said that the counterintuitive connection between productivity increases and information technology investments had alarmed academic and professional groups. According to theories advanced by academics, digital technology, in general, and information systems, in particular, must fall under one of the following taxonomies to be accepted and used: system effectiveness, accuracy of the data, usability, user happiness, personal effect and organizational effect. The fourth research question looked at the future directions and emerging research themes and trends in studies of the digital banking transition. Future scholars are still interested in business models, FinTech, and DBT or banking. Additionally, the focus of the conversation is rapidly shifting to emerging and developing economies. Nevertheless, contemporary research areas include blockchain [44], mobile financial services apps [19], artificial intelligence and mobile banking service platforms [47], and sustainable business models [46]. The importance of highlighting the need for additional research in these fields of study cannot be overstated, given the growing popularity of blockchain technology and digital currency in literature.

Implications for theory

At least four substantial contributions to the body of DBT research, in our opinion, have been made by this study. We contribute primarily by expanding on current DBT reviews. While other reviewers have used qualitative methodologies, we may supplement and expand on such assessments by utilizing a thorough bibliometric study, allowing us to be more explicit about DBT's intellectual progress and structure. This is significant because it gives us a unique opportunity to highlight notable contributors and pinpoint the present and past origins of DBT research. Second, our quantitative analysis of bibliographic data demonstrates how DBT research has developed into its paradigm, which is supported by the original article by Bürk and Pfitzmann [3]. Third, we make a contribution by detecting rising and negative trends in subtopic areas, so identifying the subjects that are most likely to be studied in the future by academics. Fourth, by conducting a comprehensive assessment of DBT, we pinpoint areas where theory and practice diverge and evaluate the ways in which researchers have aided practitioners by modernizing DBT to comprehend and foresee the difficulties of "real-world" business.

Implications for practice

The banking sector, like other sectors, aspires to embrace contemporary practices and incorporate digital technologies into its operational procedures. This complicated collection of measures necessitates a methodical and considered approach, particularly in financial services where substantial sums of money and severe risks are at stake. DBT in this sense refers to several adjustments made to the banking sector to integrate different FinTech technologies to automate, optimize, and digitize procedures and improve data security. The processes and technologies employed in the financial industry will alter due to several small and significant changes implied by this process. The fundamental tendency of digital transformation, regardless of industry, is the integration of computer technologies, and Statista's analysis indicates that this trend will continue to expand. The challenges posed by introducing new digital innovations must be understood by stakeholders, who must also articulate solutions. Again, embracing digital technologies will involve taking on several tremendous risks; for this reason, bank executives must simultaneously establish and implement a strategy for managing those risks. If regulators utilizing technology to oversee and control the industry want to ensure solid financial stability in the economy, they must constantly be ahead of innovation risk with appropriate countermeasures. Digital banking involves the collection and processing of vast volumes of customer data. This raises the issue of data protection following regulations and international best practices. The DBT's third useful outcome is that it prompts organizational leaders to consider how their personal biases—which are the products of their histories, characteristics and experiences—might influence opinions and, ultimately, bank performance.

Limitations

We know that no study is faultless, and ours has its setbacks. While we made every effort to minimize problems, we nevertheless expect to offer insightful suggestions for future bibliometric and DBT studies. First, we used the Scopus database, a popular database used in bibliometric research, to gather our bibliometric data [48]. Even though Scopus contains the most data sources, it does not include all research databases on the transformation of digital banking. Furthermore, because this database has so many uses, using Scopus for data collection could likely lead to mistakes that show up when performing bibliometric analysis. To put it another way, errors might have happened if articles were mislabeled, and it is possible that the database completely missed publications important to our study [49]. To address this potential issue, we followed the best bibliometric analysis methods. For instance, we thoroughly purged duplicates and other forms of incorrect items from our data. Additionally, this research is restricted to English-language publications, and the subject only includes business, management, finance, economics, FinTech and banking digitalization. The data search will be enhanced, and the search restriction will be reduced using several databases.

Conclusion

This article assesses the intellectual landscape and future potential of the field of DBT research, as well as the influence of that research. The approach for this study is based on descriptive analysis, performance analysis and science mapping analysis, and it employs bibliometric analysis. The set was created based on 268 documents from the Scopus database that span the years 1989 to 2022. We demonstrate that DBT has continued to be a hot topic for academic research approximately three decades after its conception. Our findings also indicate that the UK, USA, Germany and China are the countries that have conducted most of the studies on the DBT. Only China and India are considered emerging economies; everyone else is looking at it from a developed economy perspective. We further categorize the body of research on DBT into five main clusters, including (1) Digital Banking Innovation, (2) FinTech and RegTech in Banking, (3) The New Digital Business Model of Banks and Other Financial Service Providers, (4) The role of IT in banking, (5) Response to DBT. Due to a significant influx of international students, the UK, China and Hong Kong continue to be the most collaborative countries. Additional research reveals that papers rated with A* and A grades frequently publish studies on DBT. Once more, the analysis identifies key theoretical underpinnings, new trends and research directions. FinTech, block chain mobile financial services apps, artificial intelligence, mobile banking service platforms and sustainable business models are currently researched. Given the rising popularity of block chain technology and digital money in the literature, highlighting the need for more research in these areas of study cannot be overstated. This study builds on previous reviews by objectively charting the inception and intellectual growth of the digital banking area and evaluating its future possibilities. In essence, this bibliometric study offers a distinct and original viewpoint on the evolution of DBT by carefully and objectively assessing prior material and concurrently offering a clear road map for future work.

Availability of data and materials

The datasets generated and/or analyzed during the current study are not publicly available but are available from the corresponding author upon request.

Abbreviations

- DBT:

-

Digital banking transformation

- FinTech:

-

Financial technology

- RegTecg:

-

Regulatory technology

- IoT:

-

Internet of things

- ATM:

-

Automatic teller machine

- AI:

-

Artificial intelligence

- IT:

-

Information technology

- ICT:

-

Information communication technology

- STP:

-

Straight through processing

- e-banking:

-

Electronic banking

- e-cash:

-

Electronic cash

- EBPP:

-

Electronic bill presentment and payment

- HFT:

-

High-frequency trading system

- E-wallets:

-

Electronic wallets

References

Barrett M, Davidson E, Prabhu J, Vargo SL (2015) Service innovation in the digital age special issue: service innovation in the digital age service innovation in the digital age: key contributions and future directions Source: MIS Q 39:135–154.https://doi.org/10.2307/26628344

Berger AN (2003) The economic effects of technological progress: evidence from the banking industry. https://about.jstor.org/terms

Bürk H, Pfitzmann A (1989) Digital payment systems enabling security and unobservability. Comput Secur 8:399–416. https://doi.org/10.1016/0167-4048(89)90022-9

Dharmani P, Das S, Prashar S (2021) A bibliometric analysis of creative industries: current trends and future directions. J Bus Res 135:252–267. https://doi.org/10.1016/J.JBUSRES.2021.06.037

Donthu N, Kumar S, Mukherjee D, Pandey N, Lim WM (2021) How to conduct a bibliometric analysis: an overview and guidelines. J Bus Res 133:285–296. https://doi.org/10.1016/J.JBUSRES.2021.04.070

White JV, Borgholthaus CJ (2022) Who’s in charge here? A bibliometric analysis of upper echelons research. J Bus Res 139:1012–1025. https://doi.org/10.1016/J.JBUSRES.2021.10.028

Omarini A (2017) Current Position: Tenured Researcher at the Department of Finance

Lee I, Shin YJ (2018) Fintech: ecosystem, business models, investment decisions, and challenges. Bus Horiz 61:35–46. https://doi.org/10.1016/J.BUSHOR.2017.09.003

Lee J, Wewege L, Thomsett MC (2020) Disruptions and Digital Banking Trends, (online) Scientific Press International Limited. https://www.researchgate.net/publication/343050625

Dietz M, Härle P, Khanna S (n.d) A digital crack in banking’s business model

Rauch A (2020) Opportunities and threats in reviewing entrepreneurship theory and practice. Entrepreneurship: Theory Pract 44:847–860. https://doi.org/10.1177/1042258719879635

Anand A, Brøns Kringelum L, Øland Madsen C, Selivanovskikh L (2020) Interorganizational learning: a bibliometric review and research agenda. Learn Organ 28:111–136. https://doi.org/10.1108/TLO-02-2020-0023

Kumar S, Pandey N, Kaur J (2023) Fifteen years of the : a retrospective using bibliometric analysis. Soc Respons J 19:377–397. https://doi.org/10.1108/SRJ-02-2020-0047

Short J (2009) The art of writing a review article. J Manage 35:1312–1317. https://doi.org/10.1177/0149206309337489

Block J, Fisch C, Rehan F (2020) Religion and entrepreneurship: a map of the field and a bibliometric analysis. Manag Rev Q 70:591–627. https://doi.org/10.1007/s11301-019-00177-2

Podsakoff PM, MacKenzie SB, Podsakoff NP, Bachrach DG (2008) Scholarly influence in the field of management: a bibliometric analysis of the determinants of University and author impact in the management literature in the past quarter century. J Manage 34:641–720. https://doi.org/10.1177/0149206308319533

Widharto P, Pandesenda AI, Yahya AN, Sukma EA, Shihab MR, Ranti B (2020) Digital Transformation of Indonesia Banking Institution: case study of PT. BRI Syariah. In: 2020 International conference on information technology systems and innovation (ICITSI), 2020, pp 44–50. https://doi.org/10.1109/ICITSI50517.2020.9264935

Harjanti I, Nasution F, Gusmawati N, Jihad M, Shihab MR, Ranti B, Budi I (2019) IT impact on business model changes in banking Era 4.0: case study Jenius. In: 2019 2nd International conference of computer and informatics engineering (IC2IE), pp 53–57. https://doi.org/10.1109/IC2IE47452.2019.8940837

Karjaluoto H, Shaikh AA, Saarijärvi H, Saraniemi S (2019) How perceived value drives the use of mobile financial services apps. Int J Inf Manage 47:252–261. https://doi.org/10.1016/J.IJINFOMGT.2018.08.014

Niemand T, Rigtering JPC, Kallmünzer A, Kraus S, Maalaoui A (2021) Digitalization in the financial industry: a contingency approach of entrepreneurial orientation and strategic vision on digitalization. Eur Manag J 39:317–326. https://doi.org/10.1016/J.EMJ.2020.04.008

Khatib SFA, Abdullah DF, Elamer A, Yahaya IS, Owusu A (2023) Global trends in board diversity research: a bibliometric view. Meditar Account Res 31:441–469. https://doi.org/10.1108/MEDAR-02-2021-1194

Liu Y, Luan L, Wu W, Zhang Z, Hsu Y (2021) Can digital financial inclusion promote China’s economic growth?. Int Rev Financ Anal 78: 101889. https://doi.org/10.1016/J.IRFA.2021.101889

Yip AWH, Bocken NMP (2018) Sustainable business model archetypes for the banking industry. J Clean Prod 174:150–169. https://doi.org/10.1016/j.jclepro.2017.10.190

Kent Baker H, Pandey N, Kumar S, Haldar A (2020) A bibliometric analysis of board diversity: current status, development, and future research directions. J Bus Res 108:232–246. https://doi.org/10.1016/J.JBUSRES.2019.11.025

Gomber P, Kauffman RJ, Parker C, Weber BW (2018) On the Fintech Revolution: interpreting the forces of innovation, disruption, and transformation in financial services. J Manag Inf Syst 35:220–265. https://doi.org/10.1080/07421222.2018.1440766

Fain D, Lou Roberts M (1997) Technology vs. consumer behavior: the battle for the financial services customer. J Direct Market 11:44–54. https://doi.org/10.1002/(sici)1522-7138(199724)11:1<44::aid-dir5>3.0.co;2-z

Henseler J, Ringle CM, Sarstedt M (2015) A new criterion for assessing discriminant validity in variance-based structural equation modeling. J Acad Mark Sci 43:115–135. https://doi.org/10.1007/s11747-014-0403-8

Laukkanen T (2016) Consumer adoption versus rejection decisions in seemingly similar service innovations: the case of the Internet and mobile banking. J Bus Res 69:2432–2439. https://doi.org/10.1016/J.JBUSRES.2016.01.013

Chaouali W, Souiden N (2019) The role of cognitive age in explaining mobile banking resistance among elderly people. J Retail Consum Serv 50:342–350. https://doi.org/10.1016/J.JRETCONSER.2018.07.009

Schueffel P (2016) Taming the beast: a scientific definition of Fintech. J Innov Manag Schueffel JIM 4:32–54

Anagnostopoulos I (2018) Fintech and regtech: impact on regulators and banks. J Econ Bus 100:7–25. https://doi.org/10.1016/J.JECONBUS.2018.07.003

Porter ME (1980) Industry structure and competitive strategy: keys to profitability. Financ Anal J 36:30–41. https://doi.org/10.2469/faj.v36.n4.30

Chesbrough H (2010) Business model innovation: opportunities and barriers. Long Range Plann 43:354–363. https://doi.org/10.1016/J.LRP.2009.07.010

Durkin M, Mulholland G, McCartan A (2015) A socio-technical perspective on social media adoption: a case from retail banking. Int J Bank Market 33:944–962. https://doi.org/10.1108/IJBM-01-2015-0014

Loebbecke C, Picot A (2015) Reflections on societal and business model transformation arising from digitization and big data analytics: A research agenda. J Strateg Inf Syst 24:149–157. https://doi.org/10.1016/J.JSIS.2015.08.002

Shafer SM, Smith HJ, Linder JC (2005) The power of business models. Bus Horiz 48:199–207. https://doi.org/10.1016/J.BUSHOR.2004.10.014

Barkhordari M, Nourollah Z, Mashayekhi H, Mashayekhi Y, Ahangar MS (2017) Factors influencing adoption of e-payment systems: an empirical study on Iranian customers. Inf Syst E-Business Manag 15:89–116. https://doi.org/10.1007/s10257-016-0311-1

Winter R, Fischer R (2006) Essential layers, artifacts, and dependencies of enterprise architecture. In: 2006 10th IEEE international enterprise distributed object computing conference workshops (EDOCW’06), p 30. https://doi.org/10.1109/EDOCW.2006.33

Agarwal R, Prasad J (1997) The role of innovation characteristics and perceived voluntariness in the acceptance of information technologies. Decis Sci 28:557–582. https://doi.org/10.1111/j.1540-5915.1997.tb01322.x

Panetta IC, Leo S, Delle Foglie A (2023) The development of digital payments: past, present, and future—from the literature. Res Int Bus Finance 64: 101855. https://doi.org/10.1016/J.RIBAF.2022.101855

Bashir I, Madhavaiah C (2015) Consumer attitude and behavioural intention towards Internet banking adoption in India. Journal of Indian Business Research 7:67–102. https://doi.org/10.1108/JIBR-02-2014-0013

Pesta B, Fuerst J, Kirkegaard EOW (2018) Bibliometric keyword analysis across seventeen years (2000–2016) of intelligence articles. J Intell 6:1–12. https://doi.org/10.3390/jintelligence6040046

Abdulquadri A, Mogaji E, Kieu TA, Nguyen NP (2021) Digital transformation in financial services provision: a Nigerian perspective to the adoption of chatbot. J Enterp Commun 15:258–281. https://doi.org/10.1108/JEC-06-2020-0126

Khalil M, Khawaja KF, Sarfraz M (2022) The adoption of blockchain technology in the financial sector during the era of fourth industrial revolution: a moderated mediated model. Qual Quant 56:2435–2452. https://doi.org/10.1007/s11135-021-01229-0

Teng S, Khong KW (2021) Examining actual consumer usage of E-wallet: a case study of big data analytics, Comput Human Behav 121:106778. https://doi.org/10.1016/J.CHB.2021.106778

David-West O, Iheanachor N, Umukoro I (2020) Sustainable business models for the creation of mobile financial services in Nigeria. J Innov Knowl 5:105–116. https://doi.org/10.1016/J.JIK.2019.03.001

Dimitrova I, Öhman P, Yazdanfar D (2022) Barriers to bank customers’ intention to fully adopt digital payment methods. Int J Qual Serv Sci 14:16–36. https://doi.org/10.1108/IJQSS-03-2021-0045

Bhatt Y, Ghuman K, Dhir A (2020) Sustainable manufacturing. Bibliometrics and content analysis, J Clean Prod 260:120988. https://doi.org/10.1016/J.JCLEPRO.2020.120988

Di Vaio A, Palladino R, Hassan R, Escobar O (2020) Artificial intelligence and business models in the sustainable development goals perspective: a systematic literature review. J Bus Res 121:283–314. https://doi.org/10.1016/J.JBUSRES.2020.08.019

Amit R, Zott C (2012) Creating value through business model innovation, MIT Sloan Manag Rev. 48.

Fornell C, Larcker DF (1981) Evaluating Structural Equation Models with Unobservable Variables and Measurement Error. J Market Res. 18:39–50. https://doi.org/10.1177/002224378101800104.

Porter ME (1996) What Is Strategy?.

Möwes T, Puschmann T, Alt R (2011) Service-based Integration of IT-Innovations in Customer-Bank-Interaction. https://aisel.aisnet.org/wi2011/102.

DeLone WH, McLean ER (1992) Information Systems Success: The Quest for the Dependent Variable, Info Syst Res. 3:60–95. https://doi.org/10.1287/isre.3.1.60.

Weill P, Woerner SL (2015) Thriving in an increasing digital ecosystem, MIT Sloan Manag Rev. 15.

Zhao JL, Fan S, Yan J (2016) Overview of business innovations and research opportunities in blockchain and introduction to the special issue, Financial Innovation. 2:28. https://doi.org/10.1186/s40854-016-0049-2

Gassmann O, Enkel E, Chesbrough H (2010) The future of open innovation. R and D Manage 40:213–221. https://doi.org/10.1111/j.1467-9310.2010.00605.x

Davis FD (1989) Perceived usefulness, perceived ease of use, and user acceptance of information technology

Zhang S, Riordan R (2011) Association for information systems AIS electronic library (AISeL) technology and market quality: the case of high frequency trading recommended citation. http://aisel.aisnet.org/ecis2011/95

Banker R, Chen P.-Y, Liu F.-C, Ou C.-S (2009) Business value of IT in commercial banks. http://aisel.aisnet.org/icis2009/76

Ende B (2010) Association for information systems IT-driven execution opportunities in securities trading: insights into the innovation adoption of institutional investors recommended citation Ende, Bartholomäus, “it-driven execution opportunities in securities trading: insights into the innovation adoption of institutional investors,”. http://aisel.aisnet.org/ecis2010; http://aisel.aisnet.org/ecis2010/118

Acknowledgements

The authors would like to graciously thank the Editor-in-Chief and the editorial team, and the two anonymous reviewers for their feedback in developing this paper. The writers also acknowledge Prof. Alfred Owusu, Dean of KsTU's Business School, for his guidance, inspiration and support. We appreciate his inventiveness and how it enabled us to clearly define the goal and possibilities of this effort. The authors also appreciate the helpful advice provided by Dr. Thomas Adomah Worae and Prof. Abdul-Aziz Iddrisu as we worked on the first versions of the manuscript. Finally, we would like to thank Riya Sureka, a research scholar at the Malaviya National Institute of Technology in Jaipur, India, for his advice on how to analyze bibliometric data using the ‘R’ and VOS viewer software.

Funding

This research received no external funding.

Author information

Authors and Affiliations

Contributions

All authors contributed significantly to the development of this article; LK generated the title, wrote the introduction, collection and analysis of the data, interpreted the co-citation analysis and put the manuscript together. YC reviewed the existing to conceptualize the study, reviewed the study and expanded the analysis. KM involved data generation from Scopus data base, software running, data analysis and review of the work. All authors read and approved the final manuscript.

Authors' information

Lambert Kofi Osei holds a masters of business administration (finance option) degree from the Kwame Nkrumah University of Science and Technology. He is currently a PhD finance and banking student of Siberia Federal University, Russia. He is currently a lecturer at the Department of Banking Technology and Finance—Kumasi Technical University—in Ghana. He also holds an associated charted membership with the Chartered Institute of Securities and Investment—UK. Osei is certified expert in microfinance (CEMF) from the Frankfurt School of Finance—Germany. Osei has had considerable level of industry experience, with over 12 years managerial experience in the banking industry in Ghana including been the chief executive officer of Eman Capital. Prior to joining Kumasi Technical University, he was the National Chairman of Ghana Association of Microfinance Companies (GAMC)—an umbrella body of all microfinance companies in Ghana. Despite joining academia recently, Osei has made two publications of his work and a lot more articles are under completion stage to be sent for review. It is the goal of him to be an authority in the field of digital banking to impact businesses and societies.

Yuliya Cherkasova holds Ph.D. in economics and is a associate professor, School of Economics, Finance and Public Administration, Siberian Federal University. She is the chair of Digital Financial Technologies of Sberbank of Russia. Her research interests include banking prudential regulation of banks, digital economy and public finance. As a researcher, she has published more than 70 articles, 10 textbooks on topics, related finance and banking aria.

Kofi Mintah Oware has a Ph.D. in business administration (sustainability finance and management) from Mangalore University, India, and an MBA degree from Aberdeen Business School (Robert Gordon University—UK). He is currently a senior lecturer in the department of banking technology and finance. He is also a chartered accountant with membership from the Institute of Chartered Accountants (ICA), Ghana, and Institute of Cost Executive & Accountants (ICEA)—UK. Before joining academia, he worked in blue-chip companies for 12 years in various capacities, including chief accountant, head of finance and general manager for finance & administration in Ghana and research consultant to Aberdeen Businesswomen network in the UK. Among his key roles during industry experience include representing management in union negotiations and presenting the firm's financial reports in the corporate board meeting. In academia, he has 34 publications in various journal, including two "A" s under ABDC (Meditari Accountancy Research), three "B" s under ABDC (Social Responsibility Journal & Society and Business Review) and one C (South Asian Journal of Business Studies) all with Emerald publications. Also, he has 10 academic papers in various journals under review.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The authors declare that they have no competing interests in this section.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Additional file 1.

A table of short literature of articles on DBT.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Osei, L.K., Cherkasova, Y. & Oware, K.M. Unlocking the full potential of digital transformation in banking: a bibliometric review and emerging trend. Futur Bus J 9, 30 (2023). https://doi.org/10.1186/s43093-023-00207-2

Received:

Accepted:

Published:

DOI: https://doi.org/10.1186/s43093-023-00207-2