- Research

- Open access

- Published:

Research evolution in banking performance: a bibliometric analysis

Future Business Journal volume 7, Article number: 66 (2021)

Abstract

Banking performance has been regarded as a crucial factor of economic growth. Banks collect deposits from surplus and provide loans to the investors that contribute to the total economic growth. Recent development in the banking industry is channelling the funds and participating in economic activities directly. Hence, academic researchers are gradually showing their concern on banking performance and its effect on economic growth. Therefore, this study aims to explore the academic researchers on this particular academic research article. By extracting data from the web of Science online database, this study employed the bibliometrix package (biblioshiny) in the ‘R’ and VOSviewer tool to conduct performance and science mapping analyses. A total of 1308 research documents were analysed, and 36 documents were critically reviewed. The findings exhibited a recent growth in academic publications. Three major themes are mainly identified, efficiency measurement, corporate governance effect and impact on economic growth. Besides, the content analysis represents the most common analysis techniques used in the past studies, namely DEA and GMM. The findings of this study will be beneficial to both bank managers and owners to gauge a better understanding of banking performance. Meanwhile, academic researchers and students may find the findings and suggestions to study in the banking area.

Introduction

The financial services formed a significant contributory trademark in the overall economic growth by stimulating employment, offering vast avenues for investment and services to the consumers and the society [1]. Thus, economic development is led by economic growth whereby required capital is provided by the financial services [2]. Suggestively, capital creation by the financial services industry through accumulation and mobilisation of resources is considered the most crucial economic growth strategy component [3]. The banking system associates with creating funds by accumulating funds from surplus and channelling them to the investors as credit; those exhibit excellent ideas to generate a surplus in the economy but lack the capital to implement such ideas [4, 5]. Accordingly, the banking system plays a vital role to pledge the leading role of finance in economic development and promoting stable and healthy financial and economic development [6].

Banking performance has been regarded as a crucial factor of economic growth [7]. Efficiency and productivity change measures are rapidly used to evaluate banking performance. Academic researchers have been focusing on the efficiency and productivity of banking institutions for a long period, while economic growth is carried out in the discussions. Discovering research activities on banking efficiency and productivity in economic growth enables researchers to identify the local and international input to this particular discipline. More so, it will enable researchers to identify the ‘hot spots’ discussed by academic researchers and find the research gaps [8]. Indeed, banking performance in standings is a broad scientific topic, and estimating research activities might not be useful. For instance, research activities in this area extended to several constituents such as methodological approaches, banking approaches. In the current study, banking efficiency and productivity are considered as banking performance that contributes to the economic growth of an economy. Therefore, the main objective of this study is to explore the research activities of banking performance to economic growth. The investigation of banking performance research activities will enable the researchers to find the present directions of the research area and thus speculates the future research suggestions. Besides, it will also enable to expound the depth of past research activities and themes on banking performance relating to the economic growth measurements.

The use of the bibliometric method is appropriate to demonstrate the research shape and activity, volume and growth in a specific discipline [9]. A bibliometric method is a quantitative application of bibliometric data [10]. It analyses a wide-ranging quantity of published research articles employing the statistical tool to identify trends and citations or/and co-citations of a certain theme by year, author, country, journal, theory, method, and research constituent [11]. Significantly, this technique further distinguishes key research themes and active researchers, countries and institutions for future research planning and funding [12]. Scholars apply this method for several reasons: to reveal emerging trends in published research articles and journal performance, cooperation patterns, and research elements, and to reconnoitre the intellectual edifice of an exact domain in the existing literature [9, 13].

Minimal studies have used bibliometric analysis related to banks. For instance, Violeta and Gordana have employed bibliometric analysis to spot the trends of DEA application in banking [14]. Another study conducted by Ikra et al. applied the bibliometric method to Islamic banking efficiency [15]. By an extensive search on the Scopus, Web of Science and Google Scholar, no such study was found related to bibliometric analysis on banking performance to the economic growth. Nevertheless, this study will be the first attempt to conduct bibliometric methods on the banking performance to the economic growth that could be the basis for future studies.

The findings of this study unfolded several contributions to both policymakers, bank managers and academic researchers. Firstly, the findings would benefit the policymakers regarding the contribution and trends of banking performance. It would allow them to take necessary initiatives to promote and improve banking performance, thus economic development. Meanwhile, bank managers may utilise the findings to strengthen their banking operations by acknowledging key factors that contributed to the performance. Finally, academic researchers are enabled to detect the current trend and topics related to the banking area that leads to further studies.

Methods

Bibliometric analysis has achieved enormous popularity in social sciences research in the current years [9, 16,17,18]. The popularity of bibliometric analysis is observed from the development, accessibility and availability of software, for instance, Leximancer, Gephi, VOSviewer, Biblioshiny and publication databases (Web of Science and Scopus). Further, the rapid growth of bibliometric analysis in scientific production has emerged from business research to information science [9]. The popularity of bibliometric methodology in social science research is not a trend but moderately an image of its usefulness for constructing high research impact by handling excessive scientific data [9].

The bibliometric analysis is beneficial for briefing the trends in the research documents classifying ‘blind spots’ and ‘hot spots’, and finding a more inclusive understanding of the published research documents [19]. In detail, this analysis empowers the recognition of the most advanced (hot spots) and the less established topics (blind spots) within the documents that, shared with other bibliometric procedures, recommend future research avenues. The bibliometric analysis uncovers several ascriptions, such as unveiling emerging trends in documents and the performance of journals, research constituents and collaboration patterns and discovering the intellectual edifice of an exact domain in the existing literature [13, 18]. The data that apply in this analysis incline to be immense (hundreds, thousands) and unbiased in nature (publications and citations number, keywords occurrences and topics). However, its explanations often depend on both subjective (thematic analysis) and objective (performance analysis) assessments formed through well-versed techniques and procedures [9]. Therefore, this study applied bibliometric analysis to examine the general perspective on banking performance and economic growth.

Two categories are mainly manifest in the bibliometric techniques, namely, performance and science mapping. Precisely, research elements’ contributions are accounted for in the performance analysis, while the connections between research elements are focused on science mapping [9]. This study follows performance analysis, science mapping and network analysis suggested by Donthu et al. [9].

Data extraction process

Two primary databases, the Web of Science and the Scopus, are commonly used in the bibliometric analysis [20]. Both databases are prominent for the peer-reviewed published research articles. The data for this analysis were a collection of bibliographic data from the Web of Science. The Web of Science (WoS) is a multidisciplinary online database providing access to several citation databases, namely Science Citation Index Expanded (SCIE), Social Sciences Citation Index (SSCI), Emerging Sources Citation Index (ESCI), Arts and Humanities Citation Index (AHCI), Conference Proceedings Citation Index, Index Chemicus and Current Chemical Reactions [18, 21].

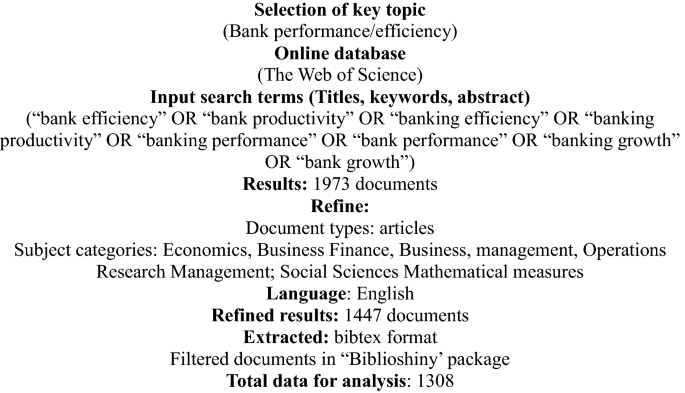

This study has applied a two-stage data extraction process, following Bretas and Alon, Alon et al. and Apriliyanti and Alon [16, 22, 23] as shown in Fig. 1. The choice of the keywords is crucial to ensure that it covers the total body of published documents on banking performance and economic growth [21]. Accordingly, the selection of keywords was carried out by reviewing several abstracts and authors’ keywords in most related literature on the Web of Science. The selected keywords were executed in the WoS online database on 9 August 2021. A combination of keyword search terms was considered; (1) ‘banking performance*’ to nail all discrepancies of the term such as the role of the bank, bank efficiency, bank productivity, banking efficiency, banking productivity, banking performance, bank performance, upon refining the search by including only research articles from the categories; economics, business finance, business, management, operations research management, social sciences mathematical measures and documents written in English.

The second stage extracted raw data from the online database combined, checked for duplicate documents and merged using ‘R’. Further, the documents were filtered in the ‘biblioshiny’ tool to omit book chapters and conference proceedings. After the extraction process for the bibliometric analysis, several impactful documents were selected based on local and global citations to conduct content analysis. The content analysis allowed the researcher to identify the leading research scopes and trends. Further, it allows identifying the streams and recommendations for future studies [22]. A total of 36 documents were selected to conduct a comprehensive review and valuation of the documents.

Results

Performance analysis

Performance analysis investigates the contributions of academic research elements to a particular discipline [24]. This analysis is naturally descriptive, which is the hallmark of bibliometric analysis [9]. It is a standard method in reviews to exhibit the performance of various research elements such as authors, countries, institutions and sources similar to the profile or background of respondents generally presented in empirical studies, albeit more statistically [9, 18]. Many measures exist in the performance analysis; hence, the most protuberant measurements are publications number and citations per research constituent or year. The publication is considered productivity, whereby citation measures influence an impact [9]. Besides, citation per document and h-index associate both publications and citations with evaluating research performance [18].

Table 1 presents the publication’s performance of banking performance. The results show a total number of 1308 documents published from 1972 to the present. Among 2275 contributed authors, a total of 202 authors were solely, and 2106 authors collaborated to the publications. A total of 31,458 citations received by published documents lead to an average of 629.16 citations per year, while 775 in h-index and 1023 in g-index. Hence, the banking efficiency field acknowledged productivity of research published by an average of 26.16 documents per year whereby nearly two authors (CI = 1.9) published one article, and standardised collaboration is 0.43 (between 0 and 1).

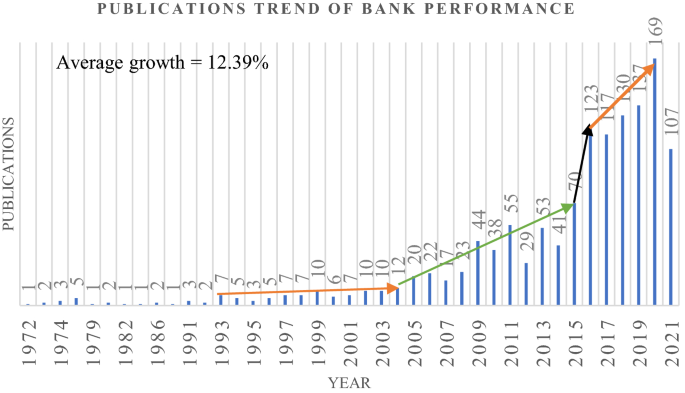

The annual production of scientific publications on banking efficiency is presented in Fig. 2. The first research article related to banking performance was published by Fraser and Rose [25], who studied the effect of new bank appearance in the market on bank performance. The annual growth of publications on banking performance or banking efficiency is recorded to 12.39%. The publications are significantly increasing in recent periods, especially from 2016 to the present. However, the mandated growth in publications is observed between 2004 and 2015, while earlier periods (1972–2003) were quite sluggish. In these consequences, academic researchers have started to focus on banking performance or banking efficiency in the recent period. As a result, it can be concluded that banking performance and its sphere are shaping upwards through the research contributions.

Science mapping

Science mapping investigates the connections between research elements [26] that relates to the intellectual connections and structural networks within research constituents [9]. The science mapping includes citation analysis, bibliographic coupling, co-citation analysis, co-occurrence network, collaboration techniques. When combined with network analysis, these techniques are instrumental in exhibiting the research area’s bibliometric edifice and intellectual structure [27].

Citation analysis

The citation analysis is a fundamental approach for science mapping that runs on the assumption that citations reproduce intellectual contributions and impact the research horizons [28]. This analysis shows the impact of published documents by measuring the number of citations they received [9]. Accordingly, it enables the discovery of the most influential and informative documents in a research constituent. Thus, it allows gathering insights into that constituent’s intellectual dynamics [9]. Table 2 presents the top 20 impactful and influential documents in the field of banking performance or efficiency. The analysis has discovered that a total of 1112 documents (85%) out of 1308 documents received global citations. The global citations refer to the number of citations received in the overall Web of Science citations. However, 196 documents (about 15%) have not received any citation; meanwhile, 130 documents (about 10%) received only one citation. A document written by Berger An received the highest number (665) of citations which was published in 1997. The second most influential document was written by Seiford [51] received a total of 549 citations, followed by the document written by Back (2013) received 512 citations. In fact, a total of four documents written by Berger An rank in the top 20 impactful research articles in the field of banking performance or efficiency.

Factually, the majority of the documents without citations was published in a recent period. At the same time, the highly cited documents were published quite earlier. To detect the immediate influence of more recent documents is to apply the measurement of an average citation per year [29]. By evaluating the average citations per year, nine out of ten documents are also among the top 10 documents. Perpetually, Beck [45] holds the highest number of average citations per year (56.89), followed by Berger An (2013) ranked second position (51.44) and Beltratti A (2012) ranked the following position (48.40). Based on the citation analysis, it can be elucidated that Berger An is the most influential author in the banking efficiency research constituent.

Co-occurrence analysis

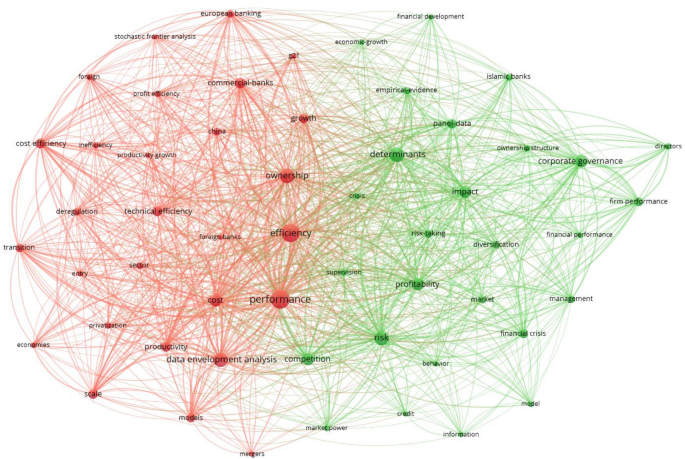

Co-occurrence analysis was projected by Callon et al. [30], considered as content analysis that is useful in plotting the strength of connotation within keywords in textual data. In other words, co-occurrence analysis is an approach that investigates the actual content of the document itself [9]. It maps the pertinent literature straight from the associations of keywords shared by research articles [24, 27, 31, 32]. The co-occurrence analysis deduces words to appear recurrently in a cluster. It exhibits conceptual or semantic groups of various topics or sub-topics considered by research constituents [9, 24]. Cobo and Herrera signified that spotted clusters could be applied with few objectives [24]. For instance, they can be applied to analyse their progression by gauging extension across successive subperiods and measuring the research area through performance analysis. Figure 3 displays the co-occurrence of keywords within the bank efficiency research constituent. As the focus of this research, bank performance represents the larger node associated with corporate governance, financial performance, financial crisis, nonperforming loans and others. In these scenarios, the red-coloured cluster depicts that these subtopics or variables are directly associated related to the bank performance theme due to repetitive co-occurrence of those words. Likewise, the green-coloured cluster represents a theme related to bank efficiency associated with performance and ownership. In the same cluster, the nonparametric data envelopment analysis is extensively used to measure commercial banks' technical and cost efficiency and productivity. Parametric stochastic frontier analysis is narrowly observed in efficiency measurements comparably. The green-coloured cluster depicts the determinants of bank profitability including other impactful variables such as risk, competition, corporate governance. This cluster applied panel data in order to examine performance, financial development as well as economic growth. Each of the cluster identifies the interacted themes used in the published documents using co-occurrence of keywords.

Collaboration networks

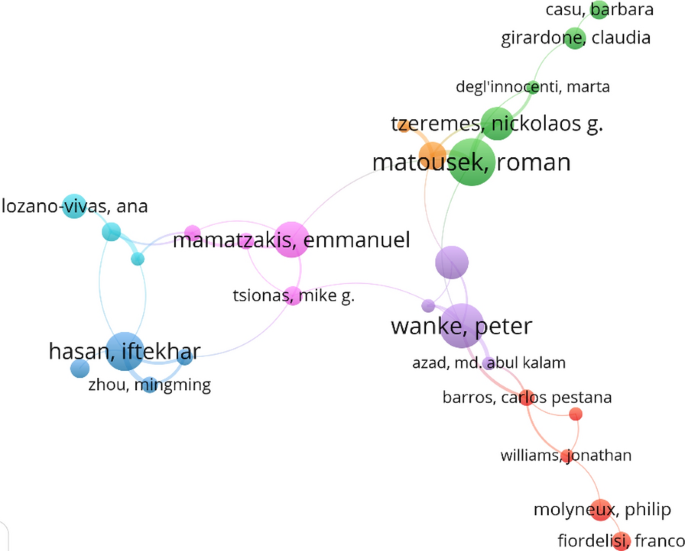

Collaboration analysis explores the associations within researchers in a particular constituent. It is a formal way of intellectual association among researchers [33, 34]. Therefore, it is crucial to understand how researchers associate among themselves [9]. In the presence of growing theoretical and methodological complexity in research, intellectual networking (collaboration) has become commonplace [33]. Indeed, collaboration or interaction among researchers enables improvements in academic research; for instance, greater interactions among diverse researchers allow richer insights and greater clarity [35]. Researchers who collaborate form a network named ‘invisible collages’ whose research can help improve undertakings in the study field [36]. Figure 4 presents the collaboration network of authors those co-authored academic articles in banking efficiency. Based on the collaboration network, Wanke P (Universidade Federal do Rio de Janeiro) was the most collaborated author who co-authored with four authors from different institutions in different countries. At the same time, Matousek, R (University Kent), Hasan, I (Rensselaer Polytechnic Institute) and Mamatzakis, E (University of Sussex), have also exhibited as greater collaborative researchers. In these consequences, authors from different institutions and from different parts of the world are collaborating to the banking performance/efficiency field.

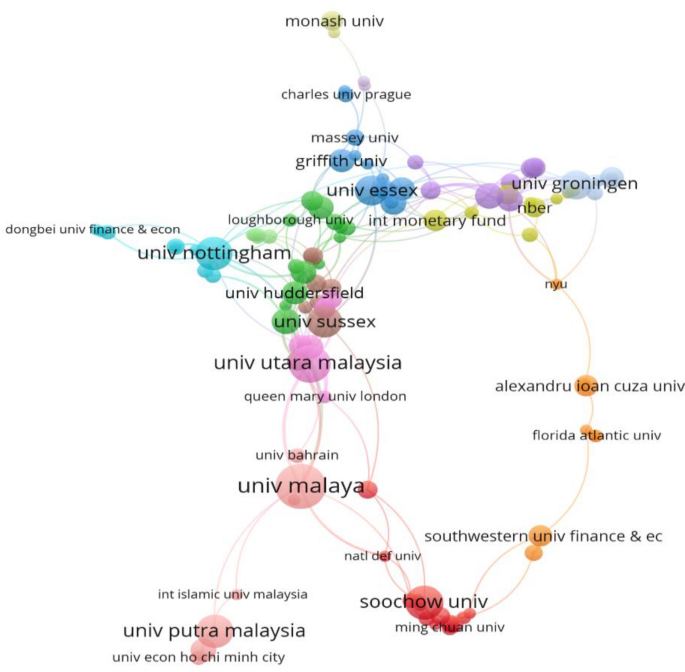

Bibliographic coupling

Co-authorship or collaborative networks within the authors and other crucial facets in the collaboration networks are the collaboration of author-affiliated countries and institutions [31]. Figure 5 exhibits the collaboration network within authors’ affiliated organisations. University Malaya and University Utara Malaysia, University Malaya and University Putra Malaysia, University Malaya and University Fed Rio de Janeiro all depict a strong collaboration network. In general, all the institutions display an embellishment among the institutions within the same region.

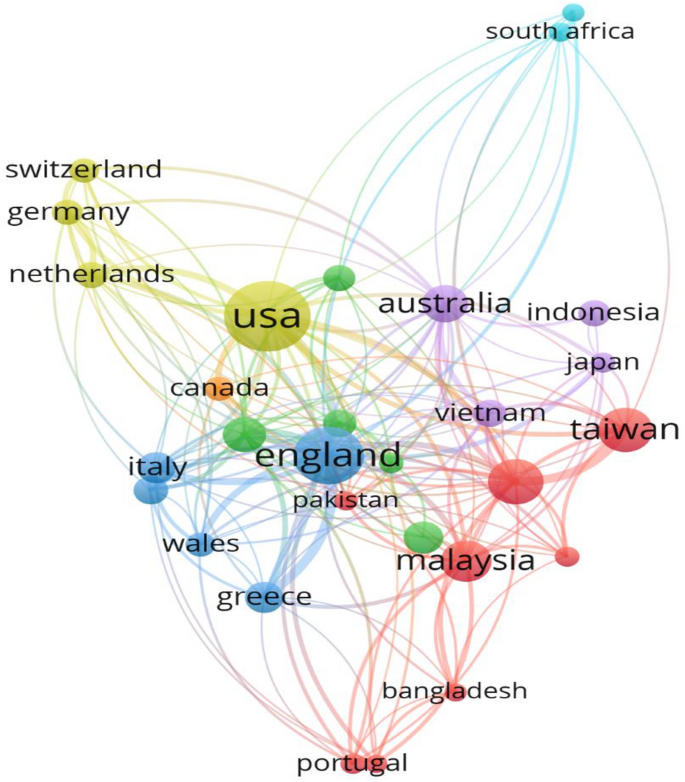

Similar to co-authors’ affiliated institutions, the collaboration of authors’ country presents a steady association among authors’ connections that allow exploring comparative and concurrent research works. Figure 6 represents the network of collaborative authors’ affiliation countries. These countries include South Africa and the USA, England and the USA, Australia and the USA, Malaysia and the USA, Germany and the USA, representing a high proportion of authors’ affiliated institutions are in the USA with this country performing as a hub of co-authorship publications from 1972 to 2021.

Discussion

This study discusses trending themes based on the bibliometric findings and reviews of highly cited and most recent documents (see Appendix 1). It also indicated the type of study, theories, methods and main findings to suggest comprehensive future studies.

Research directions

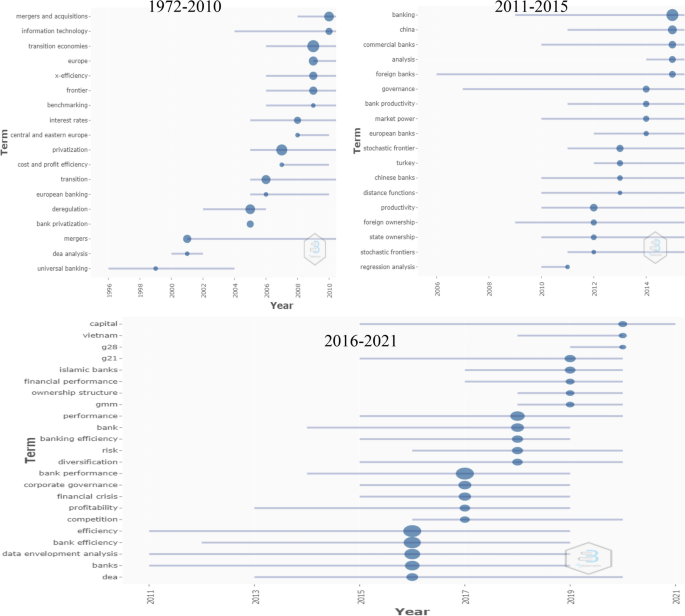

Between 1991 and 2010, studies related to banking performance have posited several antecedents to banking performance. Figure 7 displays the trend topics based on author keywords that appeared between 1972 and 2010. Studies in this period mainly focused on mergers and acquisitions, information technology and transition economies that emerged from universal banking deregulation and bank privatisation. The financial crisis during 2008–2009 drew the attention of scholars to evaluate the banking performance. Idiosyncratically, this phenomenon has been acknowledged by researchers from 2010 to 2015, focusing on the role of corporate governance in the performance of the banking industry, including compensation, risk management, determinants of stock returns, capital buffer, productivity. Idiosyncratically, a vast of studies were conducted on Chinese commercial banks and the effect on their economic growth.

In the recent period (2016–2021), diverse factors posited in the studies that dominantly present a significant interest from banking scholars. While studies earlier mainly focusing on efficiency and its contributing factors, recent periods extended research directions to multiple constituents. For example, how banks diversified their services and the role of human capital efficiency to the banking performance [37]. Bose et al. employed the effect of green banking on the performance that underpins the inclusion of the environmental sustainability approach by the banking industry [38]. Meanwhile, Bhattacharyya et al. showed the effect of CSR expenditures and financial inclusion on the performance that define the social sustainability indicator of the banks [39]. Repeatedly, the role and structure of the board, categorisation of deposits and loans, risk exposures (business cycle), macroeconomic factors were also acknowledged in recent banking performance studies [40,41,42,43]. Idiosyncratically, scholars recently focus the components of sustainability of the banking industry from economic, environmental and social aspects [44]. Furthermore, the effect of banking and its stability on economic growth has been broadly carried out in the recent period. Moreover, the development of studies was taken into account, which implies the contribution to the economic growth of particular regions. Based on the earlier and recent studies, it is precisely observed the diversification of research constituents in relation to bank performance studies. Earlier studies (up to 2015) mainly measured banking performance or efficiency based on accounting measurements, while recent studies started to include market measurements principally based on stock returns performance. On the other hand, the rise of Islamic banking and finance influenced academic researchers to compare the business models [45], banking efficiencies [46] between conventional and Islamic banks, and efficiency for Islamic banks [5].

Based on the review of impactful documents published from 1990 to 2010, two particular objectives were identified: the effect of the board of directors or ownership on the bank performance [47,48,49] and measurement of efficiency, including cost and profit efficiency [50,51,52]. These constituents extended during 2011–2020 by the inclusion of risk-taking management [53], CEO incentives [54], contributing factors including capital, banking crises on banking performance [42, 55,56,57]. Meanwhile, the Islamic banking system got crucial attention from academic researchers. Accordingly, several studies evaluated and compared efficiency between Islamic and conventional banks [45, 58, 59]. Nevertheless, the role of the banking industry in economic growth was included in the research constituents in the recent decade. For example, Xu, Santana and a few more scholars investigated the correlation between financial intermediation and economic growth [57, 60, 61]. In recent years, scholars extended the banking-related research constituents to diverse areas. The effect of human capital efficiency [37], green banking [38], CSR expenditures [39] and bank stability was included to measure banking performance. These extensions of research themes within banking performance studies posited a significant interest by academic researchers.

Apparently, almost all documents adopted the quantitative method in measuring banking performance research constituents. However, studies that measured banking efficiency mainly applied nonparametric analysis DEA [5, 51], while SFA was adopted by limited studies [37, 42, 43]. On the other hand, regression analysis was predominantly applied to investigate banking performance from 1990 to 2010 [49, 50]. In recent studies, academic researchers have vastly adopted GMM (generalised method of moments) to examine the contributing factors on banking performance [39, 42, 57, 60]. These methods are dominating the banking-related studies throughout the publication periods. Over the periods, scholars have developed DEA applications in several categories, such as bootstrap, networking. Meanwhile, GMM with different approach (dynamic and system) techniques exploited panel data primarily extracted from Bankscope, Datastream, annual reports etc.

Main findings

Earlier, banking inefficiencies were substantially observed low, negatively affecting profitability and marketability [50, 51]. This trend was continuously depicted in studies [52]. However, Berger et al. evidenced better efficiency for larger banks than smaller banks [50]. On the contrary, Seiford and Zhu posited an adverse effect of bank size on marketability [51]. More so, Rehman et al. found larger banks are less efficient than smaller banks [40]. Hence, Moudud-Ul-Huq posited diverse impacts of bank size and competition on performance [62]. So, banking size is deemed to have a substantial effect on the overall performance of banks. However, Adesina embellished that diversification of services and choices of management decisions on loans (nonperforming, debt issuances) [63, 64] and deposits [41] affect the banking performance [37]. Moreover, board structure affects banking performance [40, 65], while higher human capital efficiency enhances banking performance [37].

Generally, foreign-owned banks provide better service, greater profitability and are better efficient than local banks. This phenomenon was evidenced in several studies; for example, Bonin et al. and other scholars demonstrated that foreign-owned banks are more cost-efficient than other banks [48]. However, this trend did not exist for Islamic banks as local banks showed better efficiency than foreign peers [58] and more efficient than conventional [59]. Meanwhile, state-owned or government-owned commercial banks were less efficient and provided poorer services [48, 49, 52]. But these banks’ efficiency was higher than urban/rural banks during credit risk shock [41]. Nevertheless, banking efficiency and performance substantially depend on diversification of services, managerial adequacy, ownership, types and size.

Studies have evidenced financial development and thus the banking industry’s role in economic growth [60]. In the nineteenth century, the establishment of the savings bank demonstrated city growth in Prussia [66]. Potentially, banks provide investment capital to increase per capita GDP [43]. However, Haini documented a contrasting effect of banking development on economic growth through a push out of private investment due to high levels of the banking sector [67]. However, Stewart and Chowdhury proved that a stable banking sector lessens the negative impact of a crisis on GDP growth and provides economic resilience in both developed and developing countries. Overall, findings elaborated a crucial link between banking sector development and economic growth.

Future study suggestions

This study has recommended several scopes for future studies in the hybrid review, mainly through bibliometric findings and the structured review of impactful articles [11]. In other words, the recommendations for future studies are made by observing and analysing discussions on highly cited and recent cited documents. Overall findings and analyses raised several questions that need to be addressed for future studies.

Firstly, does the banking sector improve economic growth in the least developed countries? Prior studies mainly focused on developed and developing economies, but less attention was given to least developed countries. Secondly, vast studies investigated contributing factors of banking performance, while political instability has been ignored. Future studies might include political instability on the banking performance. Apart from it, nonperforming loans can be another addition to future studies, and even few studies documented it. Thirdly, how do banks perform during the pandemic crisis, for instance, COVID-19? The current pandemic crisis can be a significant factor in banking performance related to future studies, including efficiency, mortgages, loan recovery, deposits and business services. The studies can include consumer behaviour (due to restricted movements, safety measurements), green banking (online transaction and services), financial technologies (inclusion of nonbanking services) and the contribution or continuance of economic activities in the country during and after the pandemic crisis.

Significantly, prior studies have ignored the current trend of FinTech inclusion in banking performance. Fourthly, will FinTech takeover the banking services and diminish banks in the near future? Future studies may investigate the effect of FinTech applications on banking. More so, future studies may explore the banking industry’s barriers, challenges and threats due to FinTech growth. Fifthly, almost all studies employed quantitative analysis related to banking performance. Therefore, future studies may use qualitative methods to explore the opportunities and practices of banks and their performance. Sixthly, the majority of the studies either applied parametric or econometric techniques to investigate the bank performance. Recent developments in technologies and methods may provide easy and robust results in such related studies as using machine learning for data analysis and predicting banking efficiency and productivity determinants. Seventhly, past studies mostly followed the intermediation approach, which scarcely included production and operating approach measurement. Future studies may extend the efficiency analysis using productivity growth analysis. Further, the majority of the studies observed efficiency only. Future studies can include a productivity change index along with an efficiency analysis. Finally, GMM and regression were broadly applied to investigate the effect of antecedents of banking performance and link to economic growth. Future studies may adopt other advanced data analysis techniques such as partial least squares, structural equations and other econometric techniques.

Conclusions

The main purpose of this study is to explore the trends and research activities in banking performance and the economic growth research domain. To achieve this objective, a bibliometric analysis was applied and performed several analyses, namely citation, co-occurrence of keywords, the collaboration between authors and coupling between institutions and countries, and discussion by reviewing most cited and most recent influential research articles. This study presents the most common themes, sub-themes associated with highly cited documents and authors; furthermore, the content analysis identified the research directions, research objectives, methodologies, topics and findings.

Based on the reviewing literature, the efficiency theory, banking theory mainly intermediation approach and nonparametric technique, namely data envelopment analysis along with econometric method, regression was used in the published documents. The findings of this study, along with future study suggestions, could be beneficial to bankers as well as academic researchers and students studying banking performance and its role in the economy.

Limitations

The most crucial limitation in any bibliometric analysis is the database selection. It means selecting the data and the limits of its interpretation [68]. This study has three key limitations; firstly, it has chosen ‘Web of Science’, one of the largest online databases to gather data on banking performance research articles from 1972 to 2021 and refined based on subject categories and language (English). The database could be improved if other databases were included and also if book chapters and conference proceedings were added. Secondly, the selection of keywords; although selected keywords are deemed to be most relevant to encompass the majority of articles related to banking performance, there is always an opportunity to search further articles by using additional keywords. Lastly, this study could not conduct co-citation analysis due to the unavailability of cited documents in Web of Science data format.

Availability of data and materials

The data collected from the Web of Science online database were saved on Microsoft excel and remained with authors. The data are available upon request.

Abbreviations

- DEA:

-

Data envelopment analysis

- GMM:

-

Generalized method of moments

- WoS:

-

Web of Science

- CI:

-

Collaboration index

- CEO:

-

Chief executive officer

- CSR:

-

Corporate social responsibility

References

Berger AN, Demsetz RS, Strahan PE (1999) The consolidation of the financial services industry: causes, consequences, and implications for the future. J Bank Finance 23(2):135–194. https://doi.org/10.1016/S0378-4266(98)00125-3

Beckett A, Hewer P, Howcroft B (2000) An exposition of consumer behaviour in the financial services industry. Int J Bank Mark 18(1):15–26. https://doi.org/10.1108/02652320010315325

Berger AN (2000) The integration of the Financial Services Industry. North Am Actuar J 4(3):25–45. https://doi.org/10.1080/10920277.2000.10595922

Ndubuisi MN, Chikeziem FO (2014) Banks’ Credit as an instrument of economic growth in Nigeria. Int J Bus Law Res 2(2):25–33

Chowdhury MAM, Haron R (2021) The efficiency of Islamic Banks in the Southeast Asia (SEA) region. Future Bus J 7(16):1–16. https://doi.org/10.1186/s43093-021-00062-z

Jiang Y, Li M, Xia P (2021) Bank supply chain efficiency analysis based on regional heterogeneity: a data-driven empirical study. Ind Manag Data Syst 121(4):940–963. https://doi.org/10.1108/IMDS-10-2019-0541

Moez D (2020) Does unsystematic risk management affect the relationship between banks’ performance and the objectives of Saudi Arabia Economic Vision 2030? Acad Account Financ Stud J 24(4):1–15

Sweileh WM, Al-Jabi SW, AbuTaha AS, Zyoud SH, Anayah FMA, Sawalha AF (2017) Bibliometric analysis of worldwide scientific literature in mobile - health: 2006–2016. BMC Med Inform Decis Mak 17(1):1–12. https://doi.org/10.1186/s12911-017-0476-7

Donthu N, Kumar S, Mukherjee D, Pandey N, Lim WM (2021) How to conduct a bibliometric analysis: an overview and guidelines. J Bus Res 133(May):285–296. https://doi.org/10.1016/j.jbusres.2021.04.070

Pritchard A (1969) Statistical bibliography or bibliometrics? J Doc 25(4):348–349

Paul J, Criado AR (2020) The art of writing literature review: what do we know and what do we need to know? Int Bus Rev 29(4):101717. https://doi.org/10.1016/j.ibusrev.2020.101717

Sweileh WM (2020) Bibliometric analysis of peer-reviewed literature on climate change and human health with an emphasis on infectious diseases. Glob Health 16(1):1–17. https://doi.org/10.1186/s12992-020-00576-1

Verma S, Gustafsson A (2020) Investigating the emerging COVID-19 research trends in the field of business and management: a bibliometric analysis approach. J Bus Res 118(January):253–261. https://doi.org/10.1016/j.jbusres.2020.06.057

Cvetkoska V, Savic G (2021) DEA in banking: analysis and visualization of bibliometric data. Data Envel Anal J 5(2):455–485. https://doi.org/10.1561/103.00000044

Ikra SS, Rahman MA, Wanke P, Azad MAK (2021) Islamic banking efficiency literature (2000–2020): a bibliometric analysis and research front mapping. Int J Islam Middle Eastern Finance Manag. https://doi.org/10.1108/imefm-05-2020-0226 (ahead-of-p(ahead-of-print))

Bretas VPG, Alon I (2021) Franchising research on emerging markets: bibliometric and content analyses. J Bus Res 133(May):51–65. https://doi.org/10.1016/j.jbusres.2021.04.067

Nobanee H (2021) A bibliometric review of big data in finance. Big Data 9(2):73–78. https://doi.org/10.1089/big.2021.29044.edi

Durieux V, Gevenois PA (2010) Bibliometric indicators: quality measurements of scientific publication. Radiology 255(2):342–351. https://doi.org/10.1148/radiol.09090626

Gaur A, Kumar M (2018) A systematic approach to conducting review studies: an assessment of content analysis in 25 years of IB research. J World Bus 53(2):280–289. https://doi.org/10.1016/j.jwb.2017.11.003

Aria M, Cuccurullo C (2017) bibliometrix: an R-tool for comprehensive science mapping analysis. J Informet 11(4):959–975. https://doi.org/10.1016/j.joi.2017.08.007

Bahoo S, Alon I, Paltrinieri A (2020) Sovereign wealth funds: past, present and future. Int Rev Financ Anal 67(October):101418. https://doi.org/10.1016/j.irfa.2019.101418

Alon I, Anderson J, Munim ZH, Ho A (2018) A review of the internationalization of Chinese enterprises. Asia Pac J Manag 35(3):573–605. https://doi.org/10.1007/s10490-018-9597-5

Apriliyanti ID, Alon I (2017) Bibliometric analysis of absorptive capacity. Int Bus Rev 26(5):896–907. https://doi.org/10.1016/j.ibusrev.2017.02.007

Cobo MJ, Herrera F (2011) An approach for detecting, quantifying, and visualizing the evolution of a research field: a practical application to the Fuzzy Sets Theory field. J Informet 5(1):146–166. https://doi.org/10.1016/j.joi.2010.10.002

Fraser DR, Rose PS (1972) Bank entry and bank performance. J Financ 27(1):65–78. https://doi.org/10.2307/2978504

Baker HK, Kumar S, Pandey N (2021) Forty years of the journal of futures markets: a bibliometric overview. J Futur Mark 41(7):1027–1054. https://doi.org/10.1002/fut.22211

Baker HK, Kumar S, Pandey N (2020) A bibliometric analysis of managerial finance: a retrospective. Manag Finance 46(11):1495–1517. https://doi.org/10.1108/MF-06-2019-0277

Appio FP, Cesaroni F, Di Minin A (2014) Visualizing the structure and bridges of the intellectual property management and strategy literature: a document co-citation analysis. Scientometrics 101(1):623–661. https://doi.org/10.1007/s11192-014-1329-0

Fahimnia B, Sarkis J, Davarzani H (2015) Green supply chain management: a review and bibliometric analysis. Int J Prod Econ 162:101–114. https://doi.org/10.1016/j.ijpe.2015.01.003

Callon M, Courtial J-P, Turner WA, Bauin S (1983) From translations to problematic networks: an introduction to co-word analysis. Soc Sci Inf 22(2):191–235. https://doi.org/10.1177/053901883022002003

Donthu N, Kumar S, Pattnaik D (2020) Forty-five years of Journal of Business Research: a bibliometric analysis. J Bus Res 109(October 2019):1–14. https://doi.org/10.1016/j.jbusres.2019.10.039

Emich KJ, Kumar S, Lu L, Norder K, Pandey N (2020) Mapping 50 years of small group research through small group research. Small Group Res 51(6):659–699. https://doi.org/10.1177/1046496420934541

Acedo FJ, Barroso C, Casanueva C, Galán JL (2006) Co-authorship in management and organizational studies: an empirical and network analysis. J Manag Stud 43(5):957–983. https://doi.org/10.1111/j.1467-6486.2006.00625.x

Cisneros L, Ibanescu M, Keen C, Lobato-Calleros O, Niebla-Zatarain J (2018) Bibliometric study of family business succession between 1939 and 2017: mapping and analyzing authors’ networks. Scientometrics. https://doi.org/10.1007/s11192-018-2889-1

Tahamtan I, SafipourAfshar A, Ahamdzadeh K (2016) Factors affecting number of citations: a comprehensive review of the literature. Scientometrics 107(3):1195–1225. https://doi.org/10.1007/s11192-016-1889-2

Crane D (1972) Invisible colleges: diffusion of knowledge in scientific communities. University of Chicago Press

Adesina KS (2021) How diversification affects bank performance: the role of human capital. Econ Model 94:303–319. https://doi.org/10.1016/j.econmod.2020.10.016

Bose S, Khan HZ, Monem RM (2021) Does green banking performance pay off? Evidence from a unique regulatory setting in Bangladesh. Corp Gov Int Rev 29(2):162–187. https://doi.org/10.1111/corg.12349

Bhattacharyya A, Wright S, Rahman ML (2021) Is better banking performance associated with financial inclusion and mandated CSR expenditure in a developing country? Account Finance 61(1):125–161. https://doi.org/10.1111/acfi.12560

Rehman RU, Zhang J, Naseem MA, Ahmed MI, Ali R (2021) Board independence and Chinese banking efficiency: a moderating role of ownership restructuring. Eurasian Bus Rev 11(3):517–536. https://doi.org/10.1007/s40821-020-00155-9

Yu MM, Lin CI, Chen KC, Chen LH (2021) Measuring Taiwanese bank performance: a two-system dynamic network data envelopment analysis approach. Omega (United Kingdom) 98:102145. https://doi.org/10.1016/j.omega.2019.102145

Moudud-Ul-Huq S (2019) The impact of business cycle on banks’ capital buffer, risk and efficiency: a dynamic GMM approach from a developing economy. Glob Bus Rev. https://doi.org/10.1177/0972150918817382

Chen X, Lu CC (2021) The impact of the macroeconomic factors in the bank efficiency: evidence from the Chinese city banks. North Am J Econ Finance 55:101294. https://doi.org/10.1016/j.najef.2020.101294

Buallay A, Fadel SM, Alajmi J, Saudagaran S (2020) Sustainability reporting and bank performance after financial crisis: evidence from developed and developing countries. Compet Rev 31(4):747–770. https://doi.org/10.1108/CR-04-2019-0040

Beck T, Demirgüç-kunt A, Merrouche O (2013) Islamic vs. conventional banking: business model, efficiency and stability. J Bank Finance 37(2):433–447. https://doi.org/10.1016/j.jbankfin.2012.09.016

Kamarudin F, Nordin BAA, Muhammad J, Hamid MAA (2014) Cost, revenue and profit efficiency of Islamic and conventional banking sector: empirical evidence from gulf cooperative council countries. Glob Bus Rev 15(1):1–24. https://doi.org/10.1177/0972150913515579

de Andres P, Vallelado E (2008) Corporate governance in banking: The role of the board of directors. J Bank Finance 32(12):2570–2580. https://doi.org/10.1016/j.jbankfin.2008.05.008

Micco A, Panizza U, Yañez M (2007) Bank ownership and performance. Does politics matter? J Bank Finance 31(1):219–241. https://doi.org/10.1016/j.jbankfin.2006.02.007

Bonin JP, Hasan I, Wachtel P (2005) Bank performance, efficiency and ownership in transition countries. J Bank Finance 29(1 SPEC. ISS.):31–53. https://doi.org/10.1016/j.jbankfin.2004.06.015

Berger AN, Hancock D, Humphrey DB (1993) Bank efficiency derived from the profit function. J Bank Finance 17(2–3):317–347. https://doi.org/10.1016/0378-4266(93)90035-C

Seiford LM, Zhu J (1999) Profitability and marketability of the Top 55 U.S. Commercial Banks. Manag Sci 45(9):1270–1288. https://doi.org/10.1287/mnsc.45.9.1270

Berger AN, Hasan I, Zhou M (2009) Bank ownership and efficiency in China: what will happen in the world’s largest nation? J Bank Finance 33(1):113–130. https://doi.org/10.1016/j.jbankfin.2007.05.016

Aebi V, Sabato G, Schmid M (2012) Risk management, corporate governance, and bank performance in the financial crisis. J Bank Finance 36(12):3213–3226. https://doi.org/10.1016/j.jbankfin.2011.10.020

Fahlenbrach R, Stulz RM (2011) Bank CEO incentives and the credit crisis. J Financ Econ 99(1):11–26. https://doi.org/10.1016/j.jfineco.2010.08.010

Beltratti A, Stulz RM (2012) The credit crisis around the globe: why did some banks perform better? J Financ Econ 105(1):1–17. https://doi.org/10.1016/j.jfineco.2011.12.005

Berger AN, Bouwman CHS (2013) How does capital affect bank performance during financial crisesα. J Financ Econ 109(1):146–176. https://doi.org/10.1016/j.jfineco.2013.02.008

Santana A (2020) The relationship between financial development and economic growth in Latin American countries: the role of banking crises and financial liberalization. Glob Econ J 20(04):1–26. https://doi.org/10.1142/S2194565920500232

Kamarudin F, Sufian F, Loong FW, Anwar NAM (2017) Assessing the domestic and foreign Islamic banks efficiency: insights from selected Southeast Asian countries. Future Bus J 3(1):33–46. https://doi.org/10.1016/j.fbj.2017.01.005

Chowdhury MAM, Haron R, Sulistyowati MIK, Masud Al MA (2020) The efficiency of commercial banks in Indonesia. Int J Econ Policy Emerg Econ 1(1):1–23. https://doi.org/10.1504/IJEPEE.2020.10034525

Xu H (2016) Financial intermediation and economic growth in China: new evidence from panel data. Emerg Mark Financ Trade 52(3):724–732. https://doi.org/10.1080/1540496X.2016.1116278

Zeqiraj V, Hammoudeh S, Iskenderoglu O, Tiwari AK (2020) Banking sector performance and economic growth: evidence from Southeast European countries. Post-Communist Econ 32(2):267–284. https://doi.org/10.1080/14631377.2019.1640988

Moudud-Ul-Huq S (2020) Does bank competition matter for performance and risk-taking? Empirical evidence from BRICS countries. Int J Emerg Mark 16(3):409–447. https://doi.org/10.1108/IJOEM-03-2019-0197

Berger AN, DeYoung R (1997) Problem loans and cost efficiency in commercial banks. J Bank Finance 21:849–870

Ryu D, Yu J (2021) Nonlinear effect of subordinated debt changes on bank performance. Finance Res Lett 38(January 2020):101496. https://doi.org/10.1016/j.frl.2020.101496

Tam OK, Liang HY, Chen SH, Liu B (2021) Do valued independent directors matter to commercial bank performance? Int Rev Econ Finance 71(April 2020):1–20. https://doi.org/10.1016/j.iref.2020.06.005

Lehmann-Hasemeyer S, Wahl F (2021) The German bank–growth nexus revisited: savings banks and economic growth in Prussia. Econ History Rev 74(1):204–222. https://doi.org/10.1111/ehr.13030

Haini H (2021) Examining the nonlinear impact of the banking sector on economic growth: evidence from China’s Provinces. J Chin Econ Bus Stud. https://doi.org/10.1080/14765284.2021.1943193

Xi J, Kraus S, Filser M, Kellermanns FW (2015) Mapping the field of family business research: past trends and future directions. Int Entrep Manag J 11(1):113–132. https://doi.org/10.1007/s11365-013-0286-z

Gaies B, Nabi M (2021) Banking crises and economic growth in developing countries: why privileging foreign direct investment over external debt? Bull Econ Res 73:736–761. https://doi.org/10.1111/boer.12271

Isnurhadi I, Adam M, Sulastri S, Andriana I, Muizzuddin M (2021) Bank capital, efficiency and risk: evidence from Islamic banks. J Asian Finance Econ Bus 8(1):841–850. https://doi.org/10.13106/jafeb.2021.vol8.no1.841

Kchikeche A, Khallouk O (2021) On the nexus between economic growth and bank-based financial development: evidence from Morocco. Middle East Dev J 13:245–264. https://doi.org/10.1080/17938120.2021.1930830

Li R, Li L, Zou P (2021) Credit risk shocks and banking efficiency: a study based on a bootstrap-DEA model with nonperforming loans as bad output. J Econ Stud 48(1):1–19. https://doi.org/10.1108/JES-08-2019-0395

Stewart R, Chowdhury M (2021) Banking sector distress and economic growth resilience: asymmetric effects. J Econ Asymmetries 24:e00218. https://doi.org/10.1016/j.jeca.2021.e00218

Acknowledgements

N/A.

Funding

N/A.

Author information

Authors and Affiliations

Contributions

MAMC conducted the data analysis. SMSA prepared the manuscript by contributing literature and discussion for this study. DBAR managed the data and edited the manuscript. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Competing interest

We have no conflicts of interest to disclose.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix 1: Reviewed documents

Appendix 1: Reviewed documents

Authors | Type of paper | Objective | Theories/approach | Methods (sample & technique) | Main findings |

|---|---|---|---|---|---|

Berger et al., [50] | Quantitative | Derived profit function model and measured inefficiency | Multiple regression, annual reports | US banks’ inefficiencies were quite large, while almost half of the potential profit variables were lost to inefficiency. Further, larger banks were substantially efficient than smaller banks | |

Berger and DeYoung [63] | Quantitative | Investigated the intersection between problem loan and bank efficiency | Granger-causality (OLS, GLS), Panel data | Problem loans and measured cost efficiency posited unidirectional links; problem loans (nonperforming loans) precede reductions in cost efficiency, and cost efficiency precedes a reduction in problem loans | |

Seiford and Zhu [51] | Quantitative | Evaluated the performance of the top 55 US commercial banks | Output-oriented (CCR) DEA, (BCC) DEA, Annual reports | 90% of US banks were found inefficient relating to profitability and marketability. Besides, bank size was suggested to have a negative effect on marketability | |

Bonin et al. [49] | Quantitative | Examined the effects of ownership on bank efficiency | Regression (stochastic frontier estimation), panel data | Foreign-owned banks are more cost-efficient than other banks and provide better service, while government-owned banks are less efficient in providing services, and better banks were privatised first in transition countries | |

Micco et al. [48] | Quantitative | Assessed the link between ownership and bank performance | Regression, panel data | State-owned banks had lower profitability and higher costs than private banks in developing countries, while foreign-owned banks showed the opposite. Further, political considerations, especially during election years, differed performance between public and private banks | |

Andres and Vallelado [47] | Quantitative | Analysed the effectiveness of the board directors in the bank | Regression (OLS, system estimator regression), Panel data | An inverted nonlinear relationship was found between bank performance and board size, between the proportion of nonexecutive directors and performance. However, bank ownership, intuitional differences and weight of the banking industry differ in the relationship | |

Berger et al. [52] | Quantitative | Measured cost and profit efficiency | Regression, Annual report | Big Chinese banks are inefficient, while foreign banks were the most efficient | |

Fahlenbrach and Stulz [54] | Quantitative | Investigated the effect of CEO incentives on bank performance during the crisis | Regression, S&P, | Banks with higher CEOs’ incentives performed worse while did not perform worse during the financial crisis. CEOs had lost extremely large wealth as they did not reduce their shareholdings during the crisis | |

Aebi et al. [53] | Quantitative | Examined the effect of risk management related corporate governance mechanisms on bank performance during the financial crisis | Regression, Panel data | Banks’ stock returns and ROE exhibited higher for those credit risk officers directly reported to the board directors rather than CEO during the crisis | |

Beltratti and Stulz [55] | Quantitative | Measured the contributing factors to the poor bank performance during the credit crisis | Regression, Panel data | The fragility of banks financed with short term capital market funding and the better performing banks had less leverage and lower returns immediate before the crisis | |

Berger and Bouwman [56] | Quantitative | Investigated the effect of capital on bank performance | The screening-based theory, The asset-substitution moral hazard theories | Logit survival regressions, OLS | The capital was found to enhance the survival chances and market shares of small banks always even during bank crises, market crises, and normal periods. Large and medium-sized banks were linked by capital predominantly during banking crises and the ones with limited government intervention |

Beck et al. [45] | Quantitative | Compared efficiency between conventional and Islamic banks | Regression | Islamic banks had greater intermediation ratios, higher asset quality and better capitalisation over conventional though they were less efficient. hence, Islamic banks performed better during financial crisis regards of asset quality and capitalisation | |

Xu [60] | Quantitative | Investigated the relationship between financial intermediation and economic growth | System GMM, dynamic panel data | A diverse measure of financial development was generally linked to economic growth. The size and depth of the financial sector significantly influence economic growth | |

Kamarudin et al. [58] | Quantitative | Examined and compared the efficiency of domestic and foreign Islamic banks in SEA countries | DEA, Annual Reports | Domestic Islamic had greater efficiency than foreign banks peer | |

Moudud-Ul-Huq [42] | Quantitative | Investigated the linkage between capital buffer, risk and efficiency adjustments | SFA, GMM, panel data | The economic cycle had a substantial effect on capital holding, risk and efficiency adjustments. Besides, high capitalised banks posited less efficient than low capitalised banks due to enact of regulatory pressure | |

Buallay et al. [44] | Quantitative | Examined the relationship between sustainability reporting and bank performance after financial crisis | Value creation theory | Regression, GMM, panel data | Environmental, social, and governance scores lessen banking performance in both developed and developing countries |

Chowdhury et al. [59] | Quantitative | Measured and compared efficiency between Islamic and conventional banks | DEA, Malmquist, Annual reports | Islamic banks exhibited better comparably in efficiency than conventional. All commercial banks need to improve managerial efficiency | |

Moudud-Ul-Huq [62] | Quantitative | Investigated the relationship between risk-taking behaviour and banks’ competition performance | competition-stability theory, quiet life hypothesis. Structure-conduct-performance | GMM, panel data | Bank size heterogeneously affects bank performance and risk-taking behaviour in emerging countries, and competition substantially affects bank performance |

Santana [57] | Quantitative | Investigated the effects of banking crises and financial liberalisation on the relationship between financial development and economic growth | GMM, Dynamic panel data | Financial liberalisation did not show a positive relationship between financial development and economic growth due to the emergence and recurrence of banking crises | |

Zeqiraj et al. [61] | Quantitative | Investigated the dynamic impact of banking sector performance on economic growth | GMM, Dynamic panel data | The banking sector showed a significant positive effect on economic growth. It implied that banking efficiency is one of the key determinants of overall economic growth | |

Adesina [37] | Quantitative | Examined the effect of human capital efficiency on the link between diversification and bank performance | Intermediation | SFA, Tobit regression | Higher diversification reduces bank performance in three ways; cost efficiency, profitability and financial stability. Hence, higher levels of human capital efficiency were positively relating to bank performance |

Bose et al. [38] | Quantitative | Investigated the effect of green banking to improve banks’ financial performance | Regression (OLS), panel data, annual reports | A positive relationship was found between green banking and banks’ financial performance, while cost-efficiency moderated this relationship. However, banks’ political connection negatively driven this relationship | |

Bhattacharyya et al. [39] | Quantitative | Investigated the relationship of CSR expenditures and financial inclusion on banking performance | Freeman’s stakeholder theory, | GMM, panel data | In terms of accounting measurement, CSR expenditure and degree of financial inclusion were not linked to banks’ financial performance, while a negative link was found in terms of the stock market return |

Chen and Lu [43] | Quantitative | Examine the impact of the regional disparities in the cost and profit efficiency | Intermediation | SFA, Annual reports | Banking efficiency had a positive correlation to per capita GDP while negatively related to the urban population ratio |

Chowdhury and Haron [5] | Quantitative | Measured efficiency of SEA Islamic banks | Intermediation | DEA, Malmquist, Annual reports | Islamic banks have improved inefficiency in the region |

Gaies and Nabi [69] | Quantitative | Examined the interaction between FDI and external debt | The overlapping generation growth model | GMM, panel data | Banks posited an effect on economic growth. External debt financial enhanced vulnerability to a bank operation that generates a recessionary effect on economic growth |

Haini [67] | Quantitative | Investigated the nonlinear impact of banking sector development on economic growth | GMM, dynamic panel data | A nonlinear relationship was found between banking sector development and economic growth. High levels of banking sector development push out the positive effect of private investment | |

Isnurhadi et al. [70] | Quantitative | Evaluated the relationship between bank capital, efficiency, and risk in Islamic banks | Pooled OLS and Random Effect (RE), panel data | Bank capital positively affects bank stability and negatively on credit risk and efficiency. hence, efficiency encouraged banks to lessen risk even when the capital was lower | |

Kchikeche and Khallouk [71] | Quantitative | Examined the causal link between banking financial development and economic growth | Vector autoregression framework | Bank-based financial development affected economic growth in both the short and long run | |

Lehmann-Hasemeyer and Wahl [66] | Quantitative | Revisited the effect of saving banks on economic development in Prussia | Regression (fixed effects) | A significant positive relationship was demonstrated between the establishment of saving banks and city growth in the nineteenth century | |

Li et al. [72] | Quantitative | Investigated the impact of credit risk shocks on the evolution of banking efficiency | Efficiency theory | DEA (bootstrap-DEA), annual report | The efficiency of both state-owned and joint-stock commercial banks was higher than urban/rural commercial banks during a credit risk shock |

Rehman et al. [40] | Quantitative | Examined the effect of reformed bank sectors on the relationship between bank performance and board structure | Soft-budget constraint, intermediation | SFA, DEA, Regression, panel data | A negative link was found between board independence and banking efficiency; however, it became positive when banks were listed in the stock market. Larger banks are less efficient than smaller banks |

Ryu and Yu [64] | Quantitative | Examined the nonlinear effect on bank performance due to changes in subordinated debt | Regression (FE, RE), panel data | Debt issuances adversely and significantly affected bank performance, and redemptions did not boost up this effect | |

Stewart and Chowdhury [73] | Quantitative | Investigate the effect of bank stability, liquidity and capital on the relationship between output growth and bank crises | GMM, Panel data | A stable banking sector reduces the negative effect of a crisis on GDP growth further provides economic resilience in developed and developing countries | |

Tam et al. [65] | Quantitative | Investigated the effect of independent directions on bank performance | Regression, panel data | Independent directors with a higher board hierarchy positively affect the bank performance and cost-efficiency, while the negative effect was estimated on the variability of performances | |

Yu et al. [41] | Quantitative | Assessed the dynamic performance of banks | DEA, panel data and annual reports | Inefficiency in the deposit process caused the overall inefficiency of the banks; thus, improvement in deposit efficiency was more important than lending efficiency |

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Alam, S.M.S., Chowdhury, M.A.M. & Razak, D.B.A. Research evolution in banking performance: a bibliometric analysis. Futur Bus J 7, 66 (2021). https://doi.org/10.1186/s43093-021-00111-7

Received:

Accepted:

Published:

DOI: https://doi.org/10.1186/s43093-021-00111-7